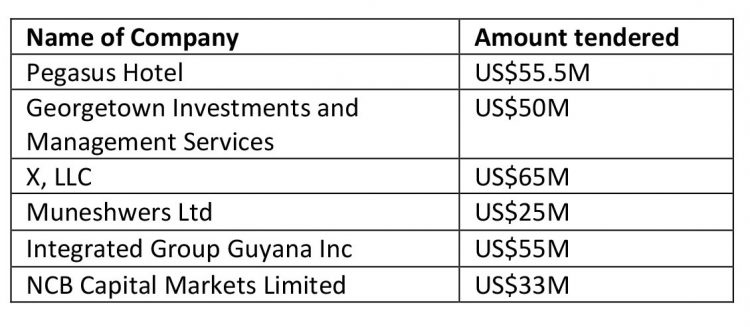

American businessman and entrepreneur Ramy El-Batrawi, founder of investment group X, LLC yesterday tendered the highest bid for the Guyana Marriott Hotel of US$65m.

The tenders for the hotel were opened in the presence of representatives of bidders at the National Industrial & Commercial Investments Limited (NICIL) head office on Camp Street and the reputed billionaire who was born in Egypt delivered the highest bid.

Guyanese hotelier, Robert Badal tendered the second highest bid of US$55.5 million for the purchase of the state-owned Kingston hotel.

Chief Executive Officer of NICIL, RK Sharma, in a statement issued following the opening of the tenders named the bidders as Georgetown Investments and Management Services Inc (Mustafa Eray Kanmaz), X LLC (Ramy El- Batrawi), Muneshwers Limited (Amarnath Muneshwer), Integrated Group Guyana Inc. (Ravindra Prashad) and NCB Capital Markets (Steve Gooding).

NCB Capital Markets of Jamaica, the wealth and asset management arm of the National Commercial Bank submitted a US$33 million bid while Integrated Management Group and Georgetown Investments and Management Services, which currently operates the Princess Hotel Casino, tendered bids amounting to US$55 million and US$50 million respectively. Muneshwers Limited tendered a bid of US$25 million.

According to the X LLC website, the group’s primary focus is to invest in and enhance target industries. El-Batrawi was described as a highly accomplished entrepreneur offering 35 years of experience in spearheading substantial business transactions, both nationally and on a global scale.

X, LLC was described as a pioneer in investment strategy innovatively combining consolidation and growth strategies. It said it adhered to a management centric investment philosophy in identifying and partnering with exceptional senior executives to acquire companies in fragmented and growing industries.

Sharma said the bids for the hotel were received before the announced closing at 2 pm yesterday. The bids after being received were kept in a controlled, secure environment by Sharma and NICIL’s Company Secretary & In-House Attorney Arianne McLean.

Sharma in the statement said that all six bidders were invited to attend the Bid Opening Meeting in NICIL’s boardroom at 4 pm yesterday.

Representatives of two companies physically attended while a representative of another bidder attend via Zoom Video Conference. The others were not present.

The six bids were opened and read aloud in the presence of all present and the bidders and their respective bids were recorded, signed and acknowledged by the bidders who were present, as well as the representatives of NICIL.

Last year, NICIL issued a ‘Pre-qualification Notice’ seeking Expressions of Interest (EOIs) from persons or companies, individually or as part of a joint venture/consortium, with an interest in purchasing its shares in AHI for the acquisition of the Guyana Marriott Hotel.

The closing date for EOIs was 10th January, 2023 at 2:00 pm. Applications for pre-qualification were to include the following: financial capability in terms of net worth, audited financial statements for the last three financial years, net worth of a minimum of US$250m and a letter of financial capability from a recognised financial institution to acquire NICIL’s shares in Atlantic Hotel Inc (AHI) for the Guyana Marriott Hotel. AHI was incorporated on 10th September, 2009, as a special purpose company to construct and manage the establishment.

NICIL had told Stabroek News “Eight (8) expressions of interest applications were received from diverse companies and consortiums locally, regionally, and internationally”. NICIL added that all eight applicants were written to and invited to submit a bid by paying a fee to purchase an information package which consisted of unaudited financial statements, agreements, architectural plans, and other pertinent information on AHI.

Six companies eventually submitted.