Introduction

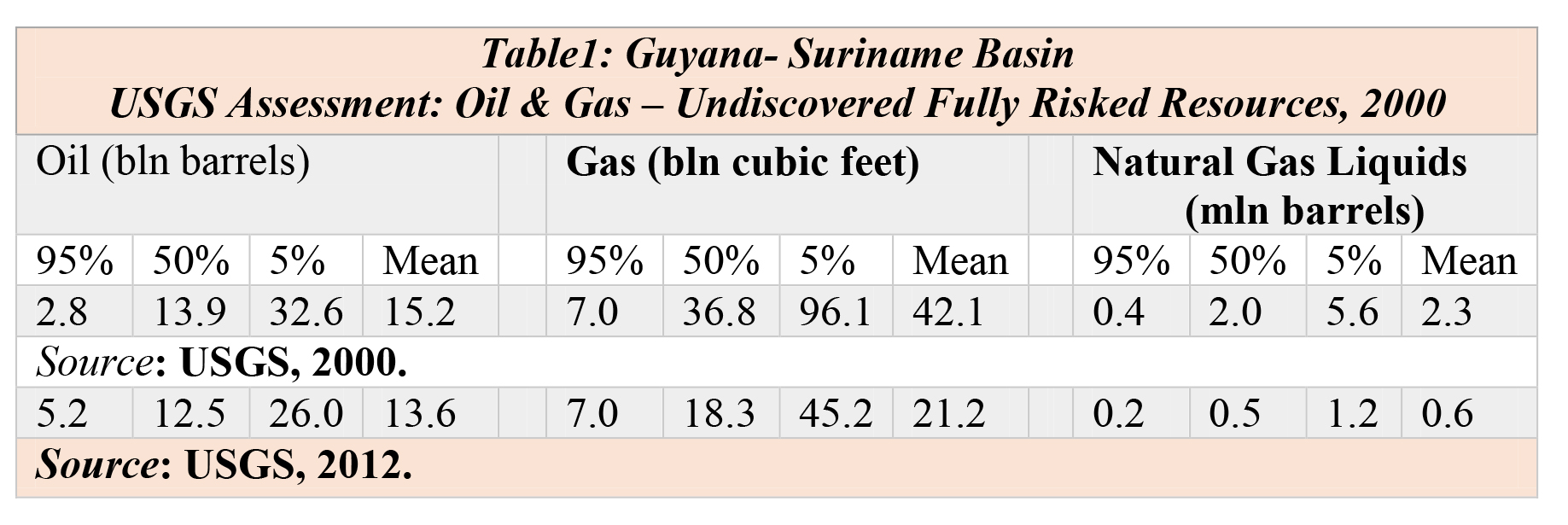

As indicated in last week’s column, today’s column focuses on two items. The first of these provides a tabular wrap-up of the United States Geological Services, USGS’ data concerning undiscovered oil and gas in the Guyana- Suriname Basin [see Table1below]. The second provides a brief reporting on my recent [2023] update of Guyana’s projected crude oil potential.

As revealed above, for the USGS 2000 Guyana assessment, the estimates range from 2.8 billion barrels of oil (95 percent likelihood) to 32.6 billion barrels (5 percent likelihood). The 50 percent likelihood is at least 13.9 billion barrels of oil equivalent and the mean is 15.2 billion barrels of oil equivalent.

However, for the 2012 assessment, the estimates range from 5.2 billion barrels at 95 percent and 26.0 billion barrels at 5 percent. The 50 percent likelihood is 12.5 billion barrels and the mean is 13.6 billion barrels. Discoveries thus far reveal amounts considerably larger than the 95 percent likelihood estimate for both assessments.

Two further observations are warranted here. First, these estimates are for a virgin frontier region and therefore remain reliant on petroleum geology assessment. Second, the mean natural gas estimates are for 42.1 and 21.2 billion cubic feet, respectively.

Updated, how massive

Last week I drew attention to four separate sources of current estimation of recoverable petroleum resources in Guyana which merit citing in any taking stock of this measure. First, ExxonMobil and partners estimate of 11 billion plus barrels of oil equivalent, boe. I remain unclear if this refers to the Stabroek Block or the Guyana-Surinam Basin or is a deliberate tactical understatement. Second the Government has included in its public auction invitation to bid the statement that the bidding is for 24 billion boe. Third, other firms operating in the sector have referenced 50 billion boe…Fourth there is my initial estimate cited last week of 13-15 billion boe. This has been recently re-visited and that effort is presented in the next Section

Thomas 2023 Estimate

As noted last week my initial gauging of recoverable resources is based on two primary drivers. Firstly, a bullish outlook on Guyana’s hydrocarbons potential. And, second the incentivizing/disincentivizing investor “resource price” set by the ruling Stabroek PSA.

I updated that prediction last year as follows. Representing the USGS results on a continuum, I opined that the reported 95 percent confidence value data reflect what may be interpreted as a conservative evaluation of the geological data. And, by parity of reasoning, the 5 percent value represents a more expansive valuation. The middle position on this continuum represents the 50 percent value and the mean likelihood, as defined in the USGS Report. Taking the above into consideration I initially chose the mean likelihood from both surveys and then rounded up to the nearest whole number to arrive at 13-15 billion boe.

More heroically, I now assume this circumstance supports the thesis of asymmetric risk. That is, the decision agents in the sector [both resource owner and lead contractor for operations] vested in the likelihood [thesis] that the reward outcome [resource finds] will be greater or lesser than is the norm depending on the placement on confidence interval. Risk is not assumed to be distributed “as likely or not”, equally along the continuum. The upside risk is therefore, more appealing to both owner and contractor.

The USGS reports that their results are based on a probabilistic method where 1] estimated reserves are fully risked 2] estimates are confined to conventional resources 3] on the probability distribution curve fractiles F95, F50, F5 and the mean reveal the estimated amounts to that value and their chances for the minimum attained. Thus, for example F95 reveals the “at least” amount that is expected with a 95 percent choice of finding.

Extrapolating from a laundry list of considerations not repeated here I moved from the search for a mid-point on the continuum, to one closer to the 5 percent confidence value and consequently riskier. My best guess now is a 10 percent fractile, yielding about 28-30 billion boe.

Conclusion

Next week’s column treats with the second driver and its metrics posted on my Template designed to frame this assessment of Guyana, as the Americas fastest emerging Petrostate. That driver and its metrics are Guyana ‘s relatively assured opportunity to export crude oil competitively in a global open market-based system for oil trades. Regulated trade is not normalized.