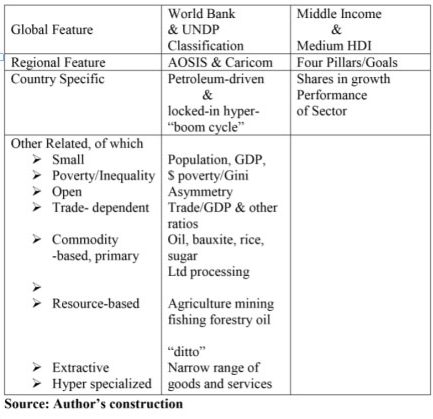

Today’s column begins with my wrap-up of last week’s column. That column had concentrated on the elaboration of key economic features and takeaways that I believe characterize the political economy framework within which Guyana’s nascent oil and gas sector has been evolving. Following publication of last week’s column, several readers have asked me to provide an even briefer recap of that presentation this week. Regrettably, such a task is beyond my present skills set; the reason being that I have treated what was presented last week as my very best effort at a truly concise effort. Instead, I have decided to offer readers, Schedule 1, which attempts a simple tabular summation of the key takeaways presented last week. Before treating with the display in Schedule I, I offer in the next paragraph one additional observation, which will complete last week’s presentation.

The observation is that, when closely examined, last week’s effort does centre almost entirely, on economic aggregates or magnitudes. These are largely macro in nature [national accounts aggregate] and micro [firm and commodity based]. However, in actuality such economic magnitudes are always organized, managed, owned and operated in a system of social, cultural, legal, political, group and personal relations. Further, elements of weak, peripheral, under-and un-developed, market capitalism prevail, and co-mingle and/or coexist alongside a State that has a significant property sector [public corporations] along with elaborate traditional public and civil services and functions.

As indicated above, turning to Schedule1 immediately below, reveals the tabular summation of last week’s presentation. In the Section after that, I treat with governance. To recall, governance is the final item in my list of ten sample items [markers/data points/indicators] on which I have relied upon, in order to portray the prevailing condition of Guyana’s economy as its nascent oil and gas sector rapidly expands.

Schedule1: Guyana Economic Features Key Takeaways Governance

Because of this circumstance, I propose to engage the topic of governance utilizing two sequences. First, I engage in today’s column, an analysis of the concept of governance as I interpret it. Second, to avoid bias I report on governance in the oil and gas sector in next week’s column based on recent assessments of Guyana’s governance outcomes by two international bodies. These are the Natural Resource Governance Institute, NRGI, and the Extractive Industries Transparency Initiative, EITI.

For present purposes, by governance of Guyana’s emerging oil and gas sector I refer conceptually to the standard consensus meaning of the term. That is, 1] governing of the exploration and development of oil and gas resources; 2] the generation of revenues from these resources for both the Owner and Contractor [under the ruling PSA; and 3] the transformation of revenues generated from sales into public spending along with the generation of capital for productive re-investment and firm growth.

At all these stages the processes seem to work best when they are guided by a set of institutions, appropriately trained personnel, and a coordinated set of policies to steer resource development. Clearly, in order to be successful, in the goal of socioeconomic transformation and broad-based development, the oil and gas sector should be built on solid foundations, especially a strategic, coherent, consistent, and secure legal system that fosters “strong, transparent, and accountable institutions to ensure the greatest value capture.”

This means: 1] “well-defined interrelationships between institutions and legal frameworks;” and 2] “better policy formulation” (IADB 2020). Indeed, the IADB cites studies in support of the thesis that these “aid navigation of those challenges which arise when seeking to maximize oil and gas resource benefits”. The immediate need to build urgently Guyana’s regulatory and management framework is therefore self-evident for the effectiveness of its emerging oil and gas sector. Further, the IADB speculates that “this remains a significant yet attainable challenge”.

Conclusion-pure humbug

It is noteworthy the IADB has asserted that, the key institutions, laws, and responsibilities along the “decision- making value chain” will be impacted by “political stability, robust civil society participation, as well as the quality and availability of human capital resources” (IADB 2020). With that in mind, it assessed the gaps in the prevailing system.

However, in my view the greatest challenge seems to lie in a seemingly high-handed and dismissive attitude of the lead Contractor to the admittedly weak legal framework of the oil and gas sector as pure humbug!

Next week I examine and report on the Natural Resource Governance Institute, NRGI assessment of Guyana’s governance outcomes; including legislative and regulatory challenges.