Dear Editor,

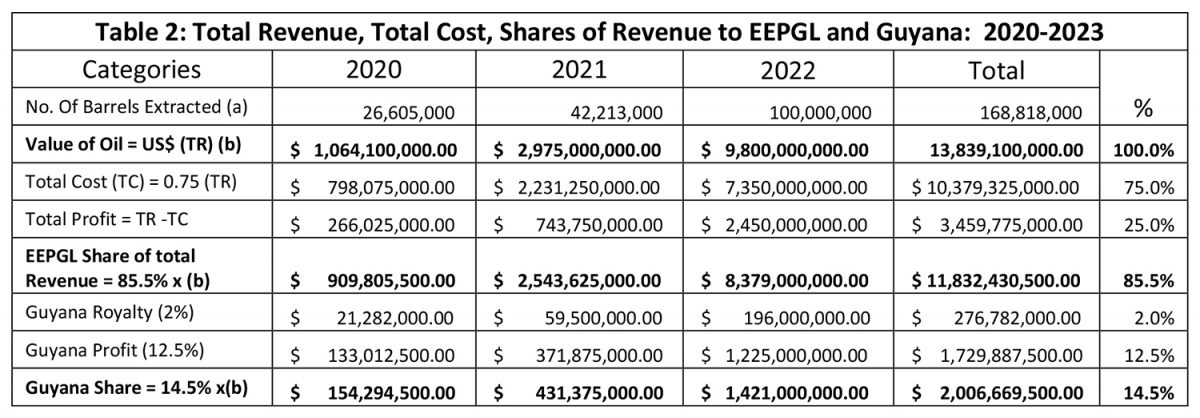

Reference is made to your article captioned ‘Exxon’s subsidiary registered $577b profit in 2022’ (SN 6/18/23) and I would like to make a few observations. First, the published data in this and another article (KN https://www.kaieteurnewsonline.com/ 2023/03/09/the-average-cost-per-barrel-of-oil-produced-by-exxon-is-questionable-unacceptable/ ) show that EEPGL has been able to extract a total of 168.8 million barrels of oil during the period 2020 to 2023, moving from a low extraction rate of 26.6 million barrels in 2020, to 42. 2 million barrels in 2021, and to a high of 100.0 million barrels in 2023 (Table 1). Guyana’s total share of the extracted oil at 14.5 percent is 24.478 million barrels, as compared with 144.339 million barrels for EEPGL, signaling thereby a capture rate of 5.90 barrels of oil for EEPGL to every one barrel that Guyana receives. Consequently, this distribution between EEPGL and Guyana is palpably inequitable and it must be changed so that Guyana receives an enhanced share of its oil from its patrimony. Moreover, since Liza I and 2 have a known extractable total quantity of 1.05 billion barrels of oil; and acknowledging that during the period 2020 to 2023, a total of 168.8 million barrels of oil have already been extracted, this implies that the remaining quantity of 881.182 million barrels of oil can be extracted in 8.81 years, assuming that the extraction rate of 100.0 million barrels of oil in 2022 is sustained over the remaining period. As our famous Caribbean Leader has stated, ‘oil don’t spoil’, with the addendum of unknown authorship being, ’but it (oil) does done’. This is the outcome of extracting a non-renewable resource that current technology cannot produce, but nature has provided in a fixed amount. Therefore, saving some of the oil revenue from an enhanced sharing model is necessary, for in 8 years Liza 1 and 2 would be exhausted; and oil will be extracted from the other reservoirs now being prepared for extraction. It is therefore incumbent on our politicians to convene a Parliamentary Sitting and protect our patrimony and sovereignty; for some oil money must be saved for future generations; otherwise, this generation, and particularly policymakers, would have failed them, given that a hole in the ground and nothing in the bank is not a bequest.

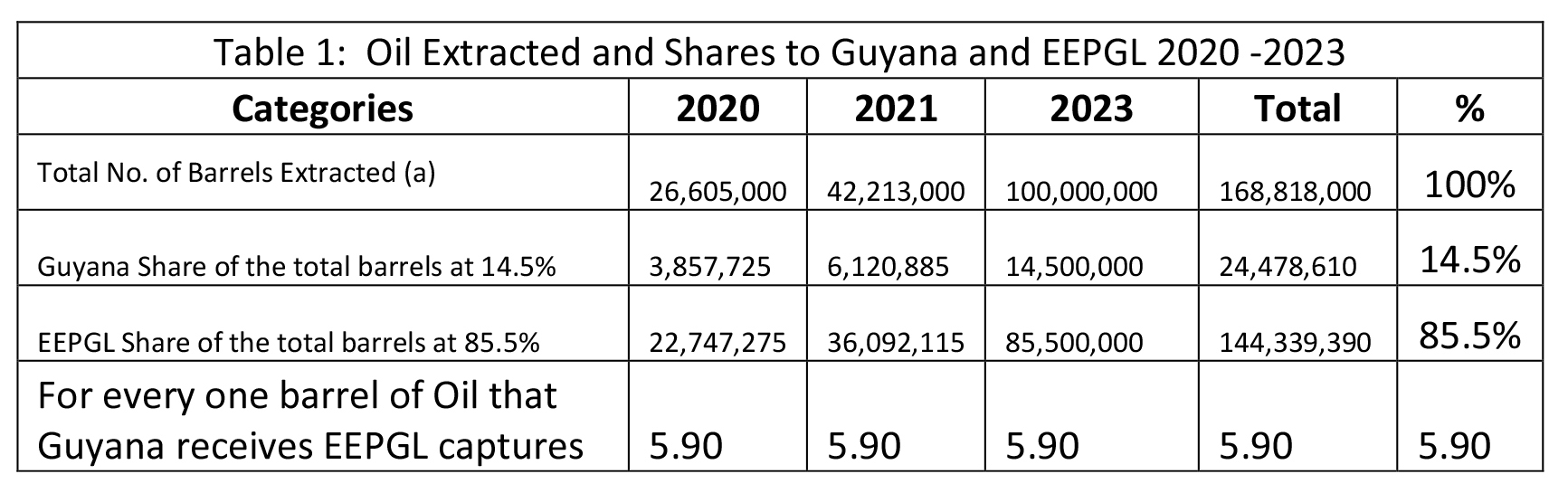

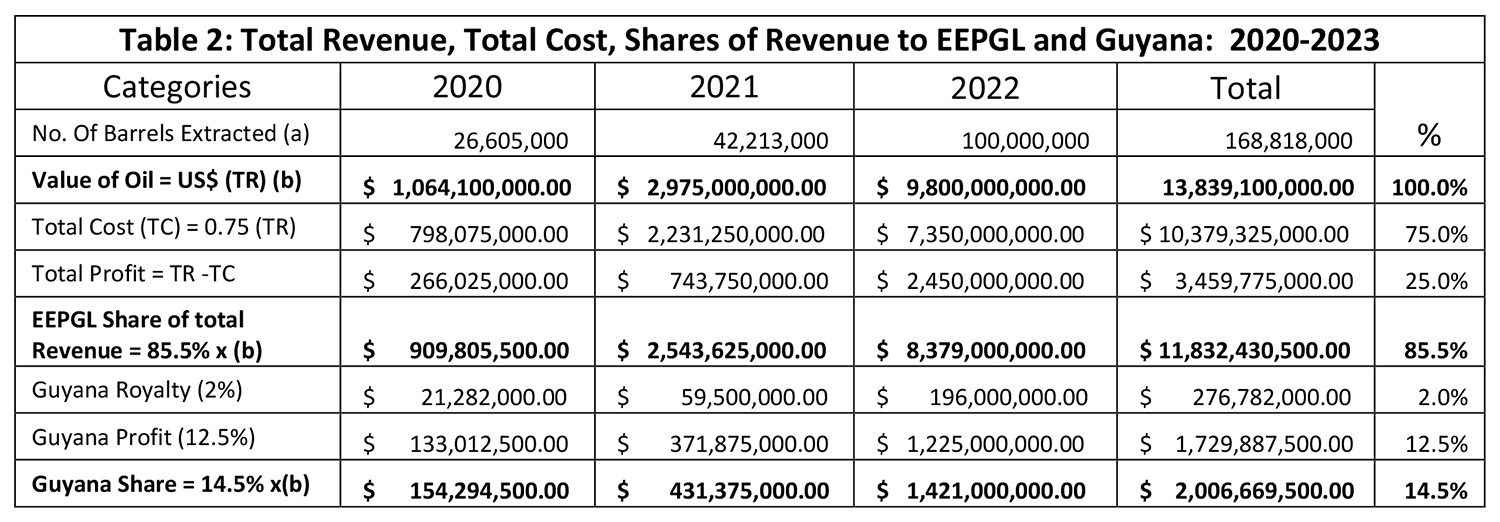

Editor, the total revenue earned during the period 2020 to 2023 is US$13.83 billion (Table 2), with the total cost at 75 percent of the total revenue being US$10.38 billion, and total profit of US$3.45 billion (25 percent of total revenue). Furthermore, while EEPGL during the period 2020 to 2023 received US$11.8 billion of the total revenue (88.5 percent), Guyana only received US$ 2.0 billion (14.5%). With no taxes being collected, and together with Guyana being exposed to the cost of an oil spill that will damage our neighbours, these are events that can be devastating for Guyana and the region. Moreover, 14.5 percent would be insufficient to cover the cost that Guyana will have to pay, as our liabilities and legal costs will be significant over subsequent decades. In fact, there will be no bequest for future generations. Incidentally, a tax holiday is a standard method used to encourage new business; but to write a receipt for EEPGL when no taxes are collected is fraud that no government should condone. Do you hear laughter Guyana? Stop this atrocity!

Finally, there is an unsubstantiated notion that once the investment cost is recouped, the profit levels that Guyana will receive will increase. This is at best wishful and misguided optimism, since there is nothing recorded in the PSA that confirms this idea. In fact, the further out in time that a non-renewable resource is extracted from an existing oil reservoir, and excluding any positive shocks to oil prices in the market, revenue will decline from that reservoir. This is what will happen in each oil reservoir. So do not believe what you are told; for Guyana must get its fair share now, since a dollar today is worth more than a dollar tomorrow, once interest rates at the Federal Reserve Bank in New York is not zero. Furthermore, EEPGL is not investing in Guyana for our development; instead, they are only interested in increasing the returns for their shareholders, and Guyana is not a shareholder, but is identified as a ‘Non-owner Associate’, who even though owns the resource, has to take the crumbs that EEPGL throws in their direction. There is work to be done Guyana. As brother Bob has reminded: ‘Get up, Stand up, Stand-up for your Rights!’

Sincerely,

Dr. C. Kenrick Hunte

Professor and Former Ambassador