Anti-money laundering laws are to be further tightened and this will allow the authorities to go after assets that were considered tainted before the passage of the original act and will also dramatically increase the period available to confiscate the property of criminals.

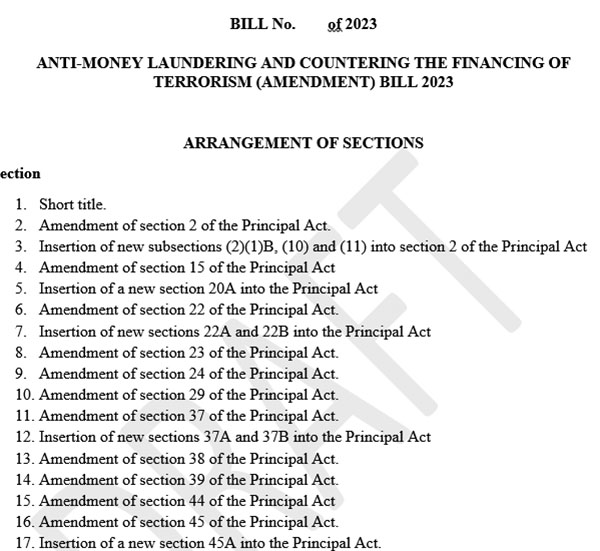

Attorney General Anil Nandlall SC yesterday released the Anti-Money Laundering and Countering the Financing of Terrorism (Amendment) Bill 2023 and the

Guyana Compliance Commission Bill 2023 and invited inputs over the next two weeks. In a statement, Nandlall acknowledged that the laws have to be in place to implement the outstanding recommendations of the Caribbean Financial Action Task Force (CFATF) and the Financial Action Task Force. He also noted that the country’s anti-money-laundering framework will be undergoing its fourth round of mutual evaluation in September 2023 by the CFATF and the tabling of the bills should be seen in this light. With the vast expansion of financial transactions accompanying the oil and gas industry, Guyana is likely to come under even closer scrutiny.

According to the Explanatory Memorandum, the amendment bill seeks to update the Act to ensure the Financial Intelligence Unit (FIU) meets the necessary requirements for membership of the Egmont Group. The Egmont Group comprises FIUs and Guyana needs to join this to be part of a network that shares information on money laundering. Membership has been spoken about for many years.

Last week, the Heads of two regional FIUs were here for a site visit on Guyana’s application to join the Egmont Group.

Sections 46 and 55 of the amendment bill provide a greater time period with regard to going after the property of criminals for confiscation for forfeiture, amending the period in question from six years to twenty years.

The Bill also inserts new sections 57 A, 57 B, 60A, 60B, 60C and 60D related to the proceeds of crime.

According to Section 57A, the Court shall determine any question arising under sections 54 -57 (confiscation/pecuniary penalty orders) on a balance of probabilities, thus indicating a more reasonable threshold than the required beyond a reasonable doubt threshold which applies to matters of innocence and guilt in criminal charges.

Under Section 57B, the Court can order a defendant to provide information, and if they refuse, the Court “may draw inference from such; this is in order to facilitate such matters without affecting the issue of the trial at large if any, as subsection (8) indicates that no information given under this section which amounts to an admission by the defendant that he or she has benefited from criminal conduct is admissible in evidence in proceedings for an offence”.

Section 60A says that the payment of a confiscation order is due the day it is made but it allows the Court to also set time frames for payment. Section 60B of the amendment bill provides that the court may order interest on unpaid sums. Section 60C provides a procedure for enforcing payments for orders made with regards to confiscation while section 60D identifies measures by which a court may order payment of the persons’ funds from a financial institution, with penalties to the financial institution for non-compliance and continued noncompliance.

Section 66 of the Bill is to be substituted as it previously precluded assets gained before the passage of the Act from confiscation. The new provision would now provide the opportunity for the relevant authorities to go after any assets suspected to be tainted property, or having been assessed as proceeds of crime.

The new sections 66B to 66E deal with the creation of the National Forfeiture Fund, where the value of all items forfeited shall be placed in the fund and used for the benefit of fighting money-laundering, terrorism financing and its predicate offences.

Section 2 of the amendment bill would amend the interpretation section by providing updated definitions for auto dealers. It outlines the meaning for the words ‘without delay’ based on discussions at previous CFATF Plenaries. As a result, the definition for politically exposed person (PEP) was also upgraded based on the current FATF Standard to include international organisation PEPs.

The amendment bill also contains a FATF Best practice definition for nonprofit organisations, as well as definitions for precious metals and precious stones. Currency has also been updated to include virtual, digital and crypto assets and currencies.

Serious offences would also be updated to involve unlawful conduct, thus also providing an all crimes approach to the listed approach which is currently available in the Schedule.

Section 29 provides that, in addition to magistrates, search warrants may also now be granted by a Justice of the Peace in order to enable hot pursuit and hot tip situations, to allow swift action and prevent a person from quickly disposing of their assets or instruments of the crime.

Section 37 says that applications for seizure may now be made before either a High Court Judge or a magistrate. Section 37A and 37B are also included to ensure that the cash seizure regime is made more efficient. The period for detention of cash for investigative purposes has also been increased from 72 hours to 7 days.

Section 39 at new subsections (6) to (8) ensures that not only can the Court make whatever necessary orders to make restraint orders effective, but it also enables a law enforcement officer to seize the property for the purpose of preventing any property being removed from Guyana or concealed or destroyed domestically.

This Bill provides a new section 109A, which recognizes the Special Organised Crime Unit (SOCU) as the primary body within the Guyana Police Force addressing matters relating to money laundering, terrorist financing and proliferation financing.

It is also given the mandate to cooperate both with domestic agencies, as well as internationally. SOCU can also collaborate with other agencies and law enforcement bodies to prevent and counter terrorism, with regard to the Anti-Terrorism and Terrorist Related Activities Act.

The First Schedule to the Act is amended by the Bill, by replacing used car dealers or car part dealers with auto dealers, which has a definition to capture all categories. Commissioners of Oaths to Affidavits are also now included as a reporting entity in the AML/CFT Supervisory regime. The Fourth Schedule is also amended accordingly to include these two.

The Bill inserts a Fifth Schedule, which deals with threshold reporting, which is provided under section 4 of the Principal Act. It provides threshold reporting for betting shops ($500 000), pawnbrokers and money lenders ($300 000) and Credit Unions ($500 000), of which anything below these thresholds are of low risk, and therefore would ease the burden on collection and analysis by the relevant supervisory authorities of these reporting entities.

Based on a recommendation from 2021 and a target within the National AML/CFT/CPF Policy and Strategy, ‘migrant smuggling’ has now been criminalized under the Trafficking in Persons Act 2005, as this is a predicate offence based on the Second Schedule.

This addition was done based on international best practice, coming from the International Organisation for Migration, the United Nations Protocol, and the resulting Model Law on Migrant Smuggling.

The Guyana Compliance Commission is established under this Bill by a new section 110A, with its functions to be fully elaborated under the Guyana Compliance Commission Bill 2023.

These Bills can be accessed on the Attorney General’s Chambers and Ministry of Legal Affairs website www.mola.gov.gy.