After several postponements and much hype, only six companies bid yesterday for 14 potentially oil-rich, offshore blocks and ExxonMobil is among them.

Various senior government officials had talked up the prospects of the offshore blocks but when the deadline passed yesterday only six bids, including from French oil company Total were entered. Noticeably absent were any bids from India or Indian companies. The number of bids and their origins would be seen to be below the government’s expectations.

The receipt of the bids also saw Middle East oil and gas power house, Qatar submitting a bid, a move that coincided with a one-day visit to Guyana by its Emir.

Bids for the auction: Guyana Licensing Round Oil Blocks for Tender- Continental Shelf and Deepwater – which will be evaluated from September 18th to October 6th, were yesterday morning receiv-ed at the National Procure-ment and Tender Adminis-tration Board, Kingston. The bid round for the auction had been three times postponed, as government had said it would await the completion of an upgrade of the entire regulatory framework to facilitate the process.

Those documents are a new Production Sharing Agreement (PSA), along with a new Petroleum Activities Bill 2023.

Observers had said that given the adjusted terms of the PSA which were far more beneficial to Guyana than the one ExxonMobil sealed in 2016 there would not likely be many bidders. This was particularly so given the increasing shift away from carbon fuels and the projections that in a decade or so demand would fall substantially. Bidders would have faced around a 15-year timeline between exploration and possible production with no guarantee that light crude would be found.

In August of last year, Minister of Natural Resources, Vickram Bharrat, told Stabroek News that government was still in the process of putting measures in place for the highly anticipated auctioning of available offshore blocks, and consequently the auction would not have been likely before the end of the third quarter of 2022.

According to a government of Guyana schedule on the processes for the auction, after the submission of bids on the 12th of September, they would be evaluated from the 18th of September to October 6th.

Negotiations, the schedule explains, will be conducted between October 10th and the 27th of this year with the announcement of contract awards slated for November 1st 2023.

Unclear from yesterday’s submissions of interests is which category of blocks the respective companies placed bids for, given that blocks available are both in the deepwater and the continental shelf.

Keen interest

On January 17 this year, President Ali told a press conference here that India had been asked to submit a written proposal outlining its interest in the oil and gas sector here.

“There has been a keen interest, consistently from India, to be a long-term purchaser of crude oil from Guyana. In addition to that interest, they have express-ed also a keen desire to support us in the entire ecosystem around the oil and gas sector,” Ali said when asked by Stabroek News of New Delhi’s interest during his visit there.

“I said to the team that they should put in a proposal as to what exactly they are proposing, in terms of a long- term agreement, and that has to be examined technically. In a meeting with the Minister, the interest of exploring that government-to-government collaboration was very clear,” he added.

During his visit to India, Ali met with Hardeep Singh Puri, India’s Petro-leum Minister. Following the meeting, Puri had tweeted: “Discussed direct Government to Govern-ment cooperation across entire spectrum of oil & gas sector including increased long term offtake, participation in exploration & production activities in Guyana, technical cooperation in midstream & downstream sector & capacity building”.

Ali had also said on January 17 that this country sought to galvanize interest from the Indian private sector so that they can participate in the auction of offshore blocks and government made clear to the Indian government, as it has with other nations, that they too can bid.

“There was also a clear undertaking that the private sector of India wants to partake in that auction… we also encouraged the Government of India to have their agency participate directly in the auction because we would like to see as much people [as possible]. Every government interested and would like to participate in the auction, we would like see participate,” he stressed.

And as he issued a public invitation for bidding at the auction, the President said that government hopes for maximum participation. “We are encouraging every single company. Let me say this very clear – Guyanese company, any company. You want to be part of the auction? Please come up. Any government in any part of the world, any company in any part of the world, you are free to be a part of the auction,” he emphasised.

Last December, as he stressed the need to expeditiously move to develop the country’s oil and gas resources, Ali had announced the launch of the licensing round for 14 offshore oil blocks.

“We have a situation where there is a timeframe on oil and gas development. We understand the direction in which the world is going, so it is very important for us to have developers who are serious, who will expeditiously move towards developments of the oil and gas resources”, he said

The new model PSA contains big changes such as the upping of royalty from 2% to 10%, corporation tax of 10% and a limiting of the amount of blocks for companies.

“We have decided to auction 14 blocks, and these 14 blocks will range from about 1,000 square kilometres to about 3,000 square kilometres for each block, with the majority of them being closer to 2,000 square kilometers. Eleven of these will be in the shallow area and three in the Ultra-Deep, Area ‘C’ area,” Vice President Bharrat Jagdeo had told reporters at a press conference on November 3rd last year.

Of significance, Jagdeo explained, was that signing bonuses would now see a minimum US$10m for blocks in the shallow areas and a minimum US$20m for deep water blocks.

“We decided we needed to get the bid more competitive. We will allow local and foreigners and international companies to bid. There will be minimum technical qualifications and minimum financial qualifications for the bids. They have to meet these. We don’t want them [requirements] to be too onerous, but people have to meet some minimum qualifications. The qualifications will be more stringent for the ultra-deep area because only few companies can work there. The minimum requirements there will be much greater than the shallow,” he had said.

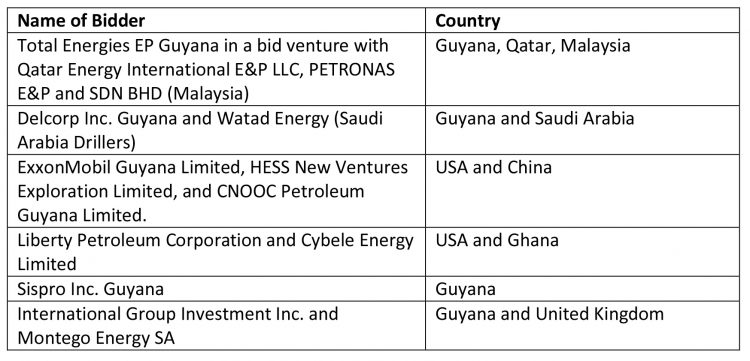

Below are the names of the bidders and the respective countries they are from.