I was intrigued by the closing paragraph of Prime Minister Samuel Hinds’ letter, ‘The PPP/C government embarked on a programme to refashion the bauxite sector so it would become profitable again’ in your edition of Sunday, May 20, 2012, which reads as follows:

“Truth is that nothing is forever; every situation has its time of birth and growth and glory days, but the world steadily moves on; things change. The glory days of our bauxite occurrences were the 1940s, ’50s and ’60s. We do not live to serve our bauxite; our bauxite is there to serve us for as long as it can, for as long as we cannot do better otherwise. This is true for all economic activities. There comes a time when one has to let go of past glories and focus on re-inventing and modernizing oneself, and one’s community.”

With regard to the statement in the paragraph “the glory days of our bauxite occurrences were the 1940s, ’50s and ’60s,” it is always difficult to comment upon or take issue with someone on such a statement which fits squarely into the realm of a value judgment defined as a ‘judgment based upon a particular set of values or on a particular value system.’

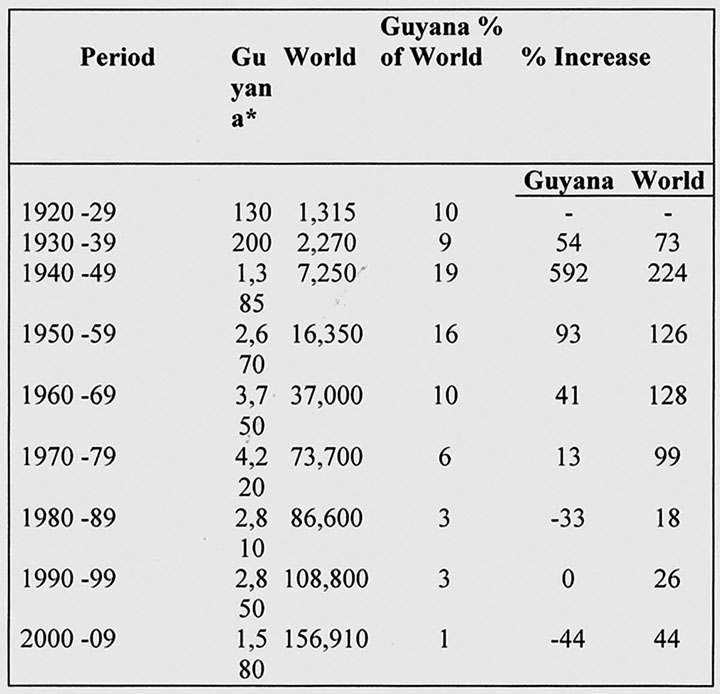

Having had the pleasure of being directly associated with the PM in the bauxite industry for 20 years and having listened to his pronouncements over the last 40 years on the demise and apparent non-existent future of Guyana bauxite, I would just like to bring to his attention the attached table, which I know, except for the last decade, he has already seen. While I have always had reservations about the accuracy of the data on world production, which often comprise a mix of bauxite ranging from 60-30% alumina content and 5-20% free moisture, and now about the data for Guyana for the last decade which record total production simply as the sum of dried and calcined bauxite, I think the data in the table is a fairly accurate representation of the historical development of world bauxite production from the decade of the 1920s to the end of the last decade

GUYANA AND WORLD BAUXITE PRODUCTION

10 YEAR AVERAGES

(000 tonnes)

* Dry Bauxite equivalent-0 moisture content for period 1920-2000

I cannot take issue with one who probably focuses on percentage of world production as his glory days criterion, but am sure most rational analysts would be more happy with an average 6% of 73 million in the decade of the ’70s than 19% of 7 million in the decade of the 1940s, especially when the 6% comprised bauxite of the highest grade and value-added products like alumina and refractory bauxite, compared with the world total, a significant percentage of which is between 45 and 35% alumina. I am sure that it cannot escape the PM’s attention that the annual average, 4.2 million tones for Guyana in the 1970-79 decade, if all were to be converted to aluminium, for which over 85% of world bauxite production is used, would have produced 1,100,000 tonnes aluminium, while the same quantity from Jamaica would have produced only 900,000 tonnes and from Australia around 700,000 tonnes. I am aware also that the PM is cognizant of the impact of Guyana’s high alumina, pure trihydrate bauxite on the cost of producing alumina – refinery capital cost; digestion temperature and pressure; raw material grinding, and digestion cycle. He should also note that Guyana’s ten year average production increased every decade from the 1920s to the 1970s.

I cannot help noting the PM’s continuing reference to the “1994 MINPROC declaration.” I had the privilege of participating in numerous meetings with the MINPROC team between 1992 and 1994 and while I was not present at the meeting where the now famous declaration was made, I had the opportunity at a subsequent meeting to listen to the CEO’s rationale for the declaration. I must admit that I heard nothing new, just the same litany – high overburden and consequent high stripping cost; low ore: RASC recovery and consequent high RASC production cost; high freight rates, and the low price of Chinese refractory bauxite. I never interpreted that declaration as signalling the final nail in the coffin of the Linden bauxite operation; what I read into the CEO’s statement was that his company MINPROC which had no experience in managing a large mining operation nor his Guyana team, consisting of the CEO, a mining engineer with limited experience in the field, one experienced maintenance engineer, two accountants, one so-called computer specialist, one purchasing agent and a salesman, none of whom had any experience in the bauxite industry “could see how the Linden bauxite operation could be made viable.” Incidentally, the Alcan team whose study provided the basis for the MINPROC contract, thought otherwise, and did advance a proposal to make it viable.

I cannot resist making reference to the last two words in the first sentence (detached in the print) of the paragraph – “things change.” I am not sure if the PM is fully aware of the significance of those two words; it appears as though his concept of change is one-directional. During our numerous discussions, debates, arguments over the years, and numerous statements he has made in various forums, he makes reference to the prospects for Guyana bauxite as outlined to him by the then GM of Demba when he joined the industry in the 1960s, effectively that the high overburden in the Guyana bauxite deposits makes it uncompetitive with bauxite from sources often with close to zero overburden. I assume that his busy schedule does not allow him to keep abreast of many of the developments in the world bauxite scenario. I must admit my failure to convince him over the years that stripping overburden is only one element in the overall cost of producing alumina from bauxite, and that a host of other elements have to be taken into consideration. One notable development in the industry is that many of the low overburden bauxites in the world are of relatively low alumina content, as low as 27% available alumina in some of the currently exploited Western Australia deposits. In addition, most of these bauxites have a high monohydrate alumina content which necessitates medium to high temperature and high pressure digestion, With oil at US$2.00 per barrel in the 1960s, high temperature and high pressure digestion did not matter; with oil at US$100.00 per barrel, the entire scenario changes. This probably explains RUSAL transporting Guyana bauxite in relatively small 30,000 tonne ships over a distance of 5,000 miles to their refinery on the Black Sea and planning to increase their production of such bauxite. Alcoa which recently expanded the Suralco, Suriname alumina refinery to over 2 million tones per annum, has now dubbed the refinery as expensive due mainly to the unavailability of quality bauxite from their existing mines, resulting in the company having to resort to the importation of quality bauxite from Brazil, and is now moving to exploit the 40 million tonne Nassau plateau deposit in Eastern Suriname, a project that would involve not only expensive mine infrastructure development, but the construction of a 104 km paved road and a bridge across the Suriname River to take the bauxite to their Paranam refinery. Further the company is reverting to the reopening of three remnant mines to extend the 7-8 year life of the Nassau deposit to 11 years, after which they plan to exploit the Western Suriname Bakhuis deposits with 34% available alumina to keep their refinery running.

While there are constant reports about lower aluminum prices and lower profits by the major aluminum companies, a review of developments in the industry shows all these same majors – Billiton in Western Australia; Rio Tinto-Alcan in Eastern Australia; MRN and Alcoa in Brazil; RUSAL in Guinea and Russia; Chalco in China and now Vietnam, substantially increasing bauxite production and increasing alumina capacity in their operations around the world. There are also consistent reports of countries around the world –Vietnam, Fiji, Indonesia, Cameroon, moving rapidly to develop their newly discovered bauxite resources, some of which are in the same category as our Ituni and Pakaraima laterites. We in Guyana at the same time appear content to relegate the measured 300.million and indicated 100,000 million tonnes of the world’s highest grade bauxite within a 10-mile radius of the existing Linden bauxite plant to the dustbin of bauxite history because of high overburden and the perceived end of the glory days of our bauxite.

Yours faithfully,

Sylvester Carmichael