Last week’s column continued my examination of the likely impact of the 2020 global general crisis on crude oil prices in world markets this year; and, following that, on the price obtained for Guyana’s Liza crude, as reflected in the price received for Government of Guyana, GoG, petroleum lifts, earned through its Production Sharing Agreement, PSA, with ExxonMobil and its partners. These revenue data are updated below.

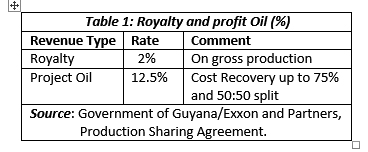

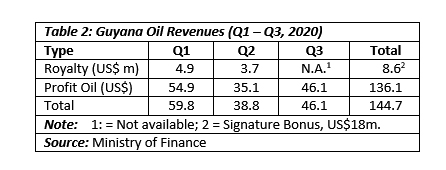

As readers are aware, the petroleum lifts represent the $ value of Guyana’s profit share along with royalties earned on ExxonMobil and partners’ gross production. It should be recalled here that, at present, Guyana is still expected to earn this year, a minimum of five such lifts totaling, of one million barrels each. So far three lifts have been earned, the third took place about a month ago. The fourth lift is scheduled for mid-November. The revenue rates are shown in Table 1 below. I return to them later in the column.

Backward-looking statistics

Surprisingly, I could not obtain an official data series for Exxon and partners production of crude oil this year. I have repeatedly complained in these columns that, real time and forward-looking (predictive) economic data on Guyana are close to non-existent. This makes considered economic discussion almost impossible. The oil and gas sector is tightly integrated into global markets. It faces fiercely competitive situations so that information asymmetry raises costs and makes for errors in decision-making.

With that in mind I am forced to rely on “spotty reported data” from a variety of sources. I cannot vouch for these sources and the data provided may well represent guesstimates. Further, these “reported data” typically refer to production at, or around the time of reporting. They are all approximations and, reported in broad quantities and percentages. As readers will observe, below, I try to infer production data indirectly from Table 1 above.

Having made the above disclosure, the day after I wrote it, information on the revenue received from Guyana’s third million barrel petroleum lift was officially released. The revenue earned from that sale was US$46.1 million; suggesting an average price of US$46 per barrel. This compares with the prices for the first two lifts, of US$55 and US$35 per barrel, respectively. These data are updated in Table 2 below.

As has been widely acknowledged, the 2020 general crisis has impacted Guyana’s crude oil output in a variety of ways. First, the Covid-19 pandemic has affected offshore activities through its impact on the scheduling of work crews. Second, the company encountered “unexpected technical problems” as they described it themselves, with the gas compression system offshore. This has forced the company to limit its reinjection of natural gas. It has also led to natural gas flaring and strong public and official reactions to the consequent pollution.

To make matters worse, the Covid-19 isolation protocols (social distancing) have added delays in seeking to correct the gas compression problems. Exxon is quoted in Argus Media as stating: We would have been on top of this earlier had it not been for Covid-19 that has severely hampered the ability to move people offshore and to get equivalent. It really has slowed things down for us.”

And, in one of the instances of sporadic reporting on Guyana’s 2020 crude oil production, Argus media has observed “Guyana is producing around 85,000 barrels per day of crude, 35,000 barrels per day short of an August target because of a prolonged gas compression on the ExxonMobil-operated Stabroek block.” This statement was made on the 27th of August, this year.

Incidentally, the same Report projected 120,000 barrels a day output (the ExxonMobil targeted level) for September this year. It also noted “output had reached 100,000 barrels per day in July, 25 percent up on June.”

The third factor, which has been driving flagging output in 2020 is the prolonged electoral and political stalemate since the last general and regional elections (March 2, 2020) and the declaration of a new Government (August 2, 2020).

While lagging production linked to the 2020 general crisis can be traced to specific considerations (compressor failure, Covid-19 pandemic, environmental-regulatory issues, electoral-political stalemate) unplanned delays always accompany major projects and this is the perspective I advance. There is no hint whatsoever at this point in time that, Guyana’s petroleum assets are being stranded.

Conclusion

Next week’s column will therefore, continue this discussion and, subsequently, attempt to calculate the “cost of delay” and lagging output in 2020.