By Christopher Ram

Banks DIH Limited, one of Guyana’s oldest and most prominent public companies held its 68th Annual General Meeting on 27 January 2024. Executive Chairman Clifford Reis presented the report of the Directors for the year ended 30 September 2023. Banks, as it is popularly known, is actually a group of companies comprising the food and beverage giant and Citizens Bank Limited in which it has a 51% interest. More recently, the company incorporated a 100%-owned Banks Automotive and Services Inc. which reported a profit of $9.2b. in 2023. The group as a whole reported a profit before tax of $14.5b which was an increase of 8.3% over 2022.

Key shareholders in the company include Demerara Life Group of Companies (11.4%), Trust Company (Guyana) Limited (8.7%), Banks Holdings (Barbados) Limited (5.9%) and the Hand-in-Hand Group of Companies (5.5%). Banks has eleven directors, the majority of whom – including two women – are non-independent executive directors reporting to a CEO who is also the Chairman of the board. Banks DIH and DDL have been known to resist any attempt at separating these roles, considered a feature of good corporate governance under most international Codes of Corporate Governance.

From all accounts, the AGM was proceeding sedately until, according to a report in an online news outlet, a shareholder indicated that he planned to invest more in the company but questioned why “the Company’s share price was not moving in tandem with all the positive things that were happening.” That question appears to have triggered quite an emotive response from Chairman Reis who expressed strong dissatisfaction about the Guyana Stock Exchange itself, the role of brokers, the size of trades and the influence of small trades on the price of traded shares. Mr. Reis even suggested that brokers have sold five shares in violation of the Company’s By-Laws.

Mr. Reis would not make such a public statement if he did not have actual knowledge of those transactions and he has every right to be upset that the most recent trade price – no matter how small the trade – becomes the new price. He knows too that in Business Page columns I wrote over several years (these are available at chrisram.net), I advocated for a reform of that practice. His Company was silent on the call because it also came with a call for a Corporate Governance Code which both Banks and DDL have stoutly resisted. Where I do believe Mr. Reis went overboard in his expansive response to the shareholder was in describing as “amazing,” 80,000 shares being sold between twenty-five persons, an apparent heresy in Reis’ view because a number of the sellers did so “without any hard financial evidence”. Mr. Reis would be doing us all a favour in providing any reference to the By-Laws of any public company in Guyana or to the Companies Act of Guyana of such a requirement.

That was not the only problem I have with Mr. Reis’ response. He practically boasted about the Company’s ability “to develop the company with all this capital works without borrowing and selling shares.” The fact that the company can do this is a direct result of the company’s dividend policy in which the directors pay shareholders a negligible share of the annual profit available for distribution.

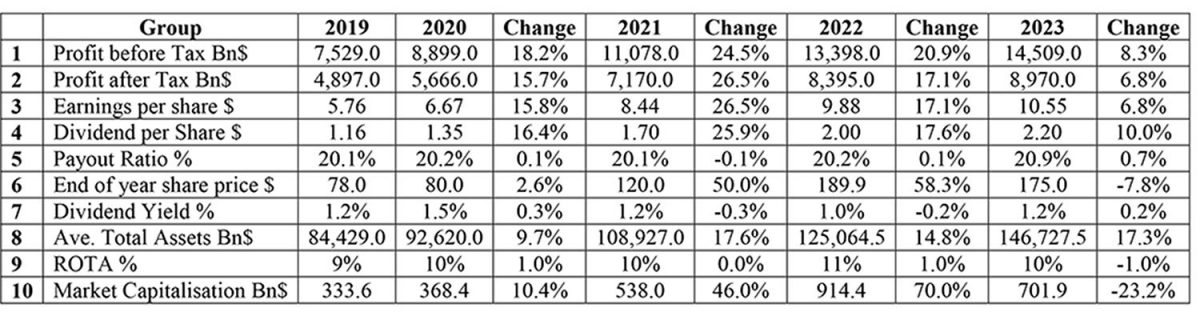

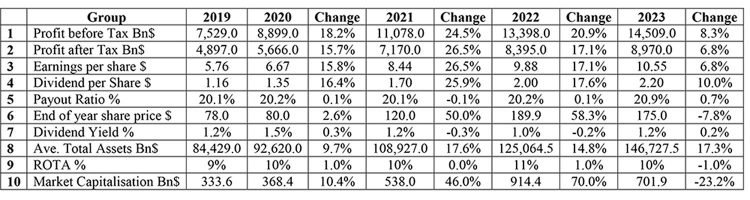

What is worse is that as the Table below shows, there is such an eerie consistency around 20% as to suggest that that is no accident – but a policy which directors are either unable or afraid to question. Moreover, that ratio is in fact the lowest among major public companies in Guyana, although again, only slightly less than DDL. It is amazing that Mr. Reis would overlook such an important determinant in the price of his company’s shares.

As a consequence of this policy, the Company fails in another significant indicator, i.e., the dividend yield, which shows how much a company pays out in dividends each year relative to its stock price. He might take some comfort that by this measure, Banks actually outperforms DDL and Demerara Bank but lags far behind Demtoco, GBTI and Republic Bank. Ironically, had his company’s share price been higher, the dividend yield would actually be even lower.

There is no intrinsic virtue in the Company financing out of retained earnings all its investment requirements. One of the things one learns in an MBA Finance programme is that equity, including retained earnings, is generally more expensive than debt. One has to believe that equity is cheap to believe that financing all investments out of equity and distributable reserves is something to be proud of. What a low payout ratio assumes is that the company will more profitably re-invest the profit than shareholders would, despite dividends being tax-free. Sadly, that misplaced confidence, or arrogance, is not limited to Banks DIH.

Mr. Reis laments the company’s share price movement which has swung by 2.6 % in 2020, 50% in 2021, 58.3% in 2022 and negative 7.8% in 2023. There was nothing in the fundamentals of the Company to justify the significant increases in 2021 and 2022, two years in which share prices across the board rose by 46% and 70% respectively. Mr. Reis did not question those increases but now raises doubts about the 2023 change of negative 7.8%, ignoring the negative 23.2% change in the market as a whole.

Some years ago, the Banks DIH directors decided that dividends would be paid in three tranches, two interims of around $0.40 per share and a final dividend of about $1.20 per share. Whatever may have been the intention, that decision makes poor sense. An interim dividend of $0.40 per share to someone who holds 5,000 shares amounts to $2,000 but carries a significant transaction cost both to the company and the shareholder. For a shareholder resident abroad, not only will the net remittance after withholding tax substantially erode the dividend, but some banks have a floor on the amount they will transfer on any single transaction. Such shareholders also bear the risk of a creeping exchange devaluation. In these circumstances, I fail to see any financial or economic reason even a medium-sized non-resident shareholder would want to hold on to their shares in this company.

It should not therefore be so amazing that persons with small numbers of shares sell their shares – they become like stranded assets, but the CEO thinks there is something amiss!

Mr. Reis made a big play about the Company’s expansion programme and its acquisition of forty acres of land and a new bottling plant for US$71m. The truth is that the Company has in fact been replacing fixed assets as line 8 of the Table shows. On that score, the profit before tax (PBT) has increased at a faster rate than average total assets for a number of years, but one must remember that PBT is based on current values while a major part of total assets is usually stated at historical cost. What is particularly troubling however, is the wide disparity between the 17.3% increase in total assets and the comparatively modest increase of 8.3% in profit before tax in 2023.

On page 15 of the 2023 Annual Report, the Directors – not the Chairman – discussed a new holding company which will subsume and change the public status of the existing company as it has been since 1955, making it a subsidiary with only one shareholder. Under this arrangement, shareholders in the existing company will exchange their shares for shares in the new holding company. According to the Directors, this step would allow the Group to enter into new activities arising from the present rapid development in Guyana and is “taken pursuant to the advice of a reputable accountable firm BDO.” I am not convinced about the wisdom and benefit of this decision, but rather consider it adventurous and poorly conceived. The existing structure has not prevented the Group from investing in a new company costing hundreds of millions of dollars and can similarly undertake several others.

The misguided, incorrect and flawed response by the Chairman makes, absolutely necessary. a reconsideration of the decision to have a new holding company with all its ramifications. If anything, my view is that the shares of Banks DIH are currently overvalued but that the problems are not insoluble. Get governance right, address the fundamentals, have regard to the interest of the shareholders and not only the company, practise some informed corporate democracy and execute judiciously, and Banks can once again be the pacesetter.

I agree that we need to address the issues of GASCI and the Securities Council to make them function more efficiently. Public companies can help in this process if they cooperate with GASCI and the Securities Council rather than treating these bodies as adversaries to be confronted.