analyse them, evaluate their impact and discuss the extent to which they provide useful economic benefits to stakeholders. These are set out in Budget Measures of the Speech. Amendments are necessary to give effect to the respective tax measures and to set the date on which the respective legislation are to take effect.

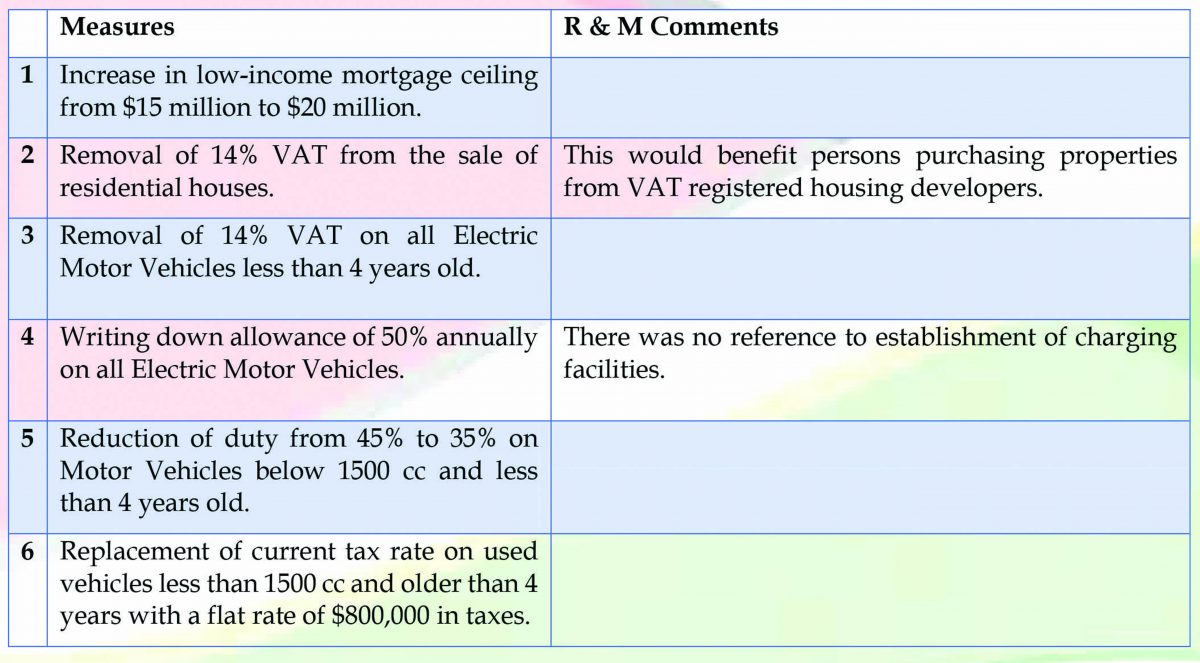

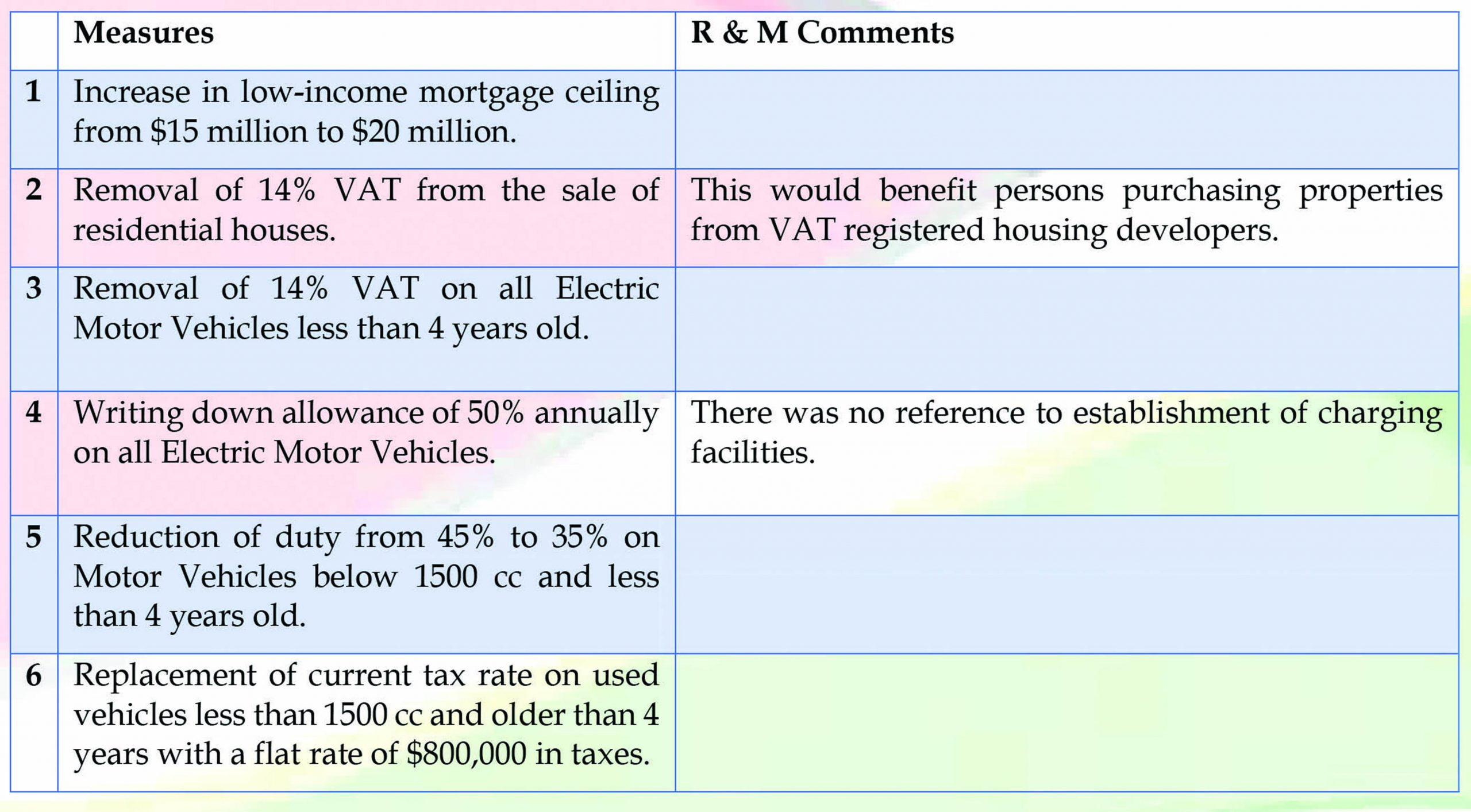

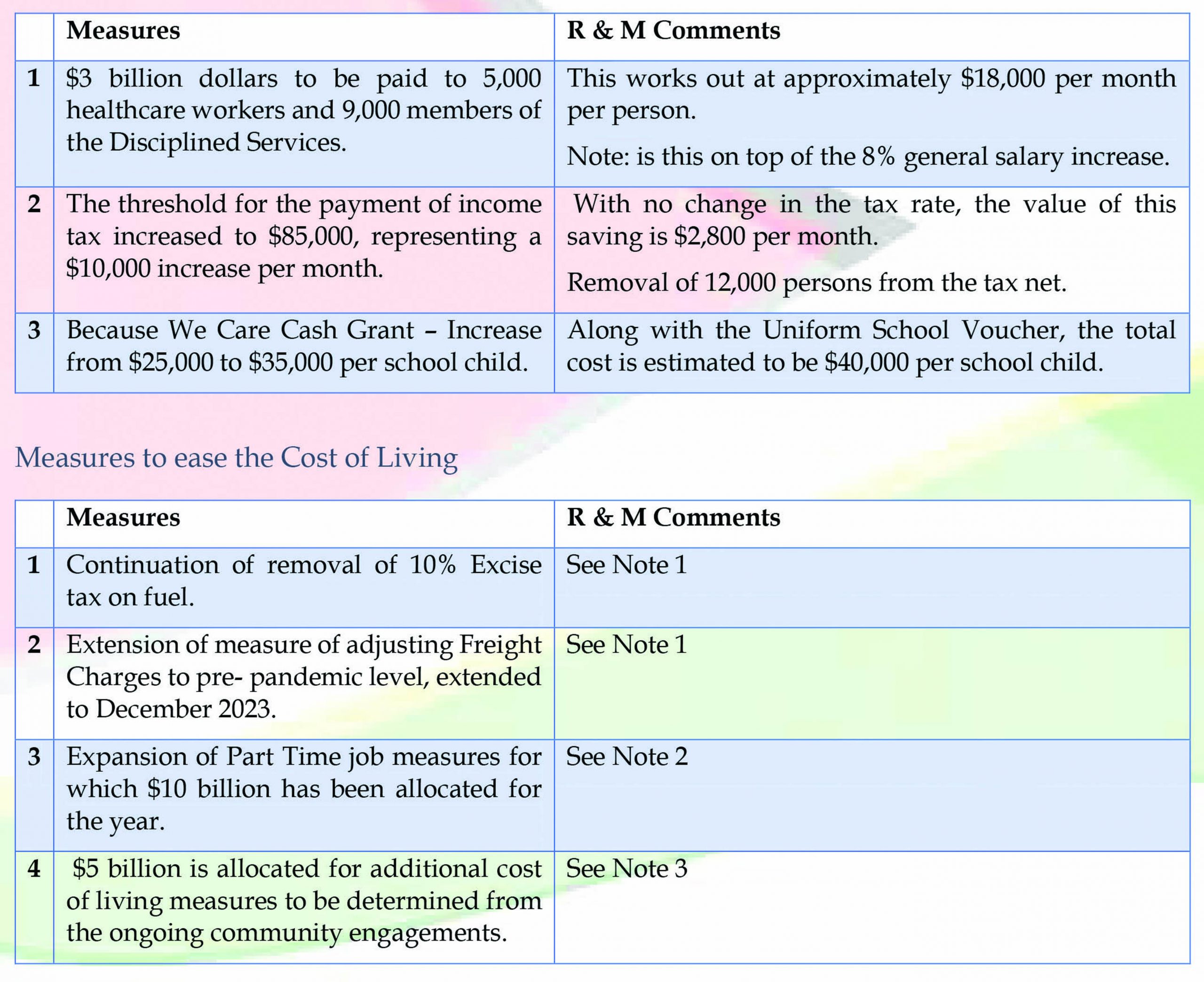

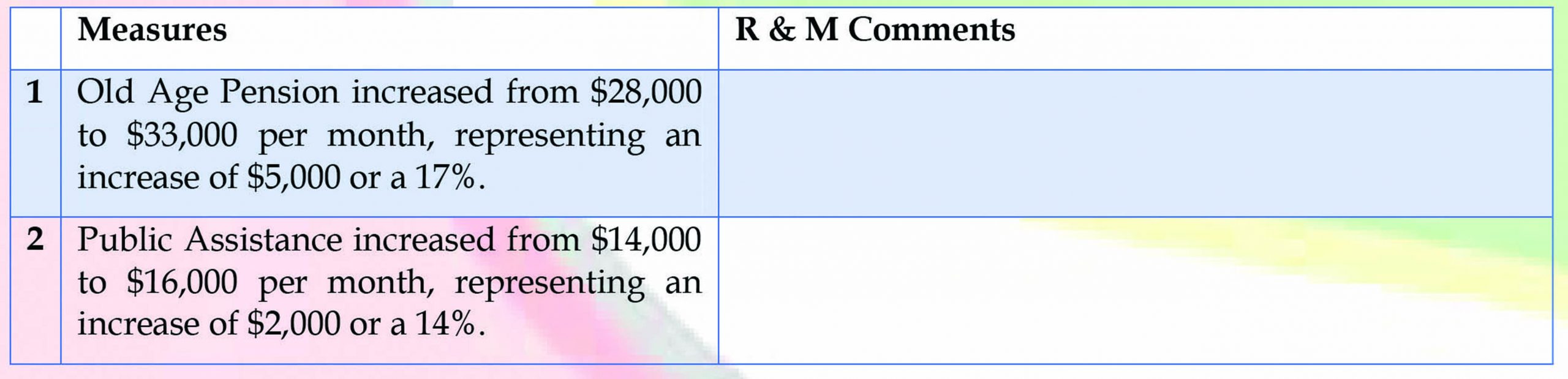

We now look at these measures and offer our comments.

Measures in Increasing Disposable Income

Note 1 – The Minister estimated costs of all budget measures at $50 Bn. These appear to include hypothetical costs based on unstated assumptions.

Note 2 – The Minister reported that this programme employed over 11,000 persons to work in public offices near their homes for 10 days per month and earning $40,000 per month. The Minister was specific in identifying the regions in which this programme operated. It is significant that Region 4 which has about 40% of the country’s population and the largest number of government offices, is not identified among these regions. This project is counterproductive, it would be far more effective if those persons receive training to enhance their skills and employment prospects.

The daily rate of these part time workers is also considerably higher than the private sector minimum wage.

Note 3 – An active outreach calendar by Ministers of the Government with a slush fund of $5 billion has not enhanced the relevance of local authorities.