About Ram & McRae

Established in 1985, Ram & McRae has distinguished itself in the field of professional services. Our client focus, commitment to professionalism, and our continuous search for excellence, are the sources of our unchallenged reputation among professional firms.

We have secured a premier place in the provision of taxation and advisory services to local and international business operators. Our continuing relationship with international partners provides us with access to worldwide resources and ensures that our clients benefit from business ideas, opportunities and solutions that place them in leadership positions in their industry.

Our partners

Christopher L. Ram, FCCA, ACMA, ACIS, LLB, LEC

Managing Partner and founder of the firm with overall responsibility for quality assurance aspects of the engagement, Christopher has in excess of thirty years experience in senior positions in international auditing firms. He was Financial Consultant to a regional government for several years where he was integrally involved in Budget preparation and Chairman of the National Insurance Board. Christopher is also a practising Attorney-at-law.

Robert V. McRae, CPA, BSc., FLMI

Robert has more than thirty years experience in the areas of audit, accounting and insurance in Guyana and the United States of America. Robert also practises as a Certified Public Accountant in New York.

Rakesh V. Latchana, FCCA

Rakesh was admitted to the partnership on January 1, 2006 bringing the number of partners in the firm to three. He has over fourteen years experience in audit and accounting; and ensures that the firm has a broad array of skills and expertise to meet the challenges faced by our varied clientele. Rakesh became Chief Executive Officer of the firm on January 1, 2010.

Acknowledgements

The Partners of Ram & McRae are truly grateful to have been once again afforded the opportunity to contribute to society through this publication.

We would sincerely like to thank those members of staff who provide us with the support to produce this publication in such a short period of time. These persons include Alexis Barry, Donna Dublin, Chetram Singh, Cleaveland Gilkes, Jermaine McPherson, Kristie Persaud, Dione Singh and Daniele Hicks.

About this Publication

This 2011 Focus on Guyana’s National Budget represents the twenty first edition of this Ram & McRae annual publication which highlights, reviews and comments on the major issues surrounding and raised in the National Budget. Each year, Budget Focus is circulated among politicians, the business community and the country representatives of international agencies operating in Guyana. But most importantly for us and the general public, is the wide circulation made possible by the publication, in the Stabroek News, of an abridged but comprehensive version of Focus.

The contents of this publication are not intended to take the place of the text of the Budget Speech or of a professional advisor. This analysis is prepared and distributed on the understanding that Ram & McRae is not engaged in rendering professional services to the reader. If financial or other expert assistance is required, please contact the Firm.

Introduction

As expected, the Budget was not spared controversy linking it to 2011 General Elections. Responding to a criticism by Leader of the Opposition Robert Corbin that the Budget would be an Elections Budget, President Jagdeo, two days before the Budget, announced at the opening of the Diamond branch of the Republic Bank (Guyana) Limited the confidence of the PPP/C that they did not consider an elections budget a necessity and that the fiscal deficit for the year would actually improve.

Well, yes, the fiscal deficit is projected to move from $18.2Bn to $17.3Bn. This reduction has been achieved not by better expenditure management that continues to deteriorate, but by higher and higher tax collections mainly from waged employees via PAYE and consumers via VAT. But the fiscal deficit is only one measure. Budget 2011 projects an overall deficit of $34.0Bn, some $13.3Bn or 65% higher than 2010. Record revenues from VAT and other taxes simply cannot keep pace with the Government’s capacity to spend which in turn translates to record borrowing. In any case, the initial Budget is not usually a good measure of whether it is elections driven or not since as night follows day there will be several requests for supplementary funds, later if not sooner. But the real source of elections driven spending is likely to be NICIL and other extra budgetary funds which the Government spends to influence the support of their non-traditional voter base. The point that Mr. Corbin did not make was that the misuse of state funds for campaign financing makes elections unfair and is a breach of an undertaking given by President Jagdeo to Mr. Corbin and President Carter to take steps to regulate campaign financing. See Commentary and Analysis.

Surprisingly, the Minister failed to acknowledge the International Year of People of African Descent and not a single “cent” has been included in subventions and contributions to any of the Afro-Guyanese organisations. The Budget optimistically projects the receipt of seventy million United States Dollars from the Guyana-Norway Agreement under the government’s Low Carbon Development Strategy. The Government is projecting to spend much of this money on the Amaila Falls Hydropower Project and huge sums on the Amerindian land demarcation process.

When one looks at the Amerindian Act 2006 however, one finds it extremely difficult to see how the process can cost any huge sums of money. As attorney-at-law Dr. Arif Bulkan notes in a soon to be published article in a professional journal, applications for title under the 2006 Act are made to and decided by the Minister using a very simplified process. All that is required to initiate it is an application in writing signed by four adult members of the community. Where applications are made by existing villages for extensions to their titled lands, the four signatories must be members of the village council, including the Toshao and Secretary. The application itself is also simple, requiring only basic information such as the name of the village or community, the size of its population, a description of the area requested and the reason for the application. All applications must be supported by at least two thirds of the adult members of the village or community, and where the application is for an extension of lands, a plan of the existing titled areas must also be included.

The Budget was presented against the backdrop of Guyana experiencing an unusually cold relationship with the diplomatic community, languishing as a very corrupt country in TI’s Corruption Perception Index and poorly rated in the Heritage Foundation / Wall Street Journal 2011 Index of Economic Freedom where it sits at number 151 out of 179 countries.

A review of this nature cannot ignore the political environment that informs and guides the preparation of the budget including the manner in which taxes, subsidies and expenditure are dispensed and directed to favour certain sectors and individuals. We are conscious too that this is the last budget under the Jagdeo’s presidency and we consider it necessary and appropriate to examine the legacy which the President will leave us. See Commentary and Analysis.

With corruption now possibly the most used word in the Guyana lexicon, this publication also addresses that issue in Commentary and Analysis. It takes some hope in the establishment of a potential national chapter of Transparency International but is not unaware that the organisation will have to challenge poor governance, weak systems, and a timid, apathetic and at times compromised populace if it is to stem the rapid descent in standards of integrity and honesty, let alone accountability and transparency. This too is addressed in Commentary and Analysis as is Debt (mis)management resulting from the excessive spending by the government.

Last year in our analysis under the caption Whither GuySuCo?, we commented that the turnaround plan did not adequately confront the issues facing the industry, including the necessity for the insulation of the entity from political interference. The future of each of the estates has to be confronted. Even if the much heralded Skeldon Project eventually operates at full capacity, it would not be able to service the Corporation’s huge debts and carry the unprofitable estates as well.

We had advised then that the longer the problems are ignored, the more costly and drastic the solutions would eventually be. Those warnings were ignored and the Corporation now requires ever increasing sums to keep its head above water. Several months ago the President had boldly announced that he was taking personal charge of GUYSUCO. Yet, the situation has simply deteriorated with production almost threatening record low figures.

On a positive note, one of the issues addressed last year, the Presi-dential Assent of Bills, has improved dramatically although the constitutionality of some of the provisions of new legislation and the quality of drafting must be causes for concern.

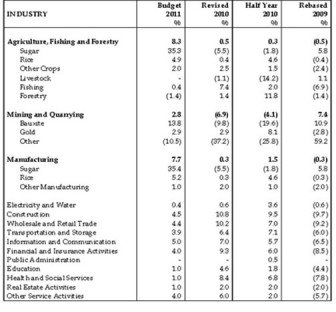

The Minister expects the nation to believe that the economy grew by 3.6% in 2010 despite the decline of 5.5% fall in sugar against a budgeted growth projection of 19.8%, a mere 0.4% in rice, a contraction of 6.9% in the mining and quarrying section against huge projected improvements in bauxite, gold and diamond, and a statistically insignificant 0.3% increase in manufacturing. While the reported growth is 1.0% lower than that projected by the Minister in his 2010 mid-year report, the dramatic decline in sugar makes even a 3.6% growth hard to believe. What adds to the credibility problem is when the 2011 projections are considered. In 2011, sugar is expected to grow by 35.3%, rice by 4.9%, manufacturing by 7.7%, while the services sector is likely to grow by smaller percentages.

Yet, expected growth is only 4.6%. Since the service sectors usually benefit from growth in the productive sector, there is a suspicion the services sector is a form of balancing figure in providing an acceptable growth figure.

Workers and their representatives would welcome the increase in the personal allowance despite the fact that adjusted for inflation, in 2011, they are actually worse off than they were in 2008. They ought also to feel extremely badly done by when for the first time in the history of the country the basic and average personal tax rate is higher than a corporate tax rate. On the other hand, incorporated businesses – except the telephone companies – would feel somewhat satisfied at the reduction by 5% in the rate of corporation tax. This unfortunate framing of the reduction comes close to discrimination so frowned upon by the supreme law of the country.

While the Minister announced that $800 million would be spent on the new Haags Bosch Dump Site and that the Le Repentir Dump Site would be “completely closed” in 2011, he did not indicate any sums allocated for this latter exercise. That Site is a threat to the health and well-being of thousands of citizens of South Georgetown and it would have been sensitive for the Minister to show that the government was prepared to spend on solid waste disposal the full sum of $849 million expected to be collected by way of the Environment Tax in 2011.

The Minister boasted about the government’s record on governance in 2010, a year in which public confidence in the integrity of public officials reached unprecedented depths. Unconvincingly he described the Procurement Act, the Audit Act and the Fiscal Management and Accountability Act as evidence of the strengthening of public accountability. The Minister ought to know that the Procurement Act presupposes the operationalising of the Public Procurement Commission, that from private and personal information that the Audit Office’s independence, integrity and capacity are compromised, and that the Fiscal Management and Accountability Act serves to subvert rather than conform to the relevant provisions of the Constitution.

Encouragingly the Minister announced the signing of a number of agreements for oil exploration in Guyana. We have passed this way before but the Minister was confident enough to speak of an oil and gas sector!

Highlights

2010 Facts

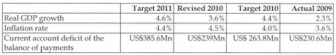

■ Growth in real GDP of 3.6% compared to 2.3% in 2009. Growth of 2.8% for the first half of the year decelerated to 0.8% in the second half of the year.

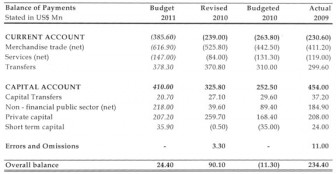

■ Overall balance of payments surplus of US$90.1Mn compared with US$234.4Mn in 2009.

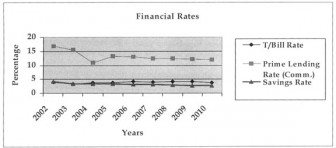

■ Decline in the 91-day Treasury bill rate from 4.18% in 2009 to 3.78%.

■ Inflation rate of 4.5% compared with a target of 4% and 3.6% in 2009. The rate announced in the first half of 2010 was 2%, while the rate for the full year had been projected at 4%.

■ Depreciation of the Guyana dollar to the US dollar by a modest 0.12%. Average market mid-rates for US$ however appreciated by 0.2% while the Canadian dollar, Pound Sterling and the Euro depreciated by 4.4%, 17% and 6% respectively to November 2010.

■ Current Revenue of G$107.8Bn compared with G$94Bn in 2009, an increase of 14%.

■ Minimum public sector wage increased to $33,207 or by 5% from $31,626 in 2009.

■ Growth in rice 0.4%, manufacturing 0.3%, fishing 7.4%, forestry 1.4%, gold and mining 2.9% other crops 2.5%, and contractions in sugar 5.5%, bauxite 9.8% and livestock 1.1%.

■ Exports and imports increased by 15% to US$891.9Mn and 16% to

US$1,417.7Mn

respectively, resulting in a merchandise trade imbalance of US$525.8Mn, or 28% over the US$411.2Mn recorded in 2009.

■ Current account deficit of US$239.0Mn (2009 US$230.6Mn); and net inflows on the capital account of US$325.8Mn (2009 US$454Mn).

11 Targets Size of the Budget: $161.4Bn, 13.1% increase

■ Inflation of 4.4% with growth in Real GDP of 4.6%.

■ Current revenue of $126Bn, an increase of 17.3% over 2010, including

GRIF receipts of $14Bn;

■ Balance of payment surplus of US$24.4Mn.

■ Current expenditure of $99Bn, an increase of 7% over 2010, including

interest and debt repayment of $11.6Bn.

■ Overall deficit of non-financial sector to decline to $17.3Bn or 3.5% of

GDP.

■ Overall deficit after grants to increase from $20.6bn to $34.0Bn.

■ Capital expenditure to increase by 33% to $62Bn.

Review 2010

Source: Annual budget speeches and Half Year reports.

The Global Economy

The Minister estimated growth in global output of 4.2% in 2011 compared to 4.8% growth in 2010. The recovery in the United States is continuing but remains moderate as a result of subdued private consumption. The Asian giants China and India recorded growth of 10.5% and 9.7% respectively.

Caribbean economies are estimated to have recorded marginal growth of 0.5% in 2010 and are projected to grow by 2.2% in 2011. Sub-Saharan Africa has quietly been recording significant growth and a recent analysis by The Economist magazine found that over the ten years to 2010, no fewer than six of the world’s ten fastest growing economies came from that region.

The Domestic Economy

In his statutory 2010 mid-year report, the Minister of Finance had reported half-year real growth of 2.8% despite dismal performance in the agriculture and mining sectors.

For full year 2010, sugar production was 220,862 tonnes, 12,874 tonnes or 5.5% less than the 233,736 tonnes produced in 2009. Production for the first half of 2010 was 81,864 tonnes or 1.8% below the corresponding period in 2009. In rice, production was 360,996 tonnes or 0.4% in excess of the 359,789 tonnes produced in 2009, a decade high production.

Mining and quarrying contracted by 6.9%, with gold declarations of 308,438 ounces representing a 2.9% increase in declarations while bauxite contracted by 9.8%. The manufacturing sector grew by 0.3% overall, driven primarily by an expansion of 2% in the output of light manufacturing industries while the forestry sector recorded modest growth of 1.4% for the year.

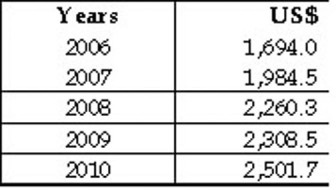

Per Capita GDP

Source of information – Annual Budget Speeches

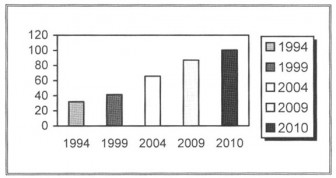

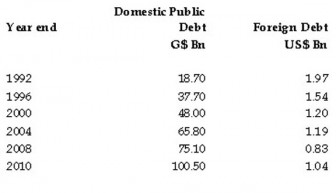

Domestic Debt

The growth in the domestic debt from 1994 to 2010 is shown in the following graph:

Source of information – BOG Statistics – All shown at December except 2010.

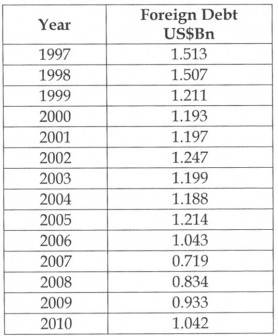

External Debt

The movement in the external debt from 1997 to 2010 is shown in the following table:

Source of information – BOG Statistics and Budget Speech – All shown at December

Balance of payments

The current account on the balance of payment reflected a surplus of US$90.1Mn in 2010, compared to US$234.4Mn surplus in 2009. Reflecting a 26.7% in gold price, the sector earned US$364.4Mn in 2010 or 23% over 2009 while rice earnings expanded by 35.5% to US$154.6Mn. These were mainly responsible for export earnings of US$891.9Mn. Merchan-dise imports however expanded by 20.2% to US$1,477.7Mn mainly due to increases in the value of fuel and lubricants.

Source of information – Estimates of the Public Sector

Banking and Interest Rates

There was continued decline in the 91-day Treasury bill rate to 3.78% and the weighted average prime lending rate at 11.95%. On the other hand, the small savings rate declined from 2.78% to 2.67%.

The following table shows the spread earned by the commercial banks as the financial rates continue to decline.

Source of information – BOG Statistics

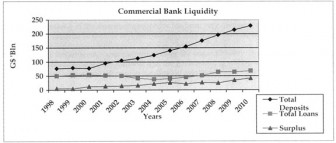

The commercial banks have generally reported significant profits as most borrowers pay rates that are higher than the prime lending rate while the banks’ effective borrowing rate is lower than the savings rate as most demand deposit accounts earn no interest. Despite the spread, deposits continue to rise while loans and advances have grown only modestly.

Source of information – BOG Statistics

The Exchange Rate

There was a slight depreciation in the value of the Guyana dollar to the US dollar by 0.12%.

Ram & McRae’s Comments

● Readers will recall that in 2010 the Minister announced that the National Income Accounts had been rebased from 1988 to 2006 affecting long time series.

● With gold continuing to shine, policy makers need to consider the future of the industry with a view to making it more compatible with the Low Carbon 3. ● Development Strategy. There is an unhelpful relationship between the industry and the government that can harm economic development. The industry is a major employer of youth from several depressed communities who might find it difficult to obtain alternative employment.

● Several sector outputs standout in comparison with the prior year as follows:

NA – Not Available

Source: 2010 and 2011 Budget Speeches

■ The results of the diversification of the economy are still not evident two decades after the ERP began. Even the LCDS is unlikely to be the

immediate dramatic change agent that the government expects and if

the efforts to find oil are successful, a complete rethink would be

necessary.

■ The performance of the manufacturing sector has been very

discouraging and there seems to be something needs to be done to

address what may very well be structural problems.

■ The rest of the economy cannot afford to carry the sugar industry. It

does not appear that the lessons of bauxite have been learnt or that the

government is willing to con front the challenges and political

implications inherent in the range of solutions.

■ The reduction in diamond output for five consecutive years is perhaps

due to resources being shifted to gold, attracted by higher prices.

■ The Government continues to ignore employment data. NIS actual

contribution data indicate no growth in employment, even as about ten

thou sand youths leave school annually. In the past five years the

number of employed persons increased by 2,623 whilst the number of

self-employed persons has increased by 2,052. Please see Commentary

and analysis.

■ Foreign direct investment of US$198 million is mainly in the gold

mining sector which is buoyed by the prevailing high world prices. The

government needs to cash in on this opportunity.

Unfinished Business

Last year, we decided that the list of unfinished business was becoming too long. We decided therefore that we would trace such incomplete issues only back to 2008. In 2010, the only policy issue of note was the establishment of the Competition and Consumer Protection Commission for which a sum of $75Mn was provided. Our information is that this Commission has been set up although little is known of it and whether the entire $75Mn was expended. We now set out the policy issues that so far as we are aware, have not been addressed.● Feasibility work to be done for alternative generations of energy form wind, solar, hydro and biological sources – No progress report but it is already obvious that expectations for any major Hydro-Electricity project were way too optimistic. With LCDS being the new mantra, these would warrant high priority.

● Freedom of Information Act – The PPP/C had committed itself to such an Act in its 1997 Manifesto “within that term.” See also page 15 on Legislation. Yet, the Government continues to dither and stall on this matter despite several commitments by the President and other members of the Government.

● Review of the Companies Act 1991, the Partnership Act, the Business Names (Registration) Act and the Friendly Societies Act – Even the relatively newer of these legislation – the Companies Act 1991 – contains errors of commission and one particularly significant omission in relation to non-profit organisations creating particular difficulties for such organisations. Additionally, as companies, attorneys and academics began to apply the Act, certain additional areas of difficulty have surfaced, while new legislation such as the Banking, the Financial Institutions and the Insurance Acts, all have some impact on the Companies Act 1991.

● Action plan based on the Labour Market Study as addressed in the Draft 2005 PRSP Progress Report – there is no indication whether this has been done. As we indicate in Commentary and analysis, it seems that the Government is avoiding any issue in relation to employment and unemployment.

● Establishment of a family court – The construction phase is almost complete and it is hoped that the court would become functional soon.

● Review of tax exemptions – Seems that there is some study of a study taking place but with the government coffers running over with annual windfalls from VAT, the government is unlikely to consider tax reform a priority. See Tax reform, below.

● Reform of Judiciary – There has been some progress in reform of the Judiciary but the pace at which the reforms are moving will not solve the huge accumulation of difficulties. While an Order was gazetted indicating that the laws had been updated to 2006, no one has seen these, nor can anyone at the Attorney General’s Chambers offer any guidance.

In November 2010 there was published a set of new Rules of the Supreme Court replacing the decades old Rules of the High Court. However, there is no indication whether these will come into effect any time soon. Suspicion is that the publication was driven more by donor funds rather than any genuine effort at rules modernisation.

● Bank of Guyana Reform – No report.

● National Drug Strategy Master Plan – Measured by successful prosecutions, this Plan has had minimal effect and cannot be separated from a more comprehensive Crime Plan.

● The Institutional Strengthening Project in the Office of the Auditor General. More money being spent but results uncertain. This project, substantially funded by the Inter-American Development Bank, approved in December 2006, is still in the implementation stage. There is an unwillingness to confront the real issues that deprive the Office of any effectiveness – financial control, conflicts of interest and low capacity.

Tax Reform

Again the Minister failed to announce a review of the tax system. The Minister’s failure to address this is an embarrassment to the Private Sector Commission whose Chairman only a few days earlier had publicly announced that there was a partnership between the Government and the Private Sector to engage a consultant to do some undefined review.

The Government of Guyana Financial Plan 2011

The table on page 26 presents a summary of the Government’s projected Financial Plan for 2011. The 2011 Plan projects a surplus on the current account of $17.7Bn, but after capital receipts and expenditure the plan projects an overall deficit of $34Bn.

The main elements of the 2010 Plan are:

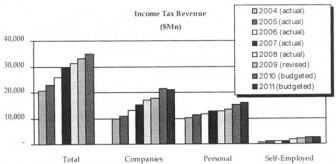

Total current revenues are projected to increase by $4.2Bn to $112Bn or by 3.9%. Of this the Guyana Revenue Authority is expected to bring in revenues of $104Bn or 93%, an increase by $3.5Bn, or 3.4% over 2010.

Of the GRA’s collections, the Internal Revenue is projected to bring in $44Bn compared with $43Bn in 2010, an increase of 1.9% or $.8Bn while Value-Added and Excise Taxes are expected to earn $50Bn compared to $48Bn in 2010, an increase of 3.9%. Collections by the Customs and Trade Administration are anticipated to be $10Bn, an increase of $.8Bn or 8.3% from 2010.

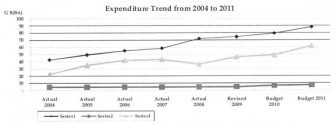

Total Current non-interest expenditure is projected to increase by $9Bn from $78.5Bn to $88Bn for 2011. Personal emoluments of $31.5Bn represent an increase of11% or $3Bn over the revised figures for 2010.

In 2011, capital revenue and grants are projected to increase by $4Bn to $15.4Bn of which HIPC and MDRI will contribute $1.57Bn while Project and Programme funds are projected to increase by $3.8Bn

Capital expenditure of $62Bn represents an increase of $15.4Bn or 33% over 2010 of $47Bn.

We also address the allocation of current and capital expenditures on pages 27-28 – ‘Who Gets What’.

Interest expenditure is projected to increase by 11% to $6.7Bn. Domestic interest is projected to decrease by $.2Bn while interest on external debt is projected to increase by $.8Bn.

The principal element of debt repayments is projected at $4.9Bn (2010 – $8Bn), made up of domestic debt repayments of a projected $1Bn (2010- $5Bn), while external debt

repayments are projected to increase to $3.9Bn. During 2011, domestic and external debt service as a percentage of current revenue is projected at 10.4% compared with 13.3% in 2010.

The Plan reflects an overall deficit of $34Bn which the Minister proposes to finance by external borrowings of $32Bn and from domestic sources by $2Bn.

Ram & McRae’s Comments

1. The Fiscal Management and Accountability Act requires the Minister to state the assumptions underlying the budgeted numbers. Despite his showcasing of this Act as his government’s commitment to probity he has often chosen the time and manner of his compliance with it. For example there are specified and detailed procedures on the use of the Contingencies Fund and the rules governing supplementary procedures. He routinely ignores these.

2. While salary increases in the public sector increased by 5%, plus an extra 1% for teachers, the overall increase of 11% was not explained by the Minister. This is almost certainly due to the uncontrolled practice of contract employees many of whom are employed at taxpayers’ expense to do political work.

3. Given the experience so far with the disbursement and receipts of LCDS money, the Minister’s projected receipt of US$70Mn or G$14.4Bn may prove to be optimistic.

4. VAT continues to produce annual windfalls but the Government has remained unmoved by calls for relief by way of a reduced rate and an increase in the range of zero-rated items.

Who Gets What in 2011

Current Non-Interest Expenditure

In this section we consider how the budgeted expenditure is allocated among the principal Ministries, Departments, Programmes and Projects.

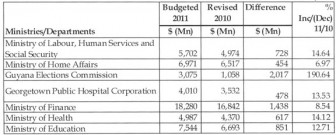

Central Government’s non-interest current expenditure (employment costs, statutory expenditure and other charges) for the year is budgeted at G$87.7Bn which is 11.7% more than revised 2010. The Ministries/ Departments with the most significant allocations are:

The regions with the most significant allocations are:

Significant changes from the previous year’s latest estimates are provided for in the following Ministries/ Departments:

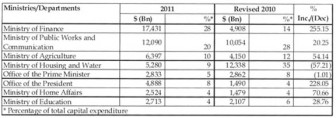

Capital Expenditure

Central Government’s capital expenditure for the year is budgeted at G$62Bn which is 33% above revised 2010 and 38.49% of total 2011 expenditure. The Ministries/Departments with the most significant capital expenditure allocations compared with the latest estimates for 2010 are:

Highlights from Ministers’ Speech

The Minister in his speech highlighted the following allocations:

Public safety and security $15.9Bn

● Health $14.0Bn

● Roads and bridges $10.1Bn

● Drainage and irrigation structures $6.6Bn

● Housing $3.6Bn

● Agriculture sector $1.5Bn

● Water $1.5Bn

● Air and river transport $1.1Bn

● Sanitation $180Mn

● Tourism $150Mn

Ram & McRae’s Comments

1. Under Subsidies and Contributions, LINMINE Community Power will receive $2.2Bn in 2011.

2. There is a fundamental problem with the allocation of resources to local government organs. Article 77A of the Guyana Constitution requires Parliament to formulate and implement objective criteria to allocate to and garner resources by the local democratic organs. More than This Article has been completely ignored.

3. There is a provision of $800Mn towards the Haags-Bosch landfill but while the Minister said the Le Repentir Site will be closed in February, he announced no allocation for this. The City Council of course does not have the expertise or the financial resources to have this done and the sire may continue to be treated like a political football with potentially dire consequences for the affected communities.

4. Contract employees continue to drive up employment cost while some traditional public servants earn monthly salaries equivalent to less than US$175 per month.

5. The allocation for the office of the Leader of the Opposition is projected to double in 2011.

6. Several entities with a poor record of audit and accountability continue to receive huge subventions and in certain cases increases. Indeed so pervasive is this situation that only those entities whose audits are in arrears by more than five years are publicised.

7. Similarly a number of the annual reports of several of these organisations are not being laid in the National Assembly as the law requires. Among these are the Guyana Information Agency, National Communication Network and the Integrity Commission.

8. State Planning Secretariat, a non-existent body, is budgeted to receive $130Mn, while the Office of the Opposition Leader sees an increase from $5.3Mn to $10.4Mn.

9. In this, the International Year of People of African Descent, there is no allocation or subvention to any African organisation.

10. The EPA gets $148Mn. The residents who have to endure the health hazards of the Le Repentir Dump Site would certainly like to know how much of this figure will go to remedial studies and measures to contain the effects.

2011 Budget Measures

The 2011 budget contained the most significant measures since the introduction of the Value-Added and Excise Taxes in his 2006 budget speech (with effect from January 1, 2007).

The Minister announced an increase in monthly Public Assistance from $4,900 to $5,500 or a 12% increase over 2010, and an increase in Old Age Pensions from $6,600 to $7,500 per month, or a 14% increase over 2010, both with effect from February 1, 2011.

The personal income tax allowance has been increased from $420,000 to $480,000 per annum.

The corporation tax rate was reduced from 35% to 30% of chargeable profits for non-commercial companies and 45% to 40% of chargeable profits for commercial companies with the exception of ‘telephone companies’ which will continue to suffer tax at the rate of 45%.

Ram & McRae’s Comments

1. The rates of Public Assistance and Old Age Pensions translate to $181 and $247 per day, not enough to pay for one, let alone three meals per day.

2. While the increase in the personal allowance would be welcomed by workers and their representatives, it is nevertheless disappointing. The allowance was last increased in 2008 from $336,000. The inflation adjusted allowance from 2008 is $483,801 and therefore the new allowance does not restore the person to the position they were in three years ago.

3. Given how well the Minister says the economy is performing he ought to have dealt with the question of the rate and its structure so that the rate would not be greater than the corporate tax rate.

4. With inflation of 4.5% in 2010, a worker earning and spending $50,000 per month would now have $51,667 in disposable income to purchase items costing $52,250. Without a compensating increase in earnings, the worker would have to reduce consumption.

5. Companies’ tax rates have also been reduced by 5%. Companies, which receive allowances and deductions of various types, now pay a lower rate of tax than the wage earner and the self-employed.

Why the Minister has singled out the telephone companies for retaining the penal rate of 45% is a matter for speculation. The Government needs to avoid any impression that it is targeting the two companies in the sector while new entrants offering similar services using VOIP technology might not be subject to the revised rate. We believe that such a move would amount to discrimination.

No doubt the cut in the corporate tax rate will be welcome by the private sector but the suggestion that this would make the country more competitive ignores the fact that the corporate tax rate in Barbados and Trinidad and Tobago is 25%. Here it is 30% and 40% and where ironically it is the companies that suffer tax at 40% which contribute the lion’s share of corporation tax.

Breaking with good practice the Minister did not indicate the cost of any of his budget measures or explain how the “lost” revenue would be recovered.

Commentary and analysis

Campaign Financing

Despite the link between campaign financing transparency and accountability, corruption and the development of the party system, society has remained remarkably silent or uninterested on the issue of how political rarties finance their elections campaign. There is no data or research by academia or civil society on this matter while the political parties, which perceive themselves as beneficiaries of non-existent campaign finance rules, have effectively blocked any discourse or movement on the subject. Ahead of every general elections since 2001, Christopher Ram, Managing Partner of Ram & McRae has raised the issue with the Guyana Elections Commission. Major General (ret’d) Joe Singh, Chairman of the Commis-sion for the 2001 elections, recently told a civil society forum that when his Commission took the matter up with the political parties, it was told that it was “none of GECOM’s business”. For that Commission, the matter ended there. GECOM under the current chairmanship has had no better results.

At some level and at some time, President Jagdeo himself seems to have recognised the concerns with campaign financing. In 2004 he agreed with former US President Jimmy Carter that the Carter Center would “send an expert to help draft comprehensive legislation requiring full disclosure of all contributions made to political parties and how funds are expended.” It is not known whether he followed up on that agreement but it did not bring about any changes and the prospects for reform ahead of the 2011 general elections are less than zero.

The absence of campaign financing rules allows the worst elements of the business community, and the criminal class, to finance and assist – often with dirty money that appears nowhere in their books – contesting political parties to buy their way into office – often with money that they too do no have to account for. Conversely, the fairness of the elections is compromised when the ruling party abuses its access to state resources, putting opposition parties at a substantial disadvantage.

The history of elections and politics in Guyana is replete with evidence of dirty money subverting the democratic process, whether it was money from the Soviet Union, the AFL-CIO and the CIA or more currently the big contractors and drug lords. Even as election campaigns have become prohibitively expensive, the inadequate and outdated provisions of the Representation of the People Act addressing campaign financing have become completely irrelevant and useless, giving the parties an excuse for non-compliance.

Recently, Germany, France, the United Kingdom and the United States have shown how difficult it is to police party and campaign financing even where there are regulations, independent electoral commissions and parliamentary ethics committees. The effectiveness of these watchdogs depends on the commitment to more ethical behavior by the main political parties and the electorate. In Guyana, that commitment would seem totally absent.

With little or no interest shown by the political parties and the possibility of failure to agree on the most effective approach to deal with the problem, a possible solution is a package of measures which look desirable in themselves and which seek to tackle the problem from the angle on which they have some consensus. That common point is corruption. By implication Guyana accepted a similar package when it acceded to the Framework Principles on Combating Corruption at the Commonwealth Heads of Government meeting in Durban, South Africa in 1999. These included a proposal that within national strategies there should be rules on the funding of political parties which serve to:

– prevent conflicts of interest and the exercise of improper influence;

– preserve the integrity of democratic political structures and processes;

– proscribe the use of funds acquired through illegal and corrupt practices to finance political parties; and

– enshrine the concept of transparency in the funding of political parties by requiring the declaration of donations exceeding a specified limit.

What the UN’s Convention is asserting is the link between campaign financing and corruption. Unfortunately, the government’s attitude to corruption does not suggest that it takes the UN Convention seriously and recent experiences give no cause for hoping that it will initiate action on its own. After all, it has incumbency, it can use state resources to hold Cabinet Outreaches, and use the Lottery money and other unaccountable funds to buy support.

Now, eleven years after the Convention, let us hope that academia, civil society including the business community, the GHRA, the Electoral Assistance Bureau, GECOM and the political parties are prepared to influence action on this matter.

How do you define corruption?

Corruption is arguably the single biggest challenge facing Guyana in this the second decade of the twenty-first century. It is a two-edged sword: it can be used by non-political actors to influence political power and by politicians to buy support, silence critics and reward friends. There seems to be an attitude prevailing in Guyana that if a government brings us roads, water and lights, there is nothing wrong if they engage in self-help with state assets – that there really is no victim. They are not unlike the writers and mainly political scientists who argued that there is a cost-benefit to corruption and relied on the words of Samuel P. Huntington the American political scientist that corruption provides “immediate, specific, and concrete benefits to groups which might otherwise be thoroughly alienated from society.” He argued that corruption may thus be functional to the maintenance of a political system in the same way that reform is.

That was more than forty years ago and recent research studies in the causes and consequences of corruption conclude that the beneficiaries of corruption are limited to elites who lavish politicians with expensive gifts and demand bribes as a regular way of conducting their affairs on politicians helping themselves to state resources. Economists on the other hand have long warned about the pernicious impact of corruption, arguing that it increases transaction costs, reduces investment incentives, and ultimately results in reduced economic growth.

That view is widely supported by the international non-governmental organisation Transparency International (TI) which plays the leading role in defining and addressing corruption. TI is supported by the multilateral financial institutions and there are now international and regional conventions on fighting corruption including the United Nations Convention against Corruption to which Guyana acceded on April 16, 2008.

With the influence of the TI, there is now no disputing what constitutes corruption: it is operationally defined as “the abuse of entrusted power for private gain.” That definition must make a number of our politicians wince.

Based on empirical data, TI has concluded that corruption has considerable cost. Some academics have suggested that for every one percent of corruption, the country loses 0.60% in economic growth. For TI, the cost of corruption is four-fold: political, economic, social, and environmental. On the political front, corruption constitutes a major obstacle to democracy and the rule of law. Economically, corruption leads to the depletion of national wealth. But TI considers that the effect of corruption on the social fabric of society is the most damaging of all. It undermines people’s trust in the political system, in its institutions and its leadership. Frustration and general apathy among a disillusioned public result in a weak civil society. Finally there is Environmental degradation.

The impact of corruption in each of these areas may not be equal but there is now a mountain of evidence of corruption in Guyana, particularly in the first three areas.

Yet, it is not that we do not have laws to combat corruption: it is that they are compromised in a system that may selectively punish wrong-doing or is too tolerant of official corruption. The several mechanisms for detecting and prosecuting corruption include at the level of the constitution the Public Procurement Commission, an independent Audit Office, an independent Judiciary, an independent office of Director of Public Prosecution and an Office of the Ombudsman. And at the level of statutes there is the Fiscal Management and Accountability Act and the Integrity Commission Act.

Cynically after more than a decade, the Public Procurement Commission is still to be appointed. The independence and professionalism of the Audit Office and the judiciary are compromised by the hand of the executive. And the Fiscal Management and Accountability Act, intended to enhance accountability, has had the effect of making the Courts, the Auditor General and the Guyana Elections Commission beholden to the Executive. The Integrity Commission has been non-functional for years while corruption even at high levels of the Government is now treated as normal.

While other countries including Zambia and Kenya, and neighbouring Trinidad and Tobago have taken the fight against corruption by passing Anti-Corruption Acts over and beyond their integrity legislation, Guyana cannot even make its Integrity Commission Act functional. That is hardly an accident.

During 2010 a group of civic minded Guyanese began a process that would see the establishment of a Guyana chapter of Transparency International. This body will have its work cut out and this publication wishes it well.

Corruption however cannot be left to a few individuals no matter how well-meaning. It requires the public to become outraged when they see the expropriation of public assets by politicians and the political parties to challenge and pursue all forms of corruption in and out the National Assembly.

Debt Mismanagement

The external debt has again crossed the psychological one billion United States Dollar threshold with a 12% increase over 2009. This is a sharp increase from the US$718 million in 2007. And all this has happened while domestic debt increased by 15.4 %, exceeding the corresponding psychological G$100 billion mark.

We repeat what we said two years ago, sounding the alarm about debt and its impact. Debt has a huge cost which has to be borne by current taxpayers and future generations. For example, in 2010, external debt service was US$28.8 million while domestic debt service rose to G$4.979 billion, an increase of 15.1% over the preceding year. As a result, the percentage of current revenue which was used to service debt increased from 7.9% in 2007 to 13.3% in 2010. The overall impact was an increase in the overall balance on the financial operations from a negative $20.5 billion in 2010 to $33.9 billion, or 65%, and double that of 2009.

If this trend of borrowing continues, the country will return to the state of indebtedness it suffered from two decades ago. There is absolutely no economic logic to having the highest level of reserves, the highest revenues collected and at the same time the highest borrowings. It means that the government is engaged in an irresponsible spending frenzy even as we pay the thousands in receipt of public assistance a meager $5,500 per month and a pension of $7,500 per month to our senior citizens. Expressed in terms of a daily sum, the public assistance is $180 per day and old age pension is $247. The daily sum of the public assistance can buy only ¾ loaf of bread while the Old Age Pension will barely finance the whole loaf.

At December 31, 1992 the level of external debt was approximately US$1,967Mn and over the next eighteen years the country received a total write-off of US$2.127Bn. In other words the write-off received includes both pre and post 1992 debts. Consequently, the current balances of both domestic and external debts represent borrowings solely by the PPP Administration. It took twenty five years from the time the country fell into arrears in 1982 for the debt stock to return Guyana to a sustainable level. We can get back there even faster.

At the domestic level, local debt has been rising alarmingly, from $18.8Bn in 1992 to $100.5Bn eighteen years later. Together internal and external debt takes the total debt to US$1.5Bn. In 2010, the interest cost of servicing the domestic debt in 2010 was $3.9Bn while the interest on the external debt was $2Bn. Total debt service inclusive of interest cost is 13.28% of current revenue. While servicing of the external debt in 2011 is projected to increase by 27.6%, while the internal debt service is projected to fall in 2011 because of a substantial projected decrease in domestic debt repayment.

Debt has a first claim on the resources of a country as it does on individuals. We have argued before that without a constitutional cap on borrowings, any government can literally mortgage the country while being free of any obligations, all of which are borne by taxpayers and succeeding generations. The higher the borrowings the greater the interest and other servicing costs, which of course can only be financed by further borrowings and taxation.

The Fiscal Management and Accountability Act was intended to bring some order into the management of the country’s finances. It is not having the desired effect.

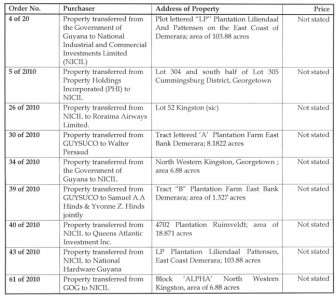

Diverting Public Funds

The state-owned company National Industrial, Commercial and Investments Limited (NICIL) has become the vehicle of choice and convenience for diverting public funds for all kinds of unusual expenses. As it has succeeded in that unlawful and dangerous role it has become more brazen and less concerned about public criticisms.

The company was formed under the former Companies Act and the Public Corporations Act with the stated purpose to subscribe for, take or otherwise acquire and hold the Government shares, stocks, debentures or other securities of any company, co-operatives societies or body corporate. It has been doing much more than that. It was involved in the sale of land at Prado Ville 2; the sale of properties to politically-connected business persons and to others; and it was involved in the controversial and contested award of the Amaila Falls Road contract to Synergy Inc. It is a government favourite that acts as though it too enjoys immunity from action.

In 2010 NICIL was involved in no less than thirty property transactions, of which the following, drawn from the Official Gazette, are the most notable. Orders 4 and 43 are instructive. There is nothing that would have prevented the government selling the property to National Hardware and placing the money direct into the Consolidated Fund. Instead the land is first vested in NICIL which then sells the land, holding the money which it can then spend as it pleases and pay into the Consolidated Fund whatever dividends its directors – all politicians – choose to pay.

One of these transactions involved approximately six hundred million dollars. Public moneys, according to the Constitution and the Fiscal Management and Accountability Act should be placed in the Consolidated Fund, from which it can only be withdrawn with parliamentary approval.

Order 61 may be dealing with the property for the Kingston Atlantic Hotel which is a 100% owned subsidiary of NICIL and whose sole director is the CEO of NICIL. It would be hard to find a more improperly interconnected relationship even in a private setting. NICIL is 100% state-owned.

There is no indication that NICIL will be paying any money into the Consolidated Fund in 2011 or that it will become compliant with the Companies Act 1991 or the Public Corporations Act or have its annual reports laid in the National Assembly by its subject minister who is the Minister of Finance.

It is noted that in no case is the price at which the properties are sold by NICIL disclosed in the public records. Clearly the publication is intended merely to meet statutory requirements, and not to provide information. NICIL, most of whose board members are members of the Cabinet, has failed to file annual returns and audited financial statements with the Registrar of Companies. The Constitution is subverted; the politicians control public moneys; and the public is kept in the dark.

Despite the egregiousness of these conditions, NICIL never receives even a token mention in the report of the Auditor General. It clearly is outside of the law. It must be hard to find its equal even in the most banana of republics.

Jagdeo’s Legacy

Budget Focus 2006 had predicted that President Jagdeo would be returned for a second term. But having pointed out a number of plusses and weaknesses in his presidency to that time, we opined that in his final term he would best serve the country by acting more deliberately and continuously working towards repairing some of the fissures created during his earlier years.

Because he has so single-handedly shaped public management in the past ten years, in this the last Budget under his presidency, Focus considers it opportune to assess whether he has lived up to those expectations and whether the conditions then identified still prevail. They do and many continue to retard the development of the people and the country. Mr. Jagdeo has never taken the rule of law seriously and had no qualms in ignoring even the country’s supreme law which he had taken an oath to respect and uphold. Key constitutional arrangements are ignored or subverted giving rise to the state of the Ethnic Relations Commission; the absence of a Local Government Commission and no local elections for fourteen years; the non-appointment of the Public Procurement Commission and the Standing Committee on Constitutional Reform; no Ombudsman for the entire last term; no Freedom of Information Act to give effect to the constitutional right to information; and the loss of independence and professionalism at the Office of the Auditor General.

But even these serious breaches do not fully reflect Jagdeo’s legacy. He has subverted the executive presidency into what must amount to an autocracy where it is his word alone that matters; sacrificed the inviolability of the constitution; and tested and stretched its presidential immunity provisions to breaking point.

The presidency has witnessed corruption rising to heights that are as dramatic as the depth of governance at its nadir; civility has given way to abuse and consultation to

confrontation. The public sector has effectively been made subservient to the political directorate, the independence of the judiciary under constant threat, while the country’s Foreign Service has been destroyed by appointments of neophytes of one sort.

At the economic level, the country’s physical infrastructure continues to improve, but there is growth without development, the gap between the rich and the poor widening into a chasm. Quality education and health have shifted to the private sector from which the poor are economically excluded. The tax system favours the better off, the entrepreneur over the employed, the capital class over the labouring class.

There is virtual political stalemate, Article 13 of the Constitution requiring citizen participation is ignored, communities are deprived of a role in choosing their representatives, local government elections postponed into perpetuity. The trade union movement is divided, collective bargaining a thing of the past. Political patronage has served to hold beholden to the President leading members of the ruling party.

Opposition and independent voices and views are barred from the country’s only radio station and the state-owned and taxpayers-financed television and newspaper. Fear of victimisation has silenced civil society, the business community and independent professionals. In a remarkable twist, while the country’s wealth has been privatised, all the democratic space has been nationalised.

While erasing the negative elements of the Jagdeo legacy will not be easy, one ironically positive contribution he has made is to convince many, many Guyanese that the executive presidency is synonymous with dictatorship and should be drastically reformed if not totally abolished.

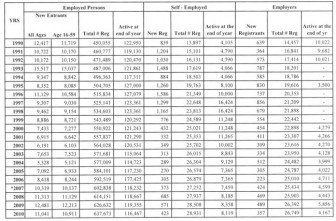

Unemployment

Page 389 of the 2011 Estimates (Volume 1) discloses a charge of $1Mn for a Labour Market Information System Commission. The Ministry of Labour also has a recruitment agency of which the first identified function is the registration of all unemployed persons. The agency does not have the mandate nor does it have the capacity to perform such a huge task. The determination of a country’s unemployed population is an important social and economic function that is the responsibility of the government’s. Yet there is an unwillingness by this Government and this Minister in particular to confront the question of unemployment in the country.

The data accompanying the Budget Speech suggests that we can determine the severely from the moderately malnourished persons, and the percentage of the population that is overweight (3.3%). But we stubbornly refuse to ascertain, as baseline data to inform policy, the number of persons out of a job and their particular skills. In other words, a full survey.

Statistics obtained from the National Insurance Scheme (NIS) show the number of active employees registered by the Scheme in 2010 at 116,467, compared to the all time high of 127,079 in 1996. Even more significantly there was a significant drop in the number of active self-employed contributors, 8,119 in 2010 compared to 16,424 in 1997, and practically no increase in the number of employers submitting contributions for their employees.

With respect to the self employed, compared with 1990, the number of registered self-employed persons has almost doubled from 4,105 in 1990 to 8,119 in 2010. Conversely the number of active employers in 1990 has declined from 10,022 to 4,167.

That these numbers do not make sense should cause even more concern to the policy makers. Ignoring the problem does not make the problem disappear and may even exacerbate it.

The Minister will understand that we will never be able to build Guyana on the backs of an army of unemployed youth, let alone build tomorrow’s Guyana today.

* Adjusted to Annual Report Figures

Conclusion

This economy continues to be driven by the public sector. Between 2006 and budget 2011, the distribution of investment between private and public sector has moved in the following way:

This does not speak well of the private sector that keeps clamouring for more and more incentives. Nor does it vindicate the Minister’s hope that companies benefiting from lower taxes would be in a position to reinvest a significantly higher share of their profits. In fact they will probably place it in a deposit account to be sterilised at great cost by the Government.

While expenditure on health and education as a percentage of the national budget is significant, the number of persons who leave school without basic education and those who seek medical services from private practitioners and institutions should be cause for serious concern. The growth rate in the economy is too low for sustained and rapid development. Studies indicate that a 1% increase in the corruption level can conservatively reduce the growth rate by more than 0.6%. It should be obvious then that corruption is taking a huge toll on the country’s growth and development.

The President rejected charges that this is an elections budget and that his party is confident enough not to need an elections budget to retain power. Yet his Finance Minister has presented a budget with unprecedented recurrent and capital expenditure and a budget in which the deficit in overall balance is 30.3% of revenue. To suggest that that is a normal budget is to confess to total recklessness.

The President would find it hard to convince employed persons that having stifled the personal allowance for three years and releasing it in an elections year was mere coincidence even if it ignores the draconian VAT rate and the range of zero-rated items. The calculation is that the threshold, the effect of which is immediate and direct resonates more than VAT, which is indirect and now seen as simply part of the cost price.

But the business community would be very pleased with the reduction in corporate tax rates. Unfortunately it means that for the first time in the country’s history, the average rate of personal income tax is higher than the corporation tax rate. For the poor and the unemployed, the Budget offers nothing.

More importantly however is the continuing failure of the government to bring some underlying philosophy to the preparation of the national budget. The government has clearly abandoned any commitment to socialism in favour of market economics of the Reaganite type. The Minister chose the easiest option available to him in the preparation of the Budget: increase the threshold and cut the rates of tax. Dr. Singh did not even think it necessary to indicate the cost of the tax measures he announced as the Fiscal Management and Accountability Act.

There was no discussion on tax reform including the question of expenditure which is financed by taxes and borrowings. For example, current expenditure has increased over the period 1992 to projected 2011 from $17.7 billion (1992) to $126.4 billion. By contrast tax revenues have increased from $17.0 billion (1992) to $105.1 billion. There was no discussion too on unemployment and poverty. These can be left for after the elections, or later.

In suggesting that the Clico liquidation is running smoothly, the minister appears to have forgotten the close to seven billion dollars Clico owes the NIS. Even he gets carried away by rhetoric.

Finally, as the debate unfolds, the National Assembly will sorely miss the research, erudition and oratorical skills of Mr. Winston Murray who has played such a leading role in the national budgets for more than twenty-five years.