Oil and natural gas industry analysts and energy economists repeatedly highlight the basic observation that no two oil refineries are the same; stressing that they are unique in essential ways. Upfront, two dimensions to this difference are key. One is variation in size/capacity. Data provided last week regarding the world’s ten largest refineries and the variance within this group, as well as the prevalence of small refineries in the world’s largest oil refining market (United States), illustrate this truth. The second difference is variation in oil refinery capability. As matters stand, variation in capability is considered more significant. Today’s column addresses this. It will be shown that these two variables are central to the assessment of the pros and cons of a Guyana oil refinery.

Refinery Capability

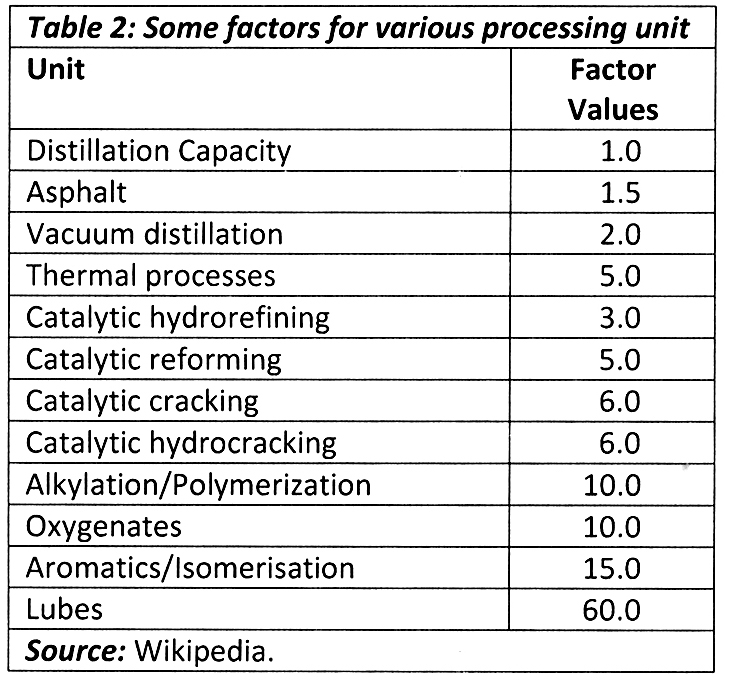

Industry manuals/textbooks assert that an oil refinery capability lies in its processing units. These units determine which petroleum products are produced. Every refinery, however, must possess a distillation column, as was indicated in my earlier columns illustrating the nuts and bolts of oil refining. The purpose of the distillation column is to separate crude oil into different petroleum products, based on their different boiling points, in response to applied heat. On its own, the distillation column offers low yields for high-value products, such as transportation fuels.

To avoid low yields, a refinery’s distillation column is combined with secondary processing units. These secondary units permit the distillation column to 1) bundle different types of crude oil (which as we have observed range from light sweet to heavy sour), and 2) produce multiple types of petroleum products. From this simple description, readers can begin to appreciate why an oil refinery that has only a distillation column is ranked low, and indeed is considered the simplest/crudest type of oil refinery. It is technologically primitive, and is termed a topping refinery.

The 2014 Congressional Research Service (CRS) Report, which I referenced last week identifies four categories of refineries; namely 1) topping refineries ranked low (with an atmospheric distillation column as referred to above. This separates the crude oil through heat into constituent petroleum products, produce naphtha, middle distillate fuels, and no gasoline). 2) hydroskiming refineries ranked medium (with an atmospheric distillation unit, naphtha refining, together with desulfurization capacity to run light sweet crude and produce gasoline).

Table 1 illustrates the operations of the distillation column at the various boiling points.

The third and fourth types of refineries are cracking (conversion) and coking (deep conversion), respectively. These have vacuum distillation and catalytic cracking processes, as well as residuals distraction to run medium/sour crude. That same report claimed that about three-quarters of the fuel-producing refineries in the US had some capacity to convert heavy crude into refined products.

Readers should note that five decades ago US refineries faced a relative supply shortage of light sweet crude oil, preferred for making motor fuels. Refineries then began switching to the more available heavy sour oils. It is this market shift, which drove accompanying technological shifts that favoured cracking (conversion) and coking (deep conversion) processes. Readers should also note that, each secondary unit that is added to the distillation column has a specific purpose. That purpose ranges from increasing ‘separation’ beyond the distillation column and/or upgrading low-valued petroleum products (like residual fuel oil), to producing very high-valued products like higher octane fuels, or facilitating environmental standards (removing pollutants).

Topping and hydroskiming

Industry analysts claim topping and hydroskiming refineries are typically “designed to prepare feedstocks for petrochemical manufacture or for industrial fuels in remote oil producing areas”. This designation sums up their primitive technological standing. I am not qualified to pronounce on the accuracy/aptness of this designation. But, if true, it seems reasonable to expect that a Guyanese refinery would probably not be able to stand far above this level of capability. The question, which arises therefore for readers would be: is there a way of determining quantitatively, oil refinery capability or ranking?

The available engineering/economics literature shows that there are simple, easy to follow, yet effective ways of establishing the relative standing of the secondary conversion capability in oil refineries. The seemingly most popular (or most widely recognized) of these indicators is the Nelson Complexity Index. This is a useful metric, which readers should be familiar.

Nelson Complexity Index

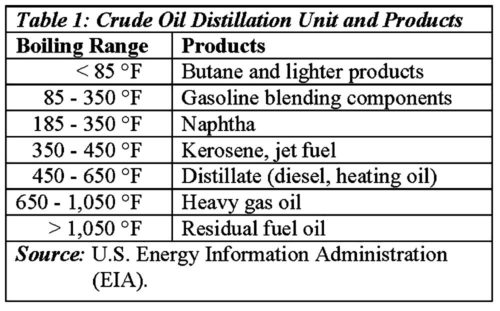

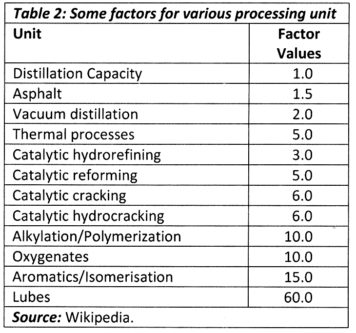

The Nelson Complexity Index was conceived by Wilbur Nelson six decades ago (in the 1960s) and published in the Oil and Gas Journal (Vol 94, Issue 12). The Index measures oil refining complexity by the level of secondary conversion capacity there is in the refinery. It also takes into account the cost of each major type of refinery equipment: For the Index, the distillation column is given a value of 1. The other units are then assigned values on the basis of their conversion and cost relative to the distillation column at 1. The larger, therefore, the Nelson Index arrived at on this basis, the more complex the refinery. And, the more complex the refinery, the more capable it is of producing higher valued end products. And, correspondingly, the more costly they are to build and maintain.

Typical complexity factors are shown in Table 2.

Conclusion

Available data (EIA, Investopedia, Hydrocarbons Technology) reveal that US refineries, based on the Nelson Index, are the most complex in the world, with other countries advancing rapidly. The US Index ranges from 3 to 17 at end of 2014. Two decades back in the 2000s, the global value of this Index was 5.9

Next week’s column will wrap-up this consideration of the two oil refinery variables: capacity and capability.