Over the next four years at least 5,000 new jobs will be created in Guyana’s oil and gas industry with engineering professionals being the main occupational profiles but the availability of skilled workers at the local level is currently limited, according to the findings of a survey carried out by the International Labour Organization (ILO).

“The challenges for the local oil and gas industry are compounded by systemic local weaknesses including quantitatively (headcount) limited workforce, a marked gender gap (especially in terms of labour force participation) and by worldwide inter and intra industry competition for talent, notably the one at par with digital transformation or replacing retiring professionals,” said the report.

It was entitled “Prospective occupational skills needs in the Guyanese oil and gas industry, 2022-2026”.

The dedicated survey about occupational and skills needs was answered by 29 companies operating at diverse stages of the oil and gas value chain and from analysis of current job openings published on online platforms.

It found that 15 percent of respondents said that engineering professionals are and will be the most in- demand occupation, 11 percent risk management professionals and 10 percent said it would be ships’ deck crews and related workers. Other occupations named in decreasing order were finance professionals, mining and construction labourers, physical and engineering science technicians, sheet and structural metal workers, moulders and welders and mineral processing plant operators. In addition to those, the report said, online job openings highlight the demand for physical and engineering science technicians as opposed to engineering professionals.

However, the report noted only 49.6 per cent of skills for the most in demand occupations are considered widely available in Guyana. Sixty-two per cent of the technical skills were considered scarce in the country but generally available abroad, while with regards to IT and transferable skills, the most common perception was one of “wide availability”, 58 and 55 per cent respectively, with some caveats.

Meanwhile, total employment was expected to grow by 1,339 full-time positions in 2022 and 2,695 within the next five years, or respectively 34 and 67 per cent vis à vis the current headcount in responding companies. “If a similar growth rate is applied to employment within the whole value chain (estimated at some 8,459 in q3 2021), we speculate that, notwithstanding market dynamics, at least 5,000 new jobs should be created in the most “in demand occupations” for the oil and gas value chain, likely more if all the other occupations are considered,” the report said.

Capable welding, capacity to ensure health and safety compliance, nautical knowledge of vessel operations, rigging, analysis of data and project management represent the technical skills most in demand and have been found to be scarcely available in the country according to the report. However, while not so extensive gaps exist in terms of IT skills, leadership, analytical capacity, and business conduct amongst the transferrable skills they are still deficient.

It was stated that for occupations such as blasters, health and safety professionals, engineers and mechanics, on-the-job training is considered as essential to complete the formal education currently offered in Guyana and that employers perceive working experience as paramount.

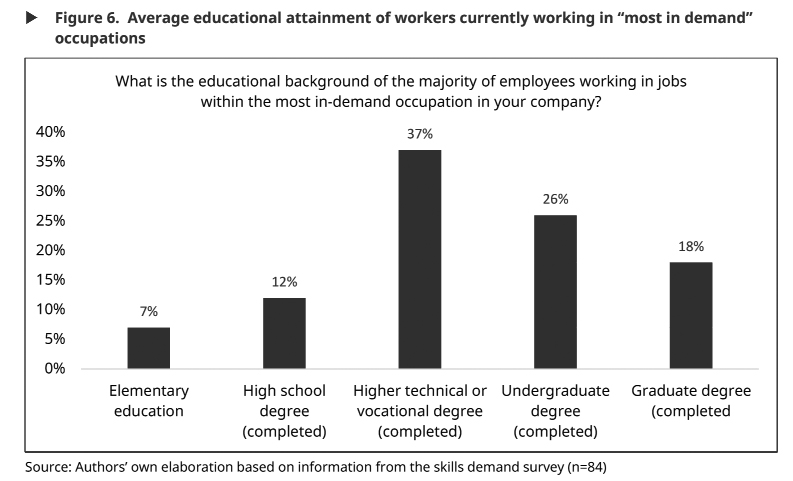

Around 81 percent of the most in-demand jobs require a higher technical or higher degree of education training, noted the report.

To address the current and future gap the country may need to implement managed immigration of specialized labour and skills development strategies to respond to oil and gas, and, possibly, green transition needs or ensure availability of fully fledged curricula preparing students with several competencies. If a choice linked to investments in educational supply must be made, a focus on technical skills may bring the largest payoff.

In addition, other than via training supply, there is room to provide public assistance by helping the private sector to formalize ongoing (or introduce) traineeship schemes. “National competent authorities, notably the CTVET and the (Board of Industrial Training), may consider the direct engagement in the area,” the report said.

“No matter the policy decision regarding the response of the national education system to the needs of the oil and gas industry, the current international context must be duly considered, specifically regarding the possibility of trained workers leaving for other destinations once trained or after having obtained a minimum working experience locally. The implications are multiple. From the public policy perspective, adequate pricing of educational offers or cost-sharing agreements with the private sector will be paramount. In addition, ‘creative’ solutions for incentives for Guyanese graduates to stay in Guyana (bonding) are to be thought through,” the report added.

The findings of this survey support the previously exposed dynamic, where exploration and production companies outsource their operating activities to service companies.