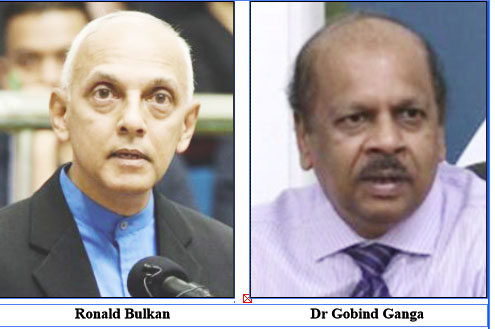

The High Court on Monday threw out a $90 million suit filed by shareholders Ronald and his brother Rustum Bulkan of Precision Woodworking Limited (PWL) against the Bank of Guyana (BoG) and its Governor Dr. Gobind Ganga.

The Bulkans had alleged misfeasance in public office, deceit, breach of statutory duty, and negligence against the bank over what they described as a suspicious and unlawful deposit of $82, 068, 617, in their company’s account.

But in striking out their claim, Justice Priya Sewnarine-Beharry ruled among other things that the case such as that filed by the Bulkans ought to have been brought in the company’s name and not theirs.

“The action ought to have been brought by the company itself and not its shareholders,” the judge said in her written ruling.

The judge said she found also, that the claim disclosed no reasonable ground for having been brought in the first place and that it had no reasonable prospect of succeeding.

Referencing case law authority, Justice Sewnarine-Beharry said it is trite that a company has a separate legal personality from its directors and shareholders and that individual shareholders have no cause of action in law for any wrongs committed on the corporation.

If an action is to be brought in that respect she said, it must be brought by the corporation itself since the account in which the deposit was made is held by and in the name of PWL at Republic Bank Limited (RBL).

She said that any action filed must be brought by and in the name of the company; adding that since the company is in receivership matters touching and concerning its assets must be brought by the company through its official Receiver.

The judge said the court found, too, that the Bulkans had not pleaded or prayed for relief for the infringement of any individual/personal rights to bring them within the exceptions of the rule to file an action; while adding that they also failed to demonstrate how the actions and/or inactions of the BoG and its Governor could give rise to a cause of action to them as shareholders.

Addressing the issue of limitation, the judge pointed out also that the action was found to be statute-barred.

On this point the judge stated in her ruling that in accordance with Section 8 of the Limitation Act, an action for the recovery of damages must be brought within three years after the cause of action arises which she said was out of time.

Justice Sewnarine-Beharry said that the statement of claim did not disclose a cause of action against the bank and its governor.

According to the judge in her ruling, it is undisputed that an investigation was conducted and the Bank of Guyana found no evidence of wrongdoing against RBL.

The court said, too, that the Bulkans failed to demonstrate by their pleadings what duty existed in relation to them, or that the duty was breached and they suffered any damage.

The judge pointed out that their claim for relief sought damages for “jeopardising and exposing the claimants to accusations, allegations, investigation and potential prosecution for money laundering”, “potential ruin to reputation” and exposure to “injurious business deal and good will”, “failing to act with due diligence to neutralize the harm of prosecution for money laundering, besmirching the character of the claimants and by extension any business goodwill” and “potential harm, distress and unease.”

The judge said, however, that the statement of claim “avers to potential harm and not any real harm, loss or damage and at best is speculative.”

The ruling went on to detail that Governor had been improperly sued in his personal capacity.

On this point the judge said that actions for alleged wrongs must be instituted against the Bank of Guyana itself since it is a body corporate and so the claim is devoid of any particulars that support a cause of action against the governor in his personally capacity.

Declaring the Bulkans’ statement of claim as being incoherent, prolix, lacking precision and obscure; the judge dismissed the action and ordered them to pay $250,000 costs to the BoG no later than October 30th.

They were also ordered that costs be awarded to the bank and its Governor against counsel for the Bulkans personally in the sum of $75,000 for prolixity of pleadings to be paid by the same deadline.

The suit of 23rd December, 2019 was aimed at exonerating the Bulkans of any taint of criminality which they say they were exposed to Ganga and the BoG.

They claimed that on 16th June 2011, an “unauthorised, disclaimed, suspicious and unlawful” deposit of $82, 068, 617, which they recognised as having been made in breach of the Anti-Money Laundering, Countering the Financing of Terrorism Act, was deposited into account number 355-733-8, which was held by PWL, at the Water Street branch of RBL.

During this time, the Bulkans (claimants) say they were the only authorised signatories to the account.

They argued that between 11th March, 2013 and 22nd December, 2017, several letters, which invited Ganga to investigate the deposit, were written to Ganga, RBL, then Minister of Finance Minister Winston Jordan and then Attorney General Basil Williams in relation to the deposit.

The invitation, the claimants say, was aimed at clearing, and guarding their name, and the businesses’ goodwill, against any perception of money laundering, which could be detrimental to the claimants as businessmen. The claimants also noted that the deposit exposed them to accusations of involvement in, or facilitation of money laundering, especially Ronald Bulkan, who had served as Minister of Communities in the former APNU+AFC Administration since 2015.

The claimants said they first wrote Ganga on 25th July 2014, but claimed that he abdicated his statutory obligations when he, in a letter dated 23rd September, 2014, responded by saying that the “matter is engaging the attention of the Court”, and that the “Bank of Guyana will be guided by the Court’s decision.”

The claimants alleged that it was Ganga’s and the bank’s intention to trick them into a belief that the deposit was not made, and an abandonment of an investigation into the truth.

The BoG sought an order striking out the claim filed by Bulkans.

It argued among other things that the Bulkans’ claim was based on an erroneous premise that the deposit complained of was made by an individual into the account.

The bank said, however, that on the contrary, the deposit was not cash but a credit by way of provisioning pursuant to the Bank of Guyana Guidelines No 5 on Loan Portfolio Review, Classification, Provisioning and other Related Requirements issued under the authority of the Financial Institutions Act (FIA).

The BoG said that the account was classified by both banks as non-performing with effect from 31 May 2011 as a result of the company being unable to satisfy its debts and obligations to RBL.