Introduction

Today’s column addresses three tasks. First, wrapping-up last week’s evaluation of National Budgets [2021/ 2022] as providers of Government of Guyana, GoG, indicators on the condition of Guyana’s oil and gas sector. Second it addresses Item 7 [the International Oil Companies, IOCs; National Oil Companies, NOCs; and Organization of Petroleum Countries, OPEC’s share of global crude oil] in the list of 10 sample markers of the sector’s condition. Thirdly, it treats with Item 8, which is termed by Transparency Institute Guyana Inc, TIGI, as an “original sin” enshrined in Guyana’s ruling Petroleum Sharing Agreement, PSA. These are considered below in the order listed

Natural Resource Fund (NRF)

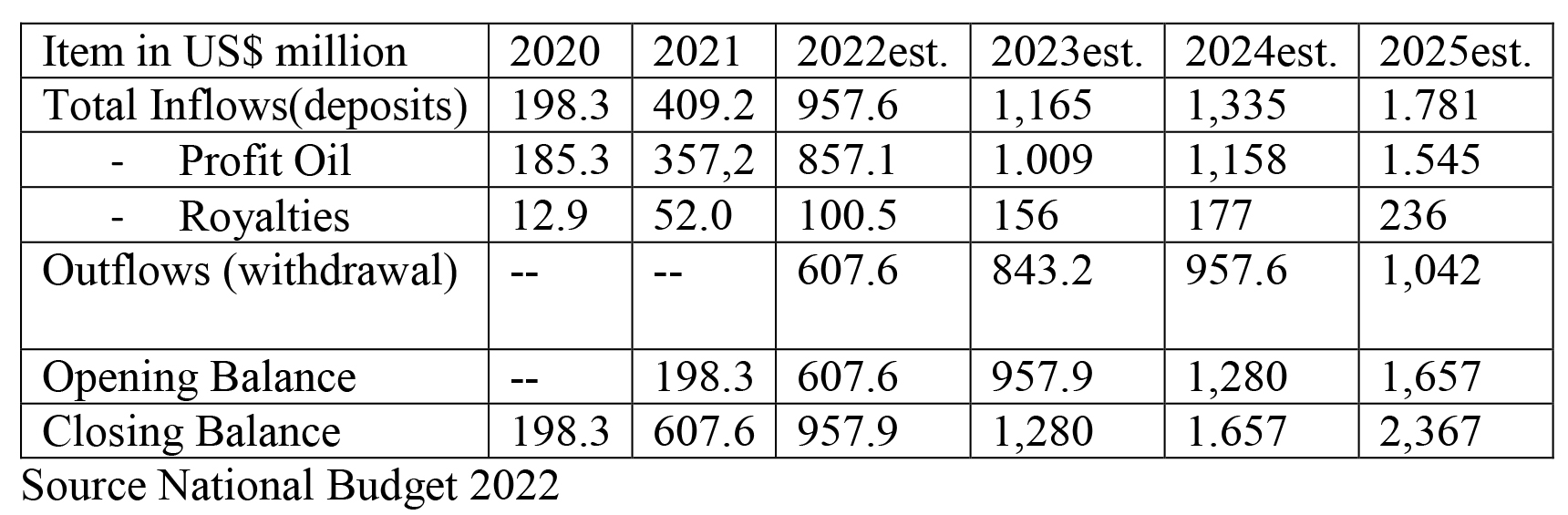

Information is available on six Items of the country’s NRF; namely, total inflows/ deposits; their two main sources, profit oil and royalties; total outflows/withdrawals; opening balance; and closing balance. The data cover the historical and projected years for the period 2020 to 2025. Additionally, I cite separately reported financial returns on balances held overseas over the period.

Reflecting the rapid growth in actual and projected crude oil output and prices, total inflows rise nine-fold over the six-year period; from US$198 million in 2020 to US$1.8 billion in 2025. Profit oil contributes most of the inflows [US$185 million in 2020 rising to US$ 1.5 billion in 2025] Royalties increase from US$13 million to US$236 million over the same period.

Actual return on the invested funds is only US$136,000 over the two historical years 2020/2021and projected to reach only US$463,000 in 2025. Schedule 1 reveals the details:

Schedule 1 Natural Resource Fund Operations and Estimates [2020 -2025]

IOC, NOC and OPEC: Global Market Shares

The shifting global shares of production and export for the three groupings listed above reflect the complexity of factors shaping the external environment facing Guyana’s emerging oil and gas sector going forward. I have addressed this problematic before and will therefore summarize the essence of my contentions here. I remind readers that I am revisiting these issues from a policy perspective going forward. My argument is simply that, the sheer size, structure and aims of each grouping contribute enormously towards shaping of the global crude oil market, within which Guyana’s oil and gas sector operates.

OPEC and OPEC+

Starting with OPEC and OPEC+, since its formation in 1960, OPEC’s five Founding Members (Iran, Iraq, Kuwait, Saudi Arabia and Venezuela) have seen new members join, leave, and even re-join the organization! Fifteen members are now current. Membership requirements include being a substantial net exporter of crude oil; and, sharing OPEC’s fundamental interests. To secure membership an applicant must obtain a majority of three-quarters of the members’ votes. Associate members are permitted. OPEC’s operational paradigm has been re-configured somewhat since the 1960s and 1970s

OPEC Perspective

OPEC’s pre-eminent goal is the coordination and unification of petroleum policies. And, while its mandate has witnessed several permutations; it has steadfastly claimed its core aims are: 1) securing fair and stable crude prices; 2) being an efficient and regular supplier to global consumers; and 3) providing a fair return to the capital invested by its members.

There is no denying that, at its inception, OPEC was seen by many as an anti-colonial and anti-imperialist body championing the cause of poor exploited underdeveloped countries. Its operating enterprises are state-owned and/or controlled. This initial narrative placed primary emphasis on national ownership and/or control of petroleum resources in order to pursue the structural transformative use of their petroleum revenues and re-balancing the global distribution of income and wealth.

Since the Great Recession, 2007/08, OPEC has been pre-occupied with negotiating global macroeconomic instabilities and uncertainties; financial/economic/political risks; and, their accompanying wider social unrest. Its core membership has remained constant with others joining, leaving, and re-joining. It has welcomed associated allies as OPEC+.

Against this brief recap perspective on its aims and structure in recent years, the grouping has: 1) produced 37 to 40% of global crude oil supply; 2) accounted for roughly 60% of global traded crude oil; and 3) control a reported 79 to 80% of proven resources.

Clearly going forward the issue of Guyana’s participation in the grouping arises. I will re-visit my recommendation on this matter offered two years ago

IOCs and NOCs

Driven largely by OPEC’s explosive growth, IOCs dominate global crude output, traded, and proven reserves. Globally, the 13 largest energy companies are state-owned. Together, IOCs have for long controlled around 75% of crude oil output. I have regularly addressed the issues that arise here to emphasize that despite circulating “anti-Guyana alarmism’ the realistic weight of ExxonMobil is captured in its production of about 2% of global output. I will return to this discussion later

Original Sin

The notion of original sin was introduced by Transparency Institute Guyana Inc, TIGI, in reference to an embedded defect in the ruling Production Sharing Agreement, PSA. I shall describe the defect in what follows and offer my evaluation of it at the start of the next column

In a Kaieteur News report carried on December 13 2021 entitled, “Guyana witnessing a oil hustle” the then leadership of TIGI had labeled as an original sin, the 1999 award of 600 blocks as part of the Stabroek Block’s licence, when indeed the law allows only 60 blocks. The then Minister claimed this was subject to ministerial discretion.

Conclusion

The domino effect of this defect is considered to be catastrophic for Guyana.