-leading figures from former Omai Gold Mines Ltd have role

Reunion Gold Corporation (RGD) of Canada and G Mining Ventures (GMIN) have struck a deal for gold mining in Oko West in Region Seven.

The deal will see participation from several leading figures from the former Omai Gold Mines Limited (OGML) which extracted the precious metal over a number of years at its mine site near the Omai Creek.

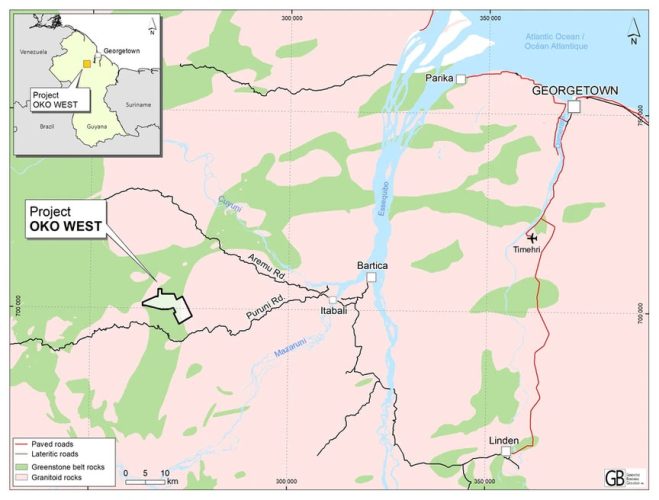

A press release yesterday from the two companies said that through the transaction, GMIN will acquire RGD’s flagship Oko West Project in the Cuyuni/Mazaruni, described as one of the most attractive mining jurisdictions on the continent.

“Oko West has emerged as a globally significant gold discovery over the last few years, with excellent potential to become a top tier deposit that could support a large, long-life mine complex to accelerate GMIN’s vision of building a leading intermediate gold producer. The GMIN team, including through the Gignac Family-owned G Mining Services (GMS), has an impressive track-record of executing world-class projects in the Guiana Shield region to generate industry leading returns for its stakeholders”, the release said.

The release said that GMIN plans to move Oko West rapidly through technical studies to a construction decision, utilizing the considerable amount of exploration, development, and permitting work that has already been completed by RGD, supported by the expected free cash flow from the Tocantinzinho Gold Project in Para in Brazil which is trending on schedule and on budget for commercial production in the second half of 2024.

Under the terms of the Agreement, the release said that GMIN and RGD shareholders will receive common shares of a newly formed company (the New GMIN) equivalent to RGD shareholders being issued 0.285 GMIN common shares for each RGD common share. In addition, RGD shareholders will receive common shares in a newly created gold explorer (SpinCo) that will hold all of RGD’s assets other than Oko West. GMIN has agreed to fund SpinCo with CAD$15 million.

RGD shareholders will receive estimated consideration of CAD$0.65 per RGD common share, an estimated Transaction equity value of CAD$875 million, based on the closing price of GMIN common shares on the Toronto Stock Exchange (TSX) on April 19, 2024, excluding the value of the SpinCo consideration. The release said that this represents a premium of 29% based on GMIN’s and RGD’s closing price and 10-day volume-weighted average price on the TSX and TSX Venture Exchange as at April 19, 2024, respectively, without accounting for value of SpinCo.

Upon completion of the Transaction, the release said that existing GMIN and RGD shareholders will own approximately 57% and 43% of the combined company on a fully-diluted in-the-money basis prior to the concurrent US$50 million equity financing, and the combined company and RGD shareholders will own 19.9% and 80.1%, respectively, of the outstanding common shares of SpinCo.

Long-life mine

The release said that Oko West is one of the most significant gold discoveries in the Guiana Shield and has potential to support a large, long-life mine complex.

It noted that the GMIN team, including through the Gignac Family-owned GMS, has an impressive track-record of executing world-class projects in the Guiana Shield region, on or ahead of schedule and on or below budget, to generate industry leading returns for its stakeholders.

It said that the principals of GMS have been continuously involved in the region since Louis Gignac led Cambior Inc. to build its first South American operation in Guyana in the early 1990s.

Louis-Pierre Gignac, CEO, President and Director of GMIN, stated in the release: “Oko West has all the key attributes GMIN is looking for in its next leg of growth. We are well-positioned to accelerate value creation at Oko West leveraging our unique expertise in building and operating mines on schedule and on budget in the Guiana Shield, deep knowledge of and network in the region, and over US$480M anticipated near-term free cash flow from Tocantinzinho. The acquisition of Oko West is the second step towards our vision of becoming a leading intermediate gold producer, building on the team’s success at Tocantinzinho. We look forward to continuing to advance our “Buy. Build. Operate.” strategy to create and unlock further value for GMIN shareholders.”

Rick Howes, CEO, President and Director of RGD, stated: “We are very pleased to announce this Transaction today, which we believe is a testament to the outstanding work our team has done rapidly discovering and advancing Oko West over the last few years. We believe that this Transaction not only delivers our shareholders an attractive upfront premium, but also the ability to participate with significant ongoing ownership in the combined company, having the opportunity to participate in an expected future re-rating as Oko West is advanced towards production. The Transaction significantly de-risks the advancement of Oko West given the financial strength, free cash flow, and development capabilities that GMIN brings to the table. Importantly, we believe this is a great outcome for the country of Guyana, with Oko West being taken forward by a company that will be a great steward of the asset for the benefit of the country and its communities.”

SpinCo

SpinCo’s focus, the release said, will be on acquiring and exploring gold mineral properties in Guyana outside of a 20-km area of interest surrounding Oko West, and in Suriname. GMIN has agreed to fund SpinCo with CAD$15 million and in return the combined company will obtain a 19.9% interest in SpinCo.

The Transaction will be completed pursuant to a court-approved plan of arrangement under the Canada Business Corporations Act. To effect the Transaction, New GMIN will acquire all of the issued and outstanding shares of GMIN and RGD. New GMIN, to be renamed G Mining Ventures Corp., will apply for listing on the TSX, the release said.

RGD will be entitled to nominate two members to the board of directors of New GMIN, in addition to the appointment of the common director, David Fennell, to the newly created role of Vice Chairman.

Fennell has been Chairman of Reunion Gold since its inception in 2003. He founded Golden Star Resources Ltd in 1983 which was instrumental in the discovery and development of the Omai Gold Mine in Guyana and the Gross Rosebel Mine in Suriname.

New GMIN’s board of directors is expected to comprise a total of 9 members (5 GMIN nominees, 3 RGD nominees and 1 La Mancha nominee), including Louis Gignac as Chairman and Louis-Pierre Gignac as director, president, and CEO.

In 2020, RGD announced a new greenfield gold discovery at its Oko West project in Guyana and announced its maiden mineral resource estimate in June 2023 after just 22 months of resource definition drilling. In February 2024, RGD announced an updated Mineral Resource Estimate containing a total of 4.3 Moz of gold in Indicated Resources grading 2.05 g/t and 1.6 Moz of gold in Inferred Resources grading 2.59 g/t. This 2024 estimate includes an underground Resource containing 1.1 Moz of gold at a grade of 3.12 g/t Au in the Inferred category.

G Mining Ventures is developing the Tocantinzinho Gold Project in Brazil’s Para, the second-largest mining state in the country. The project initially had a robust mineral reserve of 2,000,000 ounces, sufficient for ten and a half years of production using a straightforward open-pit mining approach and a 12,600-ton-per-day conventional process plant.

The Government of Guyana, through the Guyana Geology and Mine Commission (GGMC), yesterday disclosed the signing of a Mineral Agreement with Reunion Gold Corporation.

A statement dated April 21st from the Ministry of Natural Resources said that this agreement aims to establish “stable fiscal and operating conditions” for the Oko West gold project, owned entirely by the company’s Guyanese subsidiary.

Key components of the Mineral Agreement include royalty payable to the government for gold produced from the operations, as set out under the fiscal regime for mineral agreements.

As part of the agreement, Reunion Gold commits to prioritizing the employment of qualified Guyanese individuals and implementing a comprehensive training programne to develop additional skills necessary for Guyanese personnel at all operational levels, the release said.

“This approach aims to contribute to the sustainable development of the country by nurturing local talent. Additionally, the company pledges to establish a financial support programme for environmental and social projects, allocating US$1 million annually towards initiatives that promote environmental sustainability and address social needs within surrounding communities. This commitment will commence upon commercial production or within 24 months from the issuance of a mining license, whichever occurs first”, according to the release.

“The government and the ministry reaffirm the shared commitment to sustainable mining practices, aimed at minimizing environmental impacts, fostering positive community relationships, and creating lasting benefits for Guyana and its citizens”, the release added.