These two positions, which appear to conflict with each other, prompting us to revisit the auditors’ report on the matter and the Government’s reaction to date.

Pre-contract costs

Annex C of the 2016 Petroleum Sharing Agreement (PSA) defines pre-contract costs to include contract costs, exploration costs, operating costs, service costs, general and administrative costs, and overhead charges as defined in the 1999 Agreement. Around the same time that the 2016 PSA was signed, the then Administration entered into a bridging deed with ExxonMobil’s subsidiaries, linking the 1999 PSA with that of 2016, thereby extending the effective commencement date of the 2016 PSA backwards to 1999. This means that all costs incurred since 1999 are considered recoverable costs. It is, however, unclear what the rationale was for the bridging deed and what the specifics are, since the deed has never been made public. According to the Annex, the amount of US$460,237,918 refers to costs incurred in petroleum operations pursuant to the 1999 Agreement up to 31 December 2015. Exxon is to be reimbursed ‘such costs as are incurred under the 1999 Agreement between January 1, 2016, and the effective date which shall be provided to the Minister or on before 31 October 2016 and such number agreed on or before 30 April 2017’.

Auditing arrangements

The PSA is silent on the auditing of the pre-contract costs referred to above. However, to ensure that all such costs are indeed recoverable costs and are supported by adequate documentation, the then Administration commissioned an audit in September 2019 which was to have lasted four months. However, some 14 months later in November 2020, GRA stated that the draft report was handed to the Department of Energy to be forwarded to Exxon for its response. After several revisions to the report, the auditors issued their final report to the Government in March 2021. However, the results are yet to be made available to the public. In January 2022, the Minister of Natural Resources told the National Assembly that the audit remained incomplete.

GRA’s involvement vis-à-vis its mandate

When the Stabroek News raised the matter in April 2023, the Vice President denied that the Government was hiding the report. He contended that ‘the report has been with the staff of the Ministry and with the GRA and all their technical people, for the last several years’. This does not explain why, once the report was issued as a final version, it was not made available to the public. That apart, one could legitimately question the involvement of GRA and whether it acted outside its mandate since the review of the auditing of the pre-contract costs has little to do the operations of the GRA as a revenue assessment and collection agency. It is not a case where ExxonMobil’s subsidiaries submitted audited accounts for the purpose of taxation, and GRA has raised certain queries in the course of its examination of those accounts.

Following the Vice-President’s denial, GRA issued a statement the next day explaining that the auditors had issued an initial report on 20 March 2020, and what they deemed a final report on 31 July 2020. However, the report did not include Exxon’s response. Thereafter, there were two other iterations of the report between July 2020 and November 2020. After a review of the various versions of the report, GRA informed the auditors of a number of deficiencies in the report. Accordingly, it requested the auditors to further revise their report and resubmit it for transmission to Exxon’s subsidiaries by 3 February 2021. The auditors issued their final version of their report in March 2021 which was transmitted to ExxonMobil’s subsidiaries on 2 July 2021.

It has been over two years since the auditors issued their final their report, and discussions involving the Ministry, Exxon and GRA were still on-going. However, the fact that no further revisions to the March 2021 report have been made, would suggest that the auditors are standing by their report. In any event, the auditors have discharged their responsibilities under their terms of reference for the audit.

Should not the Audit Office be involved instead?

Considering that the GRA might have acted outside of its mandate in accepting to review the work of the auditors as well as the fact that it is part of the Executive Branch, it would have been entirely appropriate for the Auditor General to be involved in the review of the auditors’ report. This is especially so, given his constitutional status and independence from the Executive; and for his office to be provided with the necessary resources to do so. Why was the Audit Office bypassed remains unclear.

Both the two percent royalty and Guyana’s 50 percent share of profits after a deduction of 75 percent of the value of production, are public revenues that are auditable by the Auditor General. He is also the appointed auditor of the Natural Resource Fund (NRF) into which all oil revenues are deposited.

The auditors’ findings

The following are the key findings, as gleaned from the Executive Summary of the report:

(a) The actual amount claimed as

recoverable costs was US$1.678

billion covering the period 1999

to 31 December 2017;

(b) The Government of Guyana has

reasonable grounds to dispute

$214.4 million or 12.8 percent of

the total cost recovery claimed by

Exxon’s subsidiaries. This is in

addition to certain overhead

adjustments made by Exxon’s

subsidiary EEPGL and included

in the cost recovery amount;

(c) Of the amount of $214.4 million

referred to at (b), $34.3 million is

considered ineligible, while

$180.1 million lack adequate sup

porting documentation;

(d) Of the total cost recovery expen-

diture, amounts totalling $1.218

billion, or 73 percent, were

incurred between 2016 and 2017;

(e) Since the 2016 PSA does not con

tain ring-fencing provisions, the

cost recovery amount includes

continued exploration and devel

opments costs for all fields within

the Stabroek Block;

(f) Almost 50 percent of inter-com

pany charges was included in the

cost recovery statement;

(g) The cost recovery statement had

limited transparency and fell

short of the expected level of

accounting documentation;

(h) Despite several requests for clari

fication in relation to the inter-

company charges, EEPGL was

unable to provide adequate justi

fication for these charges;

(i) Amounts totalling $31.43 million

were included in the cost recov

ery statement but were not

reflected in the main accounting

record, the General Ledger. These

amounts relate to payments made

by the Co-Venture partners, many

of which were incurred prior to

the Co-venture partners being

signatories to the PSA.;

(j) EEPGL confirmed that data prior

to 2004 was not available as it

was purged in accordance to their

internal data retention policies.

As a result, a summary of costs

incurred during this period was

used for inclusion in the cost

recovery statement;

(k) EEPGL did not do enough to

keep the Government of Guyana

appraised of the activities and

costs associated with the develop

ment. In particular, the annual

work programme and budget sub

mission did not meet expecta

tions, and no justifications were

provided at the end of each year

for changes in scope or cost over

runs. Both of these are require

ments in the PSA; and

(l) Insurance certificates were not

provided to ensure that full cover

age has been maintained through

out the audit period. Although

each partner provided coverage

for its share of the block interest,

only EEPGL has provided premi

um details and invoices. As a

result, the auditors were unable to

confirm that Hess and CNOOC

were meeting their responsibili-

ties in this regard.

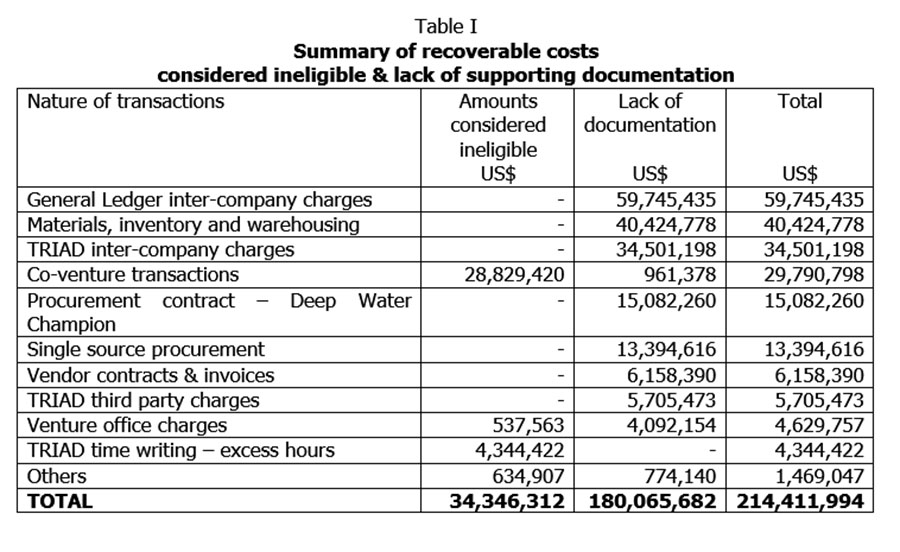

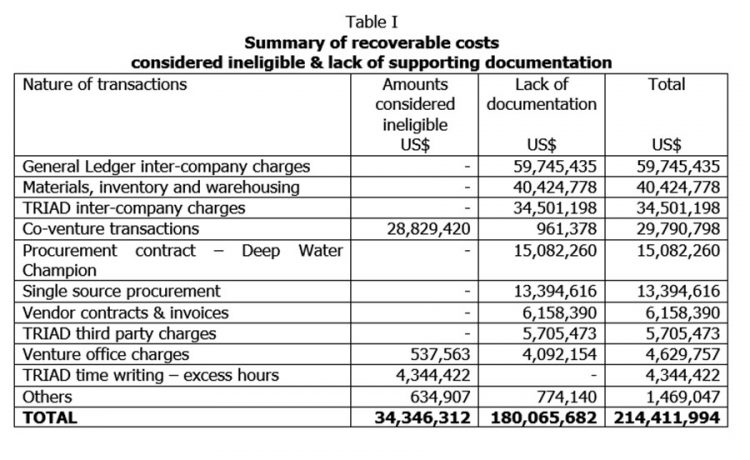

Table I provides a summary of the recoverable costs that the auditors consider either ineligible in the context of the PSA or lack adequate supporting documentation.

General Ledger inter-company charges: A total of US$78.4 million was recorded in the main accounting record, the General Ledger, for which the auditors believe relate to inter-company charges that had not been reviewed as part of the TRIAD review or the contracts review. (Exxon’s TRIAD system is used to capture expenses incurred by Affiliated Companies.) However, the General Ledger records were also not always clear, with information missing on many entries, and the supporting documentation provided lacked details of what the charges relate to or why they apply to the Stabroek Block. Following the review of all available information, the auditors concluded that there is insufficient evidence to support US$59.6 million as recoverable costs.

Materials, inventory and warehousing: The total recorded expenditure on well materials was US$143.3 million. However, the auditors were unable to verify the return to shore base of unused materials issued to the operations. Additionally, approximately US$40.4 million in materials lacked specific vendor details to enable them to be traced to the related purchase contracts. Further, the Government was not invited to witness the materials count during the audit period, as required by the PSA. Moreover, an adjustment of US$349,098 was made as inventory adjustments but there were no supporting documents to substantiate this adjustment to the General Ledger.

TRIAD inter-company charges: Total expenditure recorded in the TRIAD system amounted to US$391 million. However, around 11.4 percent of this expenditure lacked sufficient clarity to allow for the tracing of the transactions. These consist of time writing – US$4,450,745; inter-company – US$34,501,198; third party charges – US$5,705,788; and other expenses – US$62,912.

Co-venture transactions: Of the amount of US$31.43 million representing co-venture costs, EEPGL was only able provide contracts and invoices for US$2.6 million to demonstrate that these expenses were related to Stabroek Petroleum Operations. An additional US$28.83 million was incurred prior to the co-venturers being signatories to the PSA. There was also no documentary evidence to justify a further US$0.95 million of costs. The auditors concluded that US$29.79 million should be removed from the cost recovery statement.

Procurement contract – Deep Water Champion: According to the auditors, Deep Water Champion drillship, which was on long term hire to ExxonMobil and for drilling the Liza-1 well, was one of the highest ever recorded daily rates for an offshore rig. Additionally, an amount of US$500,000 was recorded as seismic-related costs but there was no evidence of seismic activities being carried our during the period under review.

Vendor contract & invoices: Payments to vendors for the period under review amounted to US$953 million. However, 25 percent, or US$240 million, of the contracts awarded were based on single source procurement; while 11 percent, or US$99.5 million, were partial single source contracts. Additionally, EEPGL did not demonstrate the competitiveness of the rates for contracts valued at US$28.477 million. The auditors have also recommended the removal of an additional US$6.2 million from the cost recovery statement.

Venture office charges: The auditors have noted deficiencies in reporting of expenditure relating to Venture Office & Payroll charges and have identified amounts totalling $4.555 million as not having adequate transparency and justification. Considering the above, it is evident that the amount of US$214.4 million should be viewed as a minimum position since the auditors were unable to quantify certain transactions for which they have serious reservations about in terms of completeness, accuracy and validity as recoverable costs. For example, documents in support of the expenditure for the period 1999 to 2004 were not available, as they were disposed of in keeping with internal company policies. While the auditors did not quantify the amount involved, it is reasonable to assume that a greater portion of the U$460.238 million relate to this period. Similarly, the auditors have reservations in relation to certain overhead adjustments made by Exxon’s subsidiary EEPGL and included in the cost recovery amount.

Government’s response to the auditors’ findings

As indicated above, GRA has offered no objection to the findings of the auditors whose responsibility which was to identify expenses that they consider to have been added in error, do not relate to petroleum operations, or for which there is insufficient evidence and transparency to determine the validity of the expenses. The Vice President, however, has indicated that the disputed costs have been reduced to US$11 million since ExxonMobil’s subsidiaries submitted additional documentation in support of the expenditure. It is, however, unclear whether additional documentation could be provided to justify the expenditure after the audit was closed and the related report issued. This is especially so, considering the elaborate and exhaustive process that the auditors went through to gain acceptance of their report. Assuming this is so, and in order to allay fears that the Authorities might have been going easy on ExxonMobil’s subsidiaries in relation to the disputed costs, it is most desirable for another independent audit to be commissioned to examine the additional documentation provided by ExxonMobil’s subsidiaries. After all, Guyana’s share of the disputed costs is US$107.2 million.

That apart, the auditors have deemed amounts totalling US$34.346 million ineligible in the context of the PSA and are unlikely to be justified through additional documentation. A clarification from the Authorities is therefore needed.