IHS Markit’s audit of oil expenditure by ExxonMobil’s subsidiary, EEPGL and its partners found that its annual Work Plan and Budget (WP&B) did not comply with the terms of the oil agreement nor with international best practices in the industry.

The British auditing firm, in a report submitted to the PPP/C government in March, 2021, made startling revelations including that 12.8% of the US$1.67b expense claims made by Esso Exploration and Production Guyana Limited (EEPGL) for the period 1999 to 2017 could be disputed and that that none of the companies complied with the all-important insurance requirements.

While never released by the PPP/C government, this newspaper carried details from the report in the last Sunday Stabroek and yesterday’s edition.

Deficiencies were also pointed out by the audit firm in relation to the work plan and budget and related matters.

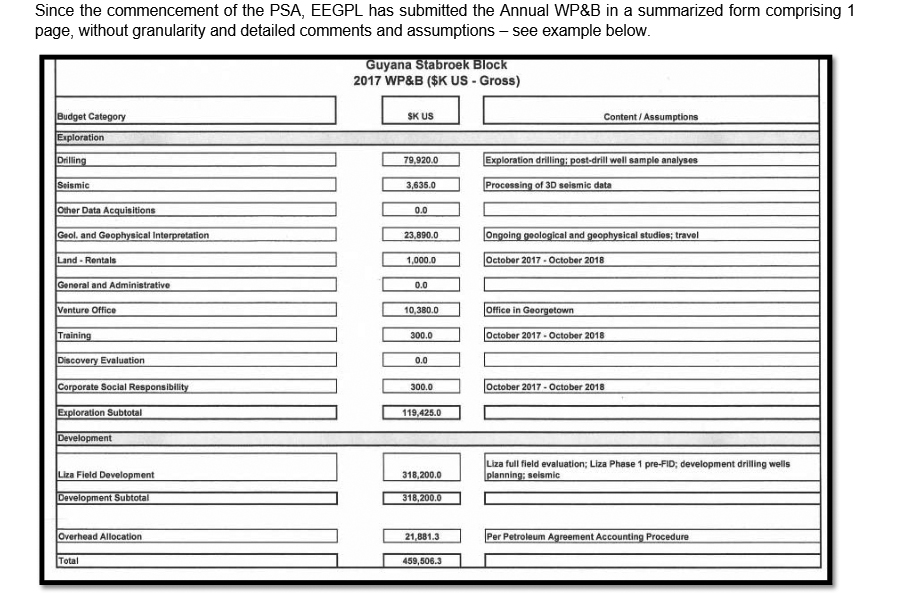

The Audit Team said that it reviewed the WP&B submissions made by EEGPL as required under the mprovisions of the PSA. IHS Markit said that budgeting exercises generally involve the preparation of a detailed budget, timely submission, discussion regarding the work plan, performance monitoring, variance analysis and justification for cost overruns – to form a basis for cost control.

It further said that the Annual Work Program & Budget is an important tool for monitoring the activities of an Operator in their Contract Area during Exploration and Development phases. It added that the PSA details the process for preparing, presenting and review of the Work Program & Budget in Article 6, 7 along with Section 7,8,9,10 of Annex C.

In its highlights, IHS Markit said:

§ The annual WP&B submitted by EEPGL does not meet the expected detail to meet the PSA requirement or

conform to international best practices in Oil & Gas operations.

§ The annual WP&B submitted by EEGPL does not provide the Government of Guyana with the ability understand the planned activities or provide any oversight. The WP&B should provide details of the activities planned to be undertaken and the resulting cost outlay, ensuring responsible and sustainable development of resources and procurement alignment with in-country value (ICV) opportunities.

§ The operator indicated that a more detailed annual work plan and budget is prepared for the Joint Venture partners each year. IHS Markit said that a copy of this was requested during the course of the audit but was unforthcoming from EEPGL.

§ EEPGL has not provided justification to changes and cost overruns against the submitted WP&B as required by the PSA. § Total budget overruns amounted to approx. $330.3 million across 2009, 2010, 2014, 2015, 2017.

IHS Markit said that Oil & Gas International best practice includes submission of a detailed Annual Work Program and Budget with sufficient detail and narratives to enable the host governments to contribute meaningfully in the partnership and develop the oil fields in a responsible and conscientious manner.

It said that the responsible Minister would be unable to review the Annual WP&B as envisaged by the PSA with the level of information provided by EEGPL. The auditing company added that in the absence of a detailed budget, there is limited transparency and the Ministry’s ability to monitor and review annual budgets and variances with actual expenditure incurred is reduced.

As an example, it said that certain PSAs contain provisions that state that overruns in actual expenditures are limited to 10% of the budget and operators are prohibited from spending more than a percentage above the WP&B without further approval (expenditure without approval is non cost recoverable). Any expenditure incurred beyond such limit would be cost recoverable only if specifically approved by the host government based on a revised WP&B or adequate justification of variances – allowing the host government to maintain project oversight, it said. However, it noted that the 2016 PSA does not require such approvals.

Given IHS’s findings of serious transgressions in the conduct of EEPGL and its partners questions have been raised as to why the PPP/C government has kept the document secret for two years. Numerous inquiries by Stabroek News with various government and oil and gas officials had failed to yield access to the report. It has still not been made publicly available and the government has so far not commented on the reports that have appeared in Stabroek News.

The last Sunday Stabroek reported that “The Audit has established that (the Government of Guyana) has reasonable grounds to dispute US$214.4 million plus overhead adjustments of the costs currently included by EEPGL in the Cost Bank. This amount represents 12.8% of the cumulative cost recovery balance as of Q4 2017 Statement”.

The disputed costs fall into three main categories – Defined Costs for Removal (DCR), Inadequate Supporting Documentation (ISD) and Ministerial Approval Required (MAR). For each the sums were: DCR US$34M, ISP $179.8M and MAR US$0.27M.

Yesterday’s Stabroek News also reported that the audit report said “Insurance is required by the PSA, applicable laws, rules, and regulations and of such type and in such amount as is customary in the international petroleum industry in accordance with good oil field practice appropriate for Petroleum Operations. EEPGL stated that each partner, EEPGL, Hess and CNOOC carry insurance cover for their respective interest in the PSA. Copies of insurance certificates have not been provided by any partner, contrary to the PSA requirement”.