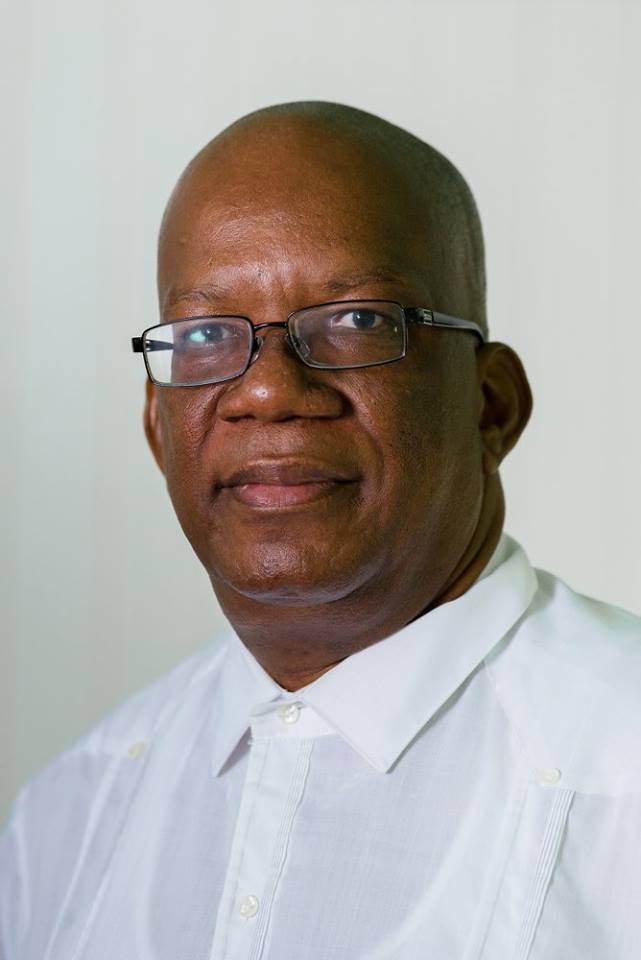

The plight of NIS pensioners specifically in relation to the failure of government to increase minimum payouts was addressed by former Minister of Finance, Winston Jordan in a letter to Stabroek News dated May 23.

In his missive, the former minister related being approached by an NIS pensioner for an explanation as to why pensions have not seen an increase above the minimum since 2020. He confessed to not being able to give a satisfactory answer but proceeded to explain the situation concerning NIS minimum payments.

He indicated the yearly increases in NIS Old Age Pensions since 2015 with the Coalition Government increasing the minimum pension (equivalent to 50% of the minimum wage) every year between 2015 and 2020, with the minimum pension increasing from $21,352 in 2015 to $35,000 in 2020.

However, he noted that following their installation in office, the PPP/C Government, while increasing salaries in 2021, 2022 and 2023, failed to similarly raise the NIS minimum pension for those years, only doing so in 2024, when the minimum pension was increased by 23.1% to $43,075. This failure of government to compensate NIS old age minimum pensioners for the 3 years, Jordan posited, has resulted in an accumulated loss in unadjusted income of $92,496 for each pensioner.

He also pointed out that the figures reveal that the last increase in NIS old age pensions above the minimum, was in 2019 when a 4% increase was granted by the Coalition Government, which was implemented from January 2020. However, since then, no further increase was given, hence the query by the pensioner. This, Jordan explained, has had several “deleterious” consequences, since importantly, money has a time value, that is, the value of today’s dollar is not the same as that of four years ago.

Further, he noted that the basket of goods bought with $52,000 dollars in 2020 will cost substantially more in 2024, which, in the absence of savings or other income to supplement his pension, a pensioner would have experienced a reduced standard of living through no fault of his own.

Given the above, the letter put forward that “a great deal of angst” has been created as a result of pensioners who were receiving just above the minimum pension. “These pensioners are now being forced to accept the new minimum pension, instead of having their pension suitably adjusted to maintain the status quo ante.”

However, the letter did acknowledge the fact that NIS must examine the sustainability of any increase in the face of several financial setbacks. On the income side, the Scheme’s revenues have suffered because of the failure of successive governments to implement the recommendations of the Actuarial Reports; low returns on Treasury Bills (its preferred source of investment), and on investments such as Berbice Bridge and CLICO; and high delinquency rates among employers and self-employed. And on the expenditure side, an aging population, resulting in increased payout of benefits; and rising administration costs, among others, have damaged the profitability of the Scheme.

Lest the aforementioned issues be construed as an excuse for government to abstain from pension increases, Jordan noted that nothing mentioned was the fault of pensioners, besides, if NIS is being prevented from paying increased old age pensions above the minimum, then the Government must act decisively to remove the impediments and/or provide relief financing. He proffered that the NIS is still a member of the Cooperative Finance Administration (COFA) and that the COFA Act has not been repealed. He explained that this Act has provisions for the government to meet any shortfall, in any financial year, of any of the financial institutions falling under the Act.

Further, even if it is assumed that the Act no longer exists, nothing stops the Government from transferring the necessary resources to the NIS. He noted that this is being done, already, in the specific case of GuySuCo, which, he contended, has benefitted from over $50 billion in transfers under the Coalition Government. In fact, the entity continues to be the recipient of billions of dollars in transfers, annually, under the current Government. The former minister said that it was the intent of the Coalition Government to transfer resources from the Natural Resource Fund (NRF) to the NIS, so that the Scheme can meet its obligations to its contributors, pensioners, and other beneficiaries. He reminded that the Scheme was similarly bailed out, in 2016, when a deal was signed for it to recover $5.6 billion it lost in CLICO in 2009.

“NIS ceases to function as an effective social safety valve when beneficiaries are denied their rightful pension, after many years of contributing to the Scheme. The great Robert (Bob) Nesta Marley sang, “In the abundance of water, the fool is thirsty”. In the abundance of resources, unheard of in the annals of our history, the NIS pensioners above the minimum are made to suffer. The Government must act now to bring permanent relief to this category of pensioners.”