Dear Editor,

This letter seeks to bring clarity to the issue of how Old Age pensions are calculated at the National Insurance Scheme. Two scenarios are given showing contributions in excess of 750 required contributions. Please be advised that the calculation of Old Age Pension is based on two factors, that is your relevant wage and the percentage you earned.

i) Your relevant wage is determined by looking at the last five (5) years you worked before attaining age 60 years. The Insurable incomes for these years are identified and the best three years (the years showing the highest total insurable earnings) are selected from the set. The average of those three years are determined by an average weekly or monthly wage/salary.

ii) A person who qualifies for an Old Age Pension is entitled to 40% of his relevant wage for the first 750 contributions, and an additional 1% for each complete block of 50 contributions above 750. This can consist of both paid and credited contributions. (Credited contributions are awarded to a person due to age or upon receipt of a complete week or more of benefits from the Scheme. No contributions are required to be paid by an Insured person who has received a complete week of Benefits from the Scheme).

The total number of contributions a person made throughout his working life is used to determine the percentage of a person’s pension. 750 contributions or 15 years of contributions is the minimum contributions required to qualify for Old Age Pension and represents a 40% pension. This percentage extends up to 60% which is equivalent to 1750 contributions or 35 years of contributing to the Scheme. The additional 20% is derived at by calculating every extra block of 50 contributions after the required 750 contributions.

Example: John has 900 contributions

Minimum contribution required= 750 (40%)

Extra blocks of 50 = 900-750=150

Then 150/50= 3%

Total percentage entitled to= 43%

When the Pension you are entitled to is calculated, it is then compared to the current minimum pension at the time you became 60. If your calculated pension is less, you are paid the minimum pension. Otherwise, you are paid the calculated pension. For example, if at the time of qualification someone’s pension was $34,000 and NIS minimum pension was $27,500 then the following year NIS increases the minimum pension to $35,000. It means that the person’s pension would now be lower than the new current minimum and as such it would have to be adjusted accordingly to reflect the new minimum. In the example stated above an increase of $1,000 was awarded to the pensioner.

Examples of calculation of pensions:

NB: the years used to calculate pensions are not calendar years but 12 months commencing from the month of your birth, e.g. July 2002 to June 2003 would be considered a year.

Case: 1- CALCULATION OF A

MINIMUM PENSION

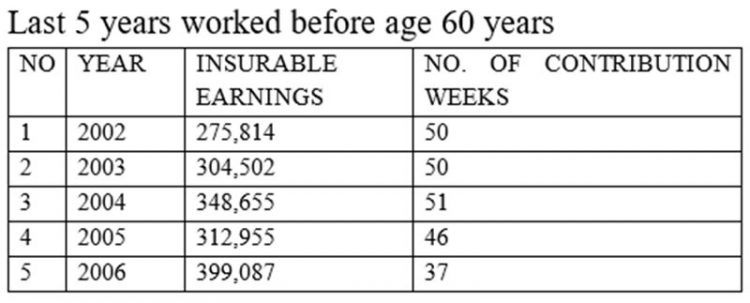

DOB: 07-01-1961

Age: 60 (07-01-2021)

Number of contribution:

Paid: 1099

Credited: 3

Total: 1102

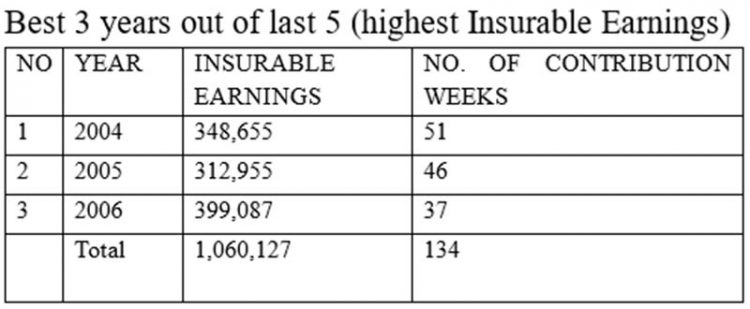

Average weekly= 1,060,127 ÷ 134 = $7911.39

Contributions (paid & credited) =1102

Percentage awarded from extra contributions after 750) = Contributions achieved

1102-contribution required 750 = 352 ÷50 (block of contribution) = 7%

Total percentage allotted = 40 (minimum %) + 7 (extra % gained) = 47%

RATE OF PENSION

47 X $7911.39 ÷ 100= $3718.35 PER WEEK

3718.35 X 52 ÷ 12 = $16,112.85 (Monthly pension qualified for)

Pension will be adjusted to NIS minimum pension of $35,000

Case: 2- CALCULATION OF AN ABOVE MINIMUM PENSION

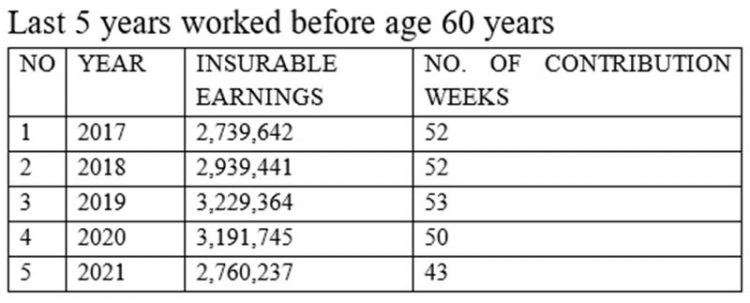

DOB: 05-07-1962

Age: 60 (05-07-2022)

Number of contribution:

Paid: 1906

Credited:

Total: 1906

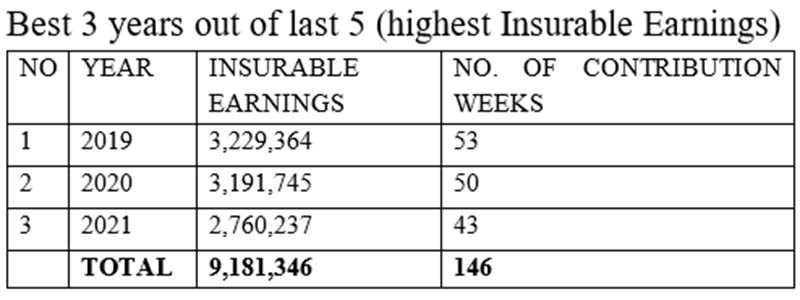

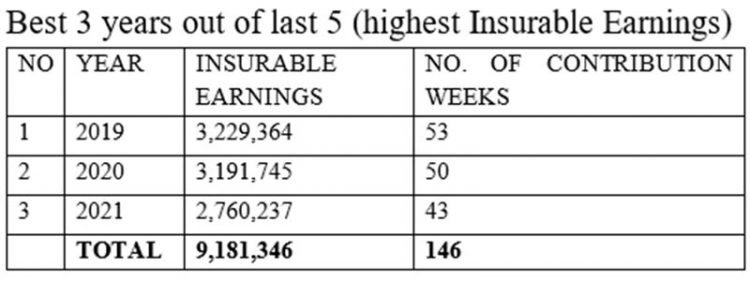

Average weekly= 9,181,346 ÷ 146 = $62,885.93

Contributions (paid) =1906

Percentage achieved = 1906 – contribution required 750 = 1156 contribution ÷50 =23

Total percentage allotted = 40 (minimum %) + 20 (% gained from extra contributions) = 60% (this is the maximum percentage used to calculate the pension.

The extra 3% will not be used to calculate the pension.

RATE OF PENSION

60 X $62,885.93 ÷ 100= 37,730.558 PER WEEK

37,730.558 X 52 ÷ 12 = $163,503 (Monthly pension qualified for)

Please note that other examples will be given in future letters to you.

Sincerely,

Dianne Lewis Baxter

Public Relations Officer