Introduction

Thus far I have considered four of the ten sample indicators, which I had earlier advanced can provide an adequate profile of the present condition of Guyana’s emergent oil and gas sector: namely 1) existential threats, Venezuelan territorial aggression and environmental catastrophe; 2) modelled cost shares for crude oil production; 3) oil price projection; and 4) the World Bank’s call on Guyana’s boom cycle. Today’s column considers the fifth and sixth indicators in the sample: namely 5) Guyana’s current estimated oil resources potential; and 6) official National Budget [2021/2022] data.

Readers should recall that, this effort to depict the driving features of the present state or condition of Guyana’s oil and gas sector is aimed at providing an analytical bridge between my theoretical interrogation of the dynamics governing the evolution of the sector to date, and the evaluation of policy formulation going forward.

Resource Potential

As readers of this column are acutely aware I have repeatedly admitted that I am bullish on Guyana’s world class crude oil potential. This is based on two justifications listed below. Perhaps more significantly I have recently updated my estimate as indicated in what follows.

Justification 1: Mirror Image Theory

This refers to the thesis that, the petroleum system of the Guianas Basin is a mirror-image – the “Atlantic Mirror” theory – of the petroleum system present in West Africa, where several large petroleum accumulations have been discovered in recent years.

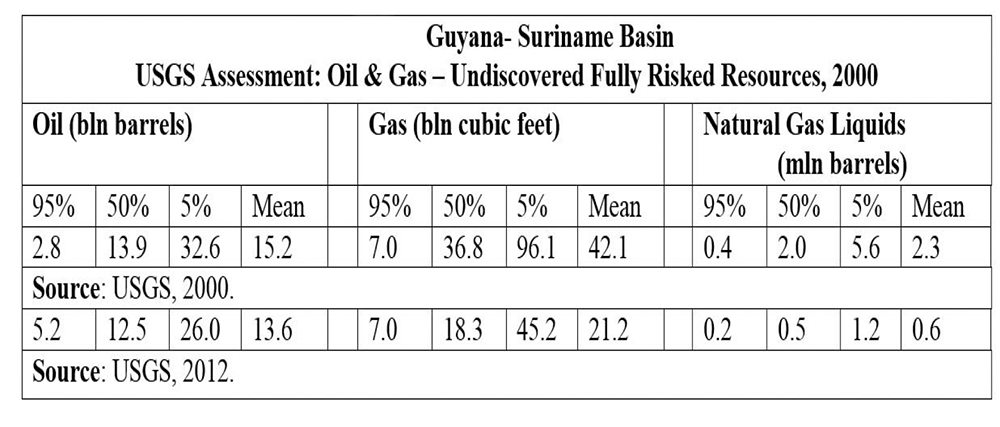

Justification 2: USGS Assessment

This refers to two United States Geological Surveys, World Energy Assessment of Undiscovered Oil and Gas Resources in Central and South America as well as the Caribbean (2000 and 2012); as a subset of its World Assessment, which covered the volume of undiscovered conventional petroleum reserves. The estimates are: 1) “fully risked” reserves; 2) at levels of 95, 50, and 5 percent probability; 3) the mean probability is reported (where fractiles are additive, under the assumption of perfect positive correlation); and 4) estimates for gas fields include all liquids. Undiscovered gas resources are therefore the sum of non-associated and associated gas. Both Survey results are reproduced in the Table below.

Adjusted Resource Estimate

Based on the above, I had made a guestimate of 13-15 billion barrels for Guyana back in 2016. I was accused at the time of reckless exaggeration. I am now certain that my initial estimate will turn out to be conservative. To be sure, a revised estimate will also fall outside of ExxonMobil’s initial guidance to investors. Indeed, its recent Investors Presentation states that the present massive Guyana resources coming from roughly 10-15 drilled wells has twice as many undrilled prospects. Further, the company’s own estimate for its final basin resources is more likely >2x its current discoveries’, more in the region of 25 billion barrels. That suggests a 30-40- year reserve life at over 2 million barrels per day /by the early-2030s, when one expects total production to range between 2.5 million to 3.5 million barrels per day.

After three discoveries in 2022 [Barrel Oil-1; Lukanani-1; and, Patwa-1] ExxonMobil has upped its guidance on recoverable resources from 10+ billion barrels of oil equivalent, boe, to 11 billion, boe.

Readers should also recall Guyana’s crude is rated high quality light sweet crude, with an API >1 and a sulfur content <0.5.

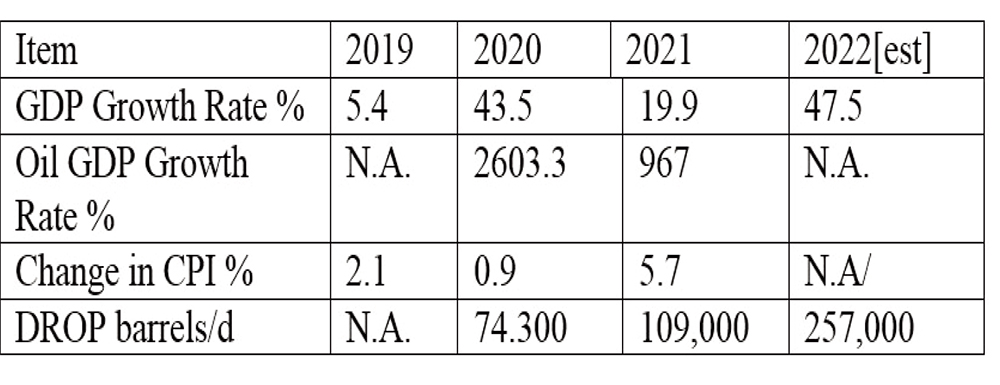

Budget Data: GDP (Total & Oil)

The National Budget information is crucial because 1) it is official; and 2) it is located in the framework of the national economy. Thus, the data reveal the oil sub sector in Guyana’s National Accounts grew by a whopping 2,603% in 2020 (the first full year of oil production). This lead to the world class spectacular annual GDP growth rates in Guyana; as revealed below.

Other Data

Other data in the Table also reveal that, the daily rate of oil production, DROP, despite significant start up compressor-related issues, is projected to grow significantly more in this year [47.5%] 2022, than last year. The Budget projects government revenue from oil this year to be the value of 13 oil lifts, each of approximately one million barrels of crude from a total of 94 oil lifts. Its projected total revenue is US$0.928 billion, of which Profit Oil equals US$0.857 billion and Royalty equals US$101 million.

Conclusion

Next week I wrap-up my appraisal of the National Budgets 2021 and 2022 data by referencing GoG reporting on the performance of the Natural Resource Fund. NRF before addressing indicators seven and eight in the Schedule provided earlier.

Note DROP = daily rate of production; CPI= consumer price index

Source National Budget 2021/2022