Because of space constraints, there are four matters that we were unable to elaborate on in our coverage last week of the Estimates of Revenue and Expenditure for the fiscal year 2022. The first is about the relationship between the inflation rate of 5.7 percent recorded in 2021 and the salary increase of 7.0 percent that public servants received in December last. Considering the absence of a salary increase in 2020, the severe impact of the COVID-19 pandemic and its variants, and the aftermath of the floods resulting in a steep increase in prices for locally produced food items, Government employees are no better off financially than they were two years ago. Indeed, the amounts they received were not even enough to cover the inflation rate for the combined two years. This state of affairs was exacerbated by the steep rise in prices for imported items as a result of increased shipping costs. It would appear that these price increases were not fully taken into account in the computation of the inflation rate for 2021. These observations must also be viewed against the backdrop of the 19.9 percent GDP growth in 2021 and a projected growth rate of 47.5 percent in 2022, raising questions about the extent to which citizens, especially those on the lower rung of the economic ladder, are really benefitting from the enhanced performance of the economy.

Second, since inflation for this year is projected at 11.0 percent, its adverse impact would have already been felt. In the circumstances, it would be more appropriate for the salary increase for 2022 to be granted now, rather than close to year-end. One hopes that the Administration will consider an interim increase, pending the outcome of negotiations with the concerned trade unions. This brings us to the third matter. Why should the disciplined services alone receive a one-month tax-free bonus at the end the year? The previous Administration had abandoned this practice no doubt because it discriminated against other categories of employees, only to be reinstated by the present Administration for which an explanation is yet to be provided. We nevertheless note that 9,200 healthcare workers received a two weeks’ tax free bonus, but this was in response to their dedicated services in dealing with the COVID-19 pandemic.

Fourth, we refer to the comments of a Member of Parliament during last week’s budget debate in which she drew attention to the contents of the International Monetary Fund (IMF) 2019 Article IV assessment report on Guyana’s Public Investment Management (PIM). In that report, the IMF referred to the recommendations it had made in earlier in which it stated that Guyana had an estimated efficiency gap of 41.0 percent, compared with 30 percent for Latin America and the Caribbean, and 20.0 percent for the emerging market economies. Considering the amount of G$218.834 billion budgeted for capital expenditure projects for 2022, it is unlikely that value will be received for $89.38 billion due to ‘weaknesses in the planning, budgeting, appraisal, selection, procurement, and implementation of capital projects’. See IMF 2019 Article IV Consultations Report on Guyana dated September 2019 to be found at https://www.imf.org/-/media/Files/Publications/CR/2019/1GUYEA2019001.ashx.

We raise this matter because on several occasions we had stated that our best estimate of the leakages in our public procurement processes was in the order of at least 20 percent, that is, for every $100 expended, only $80 in value was received. This estimate was based on our own experience reviewing the operations of government for almost 15 years as well as the results of a survey we had conducted in procurement workshops at a leading State entity. The IMF’s assessment was in relation to capital expenditure and would have included significant delays in the execution of major infrastructure projects and the related cost overruns, as in the case of the Cheddi Jagan International Airport and the Sheriff Street expansion projects. On the other hand, our assessment, which was carried out around the same time as the IMF study, included procurement under both current and capital expenditure programmes.

We were, however, taken to task by a key member of the then Opposition when we tried to quantify the amount involved. The calculated amount was $37.4 billion using the Estimates for 2018. We were at pains to point out that this amount did not represent corruption per se. Rather, it was about the extent of leakages in the procurement processes of which corruption is one component. If we had factored in the significant delays and the related cost overruns, we might have arrived at roughly the same estimate as contained in the IMF report. Considering the events subsequent to the 21 December 2018 vote of no confidence in the Government – judicial reviews of the Speaker’s ruling, the dissolution of Parliament, holding of elections, further judicial review challenging the results, and eventually change of Administration – the Government might not have been in a position to fully and effectively implement the ten recommendations made by the IMF.

A key recommendation relates to the need to ‘complete and publish the policy framework on [public-private partnerships] PPPs with tightened fiscal safeguards and an enhanced oversight role for the [Ministry of Finance] MoF; prepare implementing regulations; and ensure that new PPPs are not implemented until essential PIM preconditions are satisfied (e.g., rigorous procedures for project appraisal)’. To date, there is no evidence that such a framework was published.

In today’s article, we conclude our discussion on the 2022 Estimates of Revenue and Expenditure by looking at the budget proposals for 2022.

Size of the Budget

The size of the budget is $552.934 billion, compared with the actual expenditure of $404.852 billion in 2021, an increase of 36.6 percent. Anticipated revenue (both current and capital) amounts to $488.045 billion, inclusive of withdrawal of $126.694 billion from the Natural Resource Fund. This gives a fiscal deficit of $64.889 billion, representing 7.0 percent of non-oil GDP. Capital expenditure amounts to $217.834 billion, a more than two-fold increase over that incurred in 2021. Despite this, there is no evidence to indicate what efforts are being made to strengthen the capacity of the PIM section of the Ministry of Finance as regards, among others, its ability to undertake project appraisals to determine their feasibility and cost effectiveness as well as to monitor the execution of projects to minimise the extent of time and cost overruns.

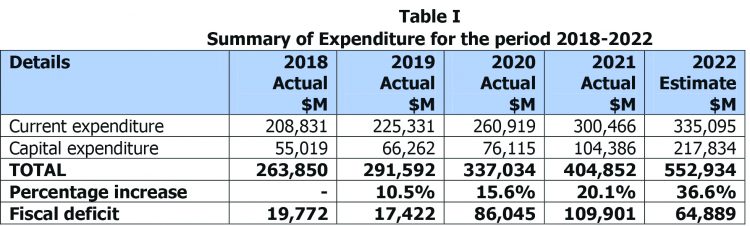

Table I gives a summary of the Estimates of Expenditure for the 2022, compared with the expenditure incurred in the preceding four years:

As can be noted, expenditure during the period 2018- 2021 increased by 53.4 percent. With an estimated expenditure of $552.9 billion in 2022, the increase in expenditure over the period 2018-2022 will be more than double. Correspondingly, the cumulative fiscal deficit over the period 2018 to 2022 would amount to $288.029 billion. This deficit has the effect of increasing the overdraft on the Consolidated Fund which, as pointed out in last week’s article, is estimated at $398.456 billion at the end of 2021. Taking into account the estimated fiscal deficit of $64.899 billion in 2022, the overdraft on the Consolidated Fund at the end of this year can now be estimated at $463.345 billion.

Summary of macroeconomic indicators

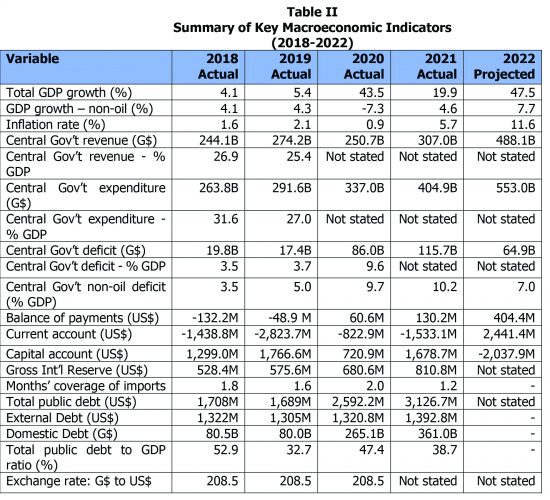

Table II provides a summary of the key macroeconomic indicators for 2021, along with comparative figures for the previous three years as well as projections for 2022:

Budget measures for 2022

The budget measures announced by the Minister are as follows:

(a) Removal of: 10 percent excise tax and 14 percent VAT on the importation of vehicles less than four years old; 14 percent VAT on the importation of new haulers for pulling containers or similar vehicles for pulling; 10 percent excise tax on new double cab pickups below 2000 cc; 10 percent excise tax on single cab pickups below 3000 cc; and 14 percent VAT on cranes, safety equipment, and oil spill response equipment;

(b) Reduction of excise tax for new double cab pickups between 2000 and 3000 cc from 110 percent to 75 percent;

(c) Removal of two percent withholding tax on resident contractors;

(d) Having farmers’ markets at key locations to reduce the cost of locally produced food items;

(e) Extension of freight cost adjustments in the calculation of the various taxes on importation;

(f) Lowering of the excise tax on fuel from 20 percent to 10 percent;

(g) Support of up to $600,000 per person for each dialysis treatment;

(h) Increase in public assistance from $12,000 to $14,000 per month for eligible persons;

(i) Increase in old age pension from $25,000 to $28,000 per month;

(j) Increase in school uniform grant from $4,000 to $5,000;

(k) Increase in cash grants from $15,000 to $25,000 per child attending school;

(l) Removal of withholding tax on interest income not exceeding $10,000;

(m) Deduction from chargeable income up to 10 percent of income or $30,000, whichever is lower;

(n) Increase in income tax threshold from $65,000 to $75,000;

(o) Increase in ceiling for low-income mortgages from $12 million to $15,000 million;

(p) Abolition of stamp duty on retail transactions; and

(q) Re-instatement of tax relief on the importation of vehicles by remigrants.