ExxonMobil will be selling the 50 million cubic feet of gas per day it brings onshore to either the government or the private sector company that will distribute the power at the Wales gas-to-shore plant, only to recover its capital for the pipeline infrastructure, Country Manager Alistair Routledge yesterday said.

“We will be selling the full 50 million cubic feet a day to the government or a government entity that is being established, in order to receive the gas and put it through the power station,” Routledge told a press conference hosted by his company at its Duke Street, Georgetown office.

An agreement was signed last July with government for the project, he revealed, saying that while the pipeline infrastructure has been estimated to be around US$1 billion, his company awaits a shared review with government before making a Final Investment Decision (FID).

Routledge explained that the cost recovery mechanism for his company’s investment in the infrastructure for this country is outlined in the framework of the agreement. He explained that ExxonMobil was making an investment in order to transport the gas onshore and it is incidental to the original developments offshore.

“That’s mostly the pipeline. That’s several (US) 100 million dollars’ worth. So in some way it needs to recover that cost. So the way that’s been agreed as well, [is] let’s make sure that that a price is put on the gas that reflects just that cost of infrastructure, no profit, just the cost of infrastructure. And what that means is that it delivers gas and very low priced to the country, very competitive with anything you’d see internationally. And therefore that’s why His Excellency, the President, has been able to tell the country it will have the cost of electricity reduced.”

While the gas will be sold at concessionary costs, no price has yet been determined and both sides will have their teams establish terms that ensure that when that sum is agreed to, that profits are not made. “It’s on a mechanism that will actually reflect that cost of the infrastructure in rather than agreeing a price and then it could end up profit bearing. That is the mechanism that has been agreed to ensure that we only pay for that,” Routledge explained.

The company has emphasised that, “the government does not pay for its share of the gas. The co-venturers (CoVs) will recover their pipeline investment cost through their share of the gas. Once the CoVs investment has been recovered, and there are no additional investments nor impacts on oil recovery, there will be no charge attached to the gas supplied.”

And when the money is recovered, which this newspaper understands will take about 20 years, profits from the gas will be shared 50/50 as per the Production Sharing Agreement of the 1999 contract.

Routledge said that a FID will be made with government, after a review, but that preliminary works, such as the building of entry roads and bridges, have begun in the area proposed for the project, to ensure that it is delivered in the timeframe stipulated.

“We are in the review process with the Ministry of Natural Resources currently on the Field Development Plan and the update to the licence for the Liza field. Once we have gone through that step, we’d be able to make all the final commitments, Final Investment Decision around all the investments that are needed,” he stated.

Fourth quarter

Government has said that the project is expected to be completed and delivered by the fourth quarter of 2024, to achieve commissioning and testing of the 300 MW power plant by the end of 2024. It aims to employ approximately 800 workers during the peak construction stage and 40 full-time workers during the operation phase.

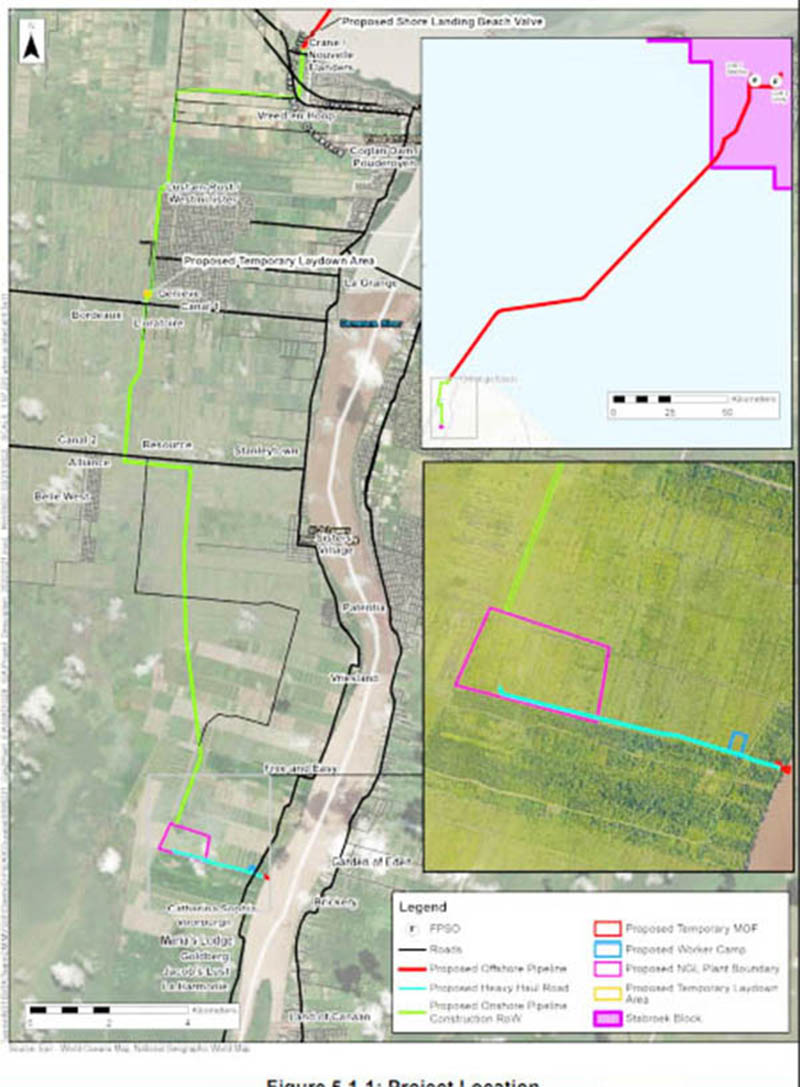

The project will be executed in three phases – construction, operation and decommissioning. It entails three aspects as well – an offshore pipeline which is approximately 220 kilometres of a subsea pipeline extending from new subsea tie-ins at the Destiny and Unity FPSOs in the Stabroek Block, to the proposed shore landing located approximately 3.5 kilometres west of the mouth of the Demerara River; onshore pipeline that is a continuation of the offshore line and extends about 25 kilometres from the landing site to the NGL plant; and the NGL plant and associated infrastructure that will be located about 23 kilometres upstream from the mouth of the Demerara River on the west bank.

Both the Liza Destiny and Liza Unity floating production storage and offloading vessels, which are operating in the offshore Stabroek Block, have pre-installed facilities to allow for the export of the associated gas along with crude production.

Routledge yesterday said that it has been determined that the gas can be exported without affecting the reinjection process to retrieve crude.

And like his company’s president, Darren Woods, who earlier this month said that the company wants a win-win agreement for Guyana and itself, Routledge said that investing in a project that brings relief to power costs paid by citizens is just one way of ensuring that.

“For us, what motivates us on gas-to-energy is that we can clearly see the benefit for the country. We came to the country wanting to ensure that everyone benefits, clearly it needs to be a win-win-win. As our chairman said recently, it needs to be a win for the investors of course, otherwise, it doesn’t attract investment. There needs to be a win for the government and its ambition to develop the country and ultimately, for all the citizens of the country,” he said.

Woods had said that the company’s position has always been one of having a “win-win-win proposition” across the board, as there “needs to be a win for the company. It needs to be a win for the Government of Guyana, and it needs to be a win for the people of Guyana.”

“And that’s what we’re seeing there, a lot of jobs, a lot of economic opportunity opening up in Guyana. We just — we’ve been working with the Guyanese government around a project to bring in gas power into the country. Lower emissions, more reliable. We’ve got work going on to help bring up some of the other social services in the country,” he had told the 2022 Q4 earnings call this month.

“So, I think people are seeing the progress. And the fact that we’re bringing this on sooner and at lower cost, I think, is a benefit to the government. They recognise the values coming faster than originally anticipated. So, it’s a – I think it’s a good story of the government, I think in ExxonMobil. We’ve got very good relationships, working very constructively. And, as I said, it’s a win-win-win proposition here, and we feel good about the progress we’re making.”

In December of last year, a US$759 million deal was inked between Guyana and US companies, CH4/Lindsayca, to build the 300 MW combined-cycle power plant and a natural gas liquids (NGL) facility.

At the core of the project is a pledge by the government that power charges to householders and industry will be halved when energy is produced.

The signing of the contract came after months of concern that Guyana faces environmental and safety risks from this sprawling project and should not be locked into an enterprise that will burn fossil fuels for decades.

No one from the company spoke on the project that President Irfaan Ali described as the largest this country has ever invested in, but both he and Vice President Bharrat Jagdeo said that there will be a special meeting where the press will get technical explanations and could ask questions.

That meeting has not yet been held.