In a sign of how much money small companies that have tied down key offshore oil blocks can attract, Reuters yesterday reported that Cataleya Energy has gathered US$30m in investment from US hedge fund Elliott Management Corp.

This investment has come despite the failure of Exxon-Mobil’s deepest well to date in the Kaieteur Block in the search for oil. It was reported last week that while hydrocarbons were found in the Tanager-1 well the find was not in commercial quantities and was of a heavier type of oil. The partners in the block would have therefore sustained a serious loss in drilling this well but are still attracting major investment which underlines optimism that the block will eventually lead to large returns.

Reuters yesterday reported that sources close to the deal informed of the investment. It said that Elliott declined to comment.

This newspaper reached out Elliott but up to press time there had been no response. Calls were made to CEO of Cataleya, Michael Cawood, but he did not answer.

Reuters posited that the deal reflects rising interest here since ExxonMobil’s first discovery in 2015 and said that Cawood, chief executive and co-founder of Canada-registered Cataleya, declined to comment on the Elliott Investment but said his shareholders come from Guyana, the Caribbean, the United States, Canada and Israel.

“We’ve got a large investor range,” he told Reuters.

Cataleya was advised on the deal by boutique investment bank Hannam & Partners, according to Reuters.

In the 3.3 million acres (13,535 square kilometers) Kaieteur Block, Exxon-Mobil now holds a 35 percent working interest while Ratio Petroleum and Cataleya Energy Corporation each hold a 25% participating interest. ExxonMobil’s Stabroek Block partner, Hess holds the remaining 15%.

Westmount holds approx. 5.4% of the issued share capital of Cataleya Energy Corporation and less than 1% of Ratio Petroleum Energy’s.

The circumstances of ExxonMobil’s buying into the operations of the controversial Kaieteur and Canje blocks have come in for much scrutiny. This is because months after the signing of its renegotiated Stabroek Block Production Sharing Agreement (PSA) in June 2016, the company bought shares in both the Canje and Kaieteur blocks. The Canje and Kaieteur blocks had been controversially awarded in 2015 under the then PPP/C government, just prior to Exxon’s first major oil strike in the Stabroek Block. The small companies that snagged the rights did not have the required capital and expertise to explore the blocks but have clearly benefited significantly from investors who have bought into the block or invested in it as the Elliott deal indicates.

Cataleya will disclose details of its beneficial ownership later this year for Guyana’s next report to the Extractive Industries Transparency Initiative, a multinational standard-setting body, Reuters reported Cawood as saying.

Reuters added that Elliott’s deal shows how companies with ownership stakes in existing blocks can provide investors with a means to gain exposure to future developments.

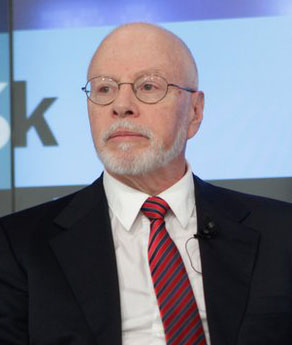

It said that the investment puts Elliott, run by billionaire Paul Singer, in a consortium with U.S. producer Hess Corp, which owns a 15% stake in Kaieteur. Elliott, a shareholder in Hess, pushed for changes at Hess in 2013 and remained critical of the company’s management for years, Reuters said.

Elliott is well-known in Latin America for its use of litigation to enforce claims on defaulted Peruvian and Argentine bonds.

In early 2018, Ratio’s Chief Geologist and Manager Eitan Aizenberg had expressed optimism in the Kaieteur Block and had told a Theatre Guild forum in Georgetown, then hosted by the Ministry of Natural Resources, that his company had drilled some 28 dry holes in his home country Israel’s Leviathan Basin before it made a huge offshore gas field discovery.

He had said that he brings to Guyana that same optimism and would have pressed to see the same investments here.

Of note by Aizenberg was that finding dry or non-commercial holes is always a deterrent to investors and the companies seeking revenue would have to justify continuing.