Dear Editor,

Permit me to respond to Joel Bhagwandin’s letter in SN of October 8th, captioned, ‘The overall objective of the PSA is to obtain a higher profit share after fully recouping investment costs’; but before doing so, I would like to recommend that Joel Bhagwandin take some finance and economic classes from Mike Persaud, ‘BetterWaytoRetire’, and Burch01, among others, who in the comments section of Stabroek News, advanced pertinent interpretations of his letter. I thank them for debunking the drivel Joel Bhagwandin (JB) has written.

JB writes that the 75% cost ceiling,” … allows for faster recovery of the capital investment (CAPEX) by the oil companies and by doing so, the company and the country would be able to cash in on a higher profit share sooner rather than later.” This statement by JB is unambiguously arrogant, for to tell a sovereign nation, we will call you for your crumbs after we collect our invested capital is consistent with working under a lopsided PSA: ‘Please, (Guyana), Step-Aside’. Therefore, my question to JB is this: Given that EEPGL is paying no taxes but receives fake tax receipts, why must Guyana wait until after the EEPGL collects its entire capital cost before Guyana receives a fair share from its non-renewable resource? There is no justification for this behaviour. Furthermore, this deferred payment arrangement harms Guyana from receiving in a timely manner the correct share of its wealth. In particular, since interest rates are not zero, this payment arrangement violates the axiom that a dollar today is worth more than a dollar tomorrow.

Guyanese have a saying, ‘mouth open, story jump out’. And in this regard, I will show that JB has exposed a probable double dipping concern in EEPGL. JB writes that the cost function consisting of 75 percent of total revenue (Cost = 0.75PQ), where P is price per barrel and Q is the number of barrels of oil) is divided into two parts: CAPEX and OPEX. He defines CAPEX as ‘… the capital expenditure (CAPEX) which was invested upfront to explore and develop the oil fields for production…” while he categorically states that,’… the OPEX…is made up of both variable costs and fixed costs…’.

Recognizing that the capital expenditure (CAPEX) is fixed costs; and noting that JB states that OPEX includes both fixed and variable costs, the question JB must answer is as follows: Is there double dipping in this PSA, as fixed cost is included twice in the total cost? Additionally, it would be useful if JB, who appears to be much more informed on the workings of EEPGL, can state what is the total fixed cost (FC) in the project? The reason for asking this question is that we can thereafter calculate the breakeven quantity (Q*) and establish where we can identify profit oil which is shared between EEPGL and Guyana. This breakeven approach is the principled pathway in establishing profit oil, and no other approach should be accepted in calculating profit oil.

Presented below is an example that will make this approach transparent. If fixed cost (FC) is $1,000.00; price (P) is $10.00; and total cost is 0.75 PQ, the breakeven quantity at zero profit is 400 barrels of oil; and every barrel of oil beyond the 400 breakeven level will be profit oil to be shared equally between EEPGL and Guyana. In this example, total revenue (PQ) is $4,000.00; fixed cost is $1,000.00; total variable cost is $3,000.00; and profit is zero. The breakeven formula where profit is zero is defined as: . The main implications of this formula are as follows: 1. Any production of oil beyond the quantity Q* is profit oil to be shared equally between by EEPGL and Guyana. 2. When fixed cost (FC) increases due to new developments and no ring fencing, the breakeven quantity increases and this reduces the number of barrels of profit oil. 3. When the price of a barrel of oil increases, the breakeven quantity of oil decreases and the number of barrels of profit oil increases. Since JB has information on EEPGL, he should publish the total fixed cost in the project so that Guyanese can get a better understanding of this project. Otherwise, we will have to wait on the audit report.

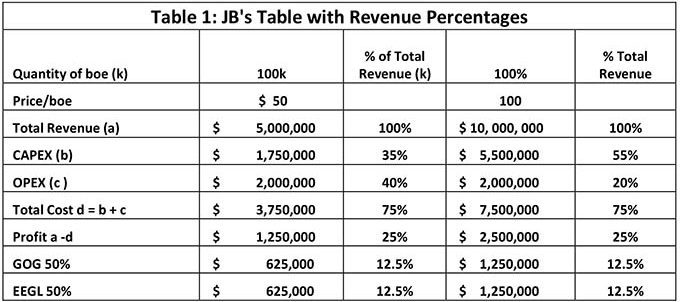

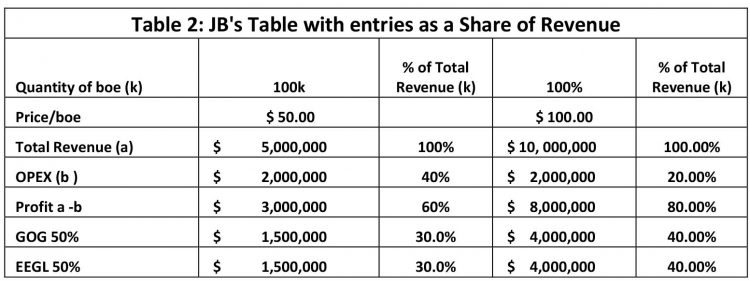

In JB’s letter he made the following statement: ‘… capital expenditure (CAPEX) … was invested upfront to explore and develop the oil fields for production…’. In the income and expenses statement prepared by JB, he included amounts as expenses for CAPEX totaling 1,750,000 and 5,500,000, respectively (Table 1). CAPEX, which accounts for 35 percent of total revenue when the price per barrel of oil is $50.00, jumps to 55 percent of total revenue when the price increases from $50 to $100.

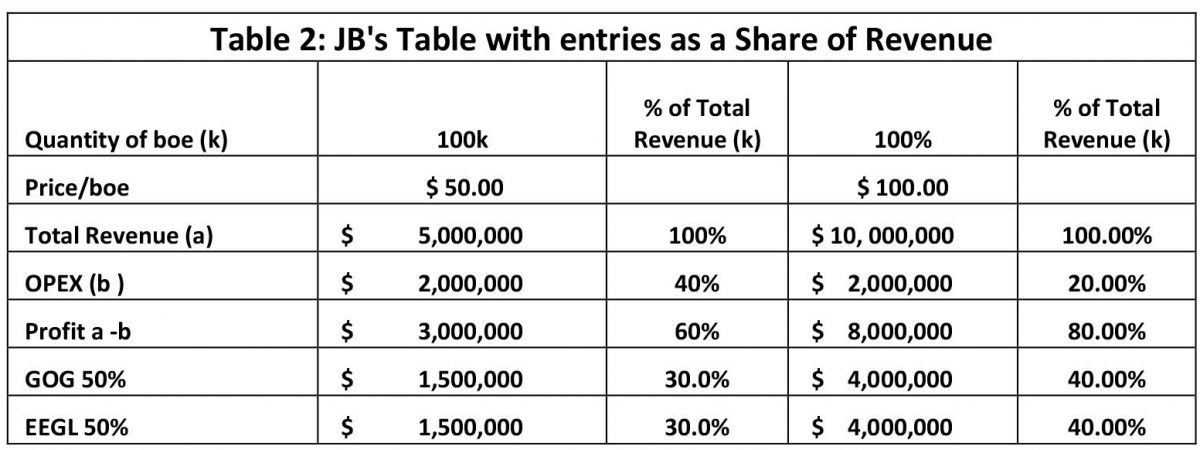

Including CAPEX in the income and expense statement is a horrible deception imposed to bamboozle Guyanese, for in standard accounting in an income and expense statement CAPEX is never included as an expense item. In fact, excluding CAPEX from the income and expense statement is supported by the definition advanced by Investopedia (https://www.investopedia.com/terms/c/capitalexpenditure.asp) in which it is stated that: “Capital expenditures are payments made for goods or services that are recorded or capitalized on a company’s balance sheet instead of expensed on the income statement. If an item has a useful life of less than one year, it must be expensed on the income statement rather than capitalized, which means it isn’t considered CAPEX. Some of the most capital-intensive industries have the highest levels of capital expenditures, including oil exploration and production, telecommunications, manufacturing, and utility industries.”. Please note that oil exploration and development are included in this collection of capital investments, which do not depreciate to zero in one year. Therefore, given the CAPEX definition and excluding CAPEX expenses, while holding the cost of oil at the same level as recommended by JB ($2,000,000), profits increase from $1,250,000 in JB’s specification (Table 1) to $3,000,000 when the price is $50.00 per barrel; and it further increases to $8,000,000 when the price moves from $50.00 to $100.00 per barrel (Table 2). Therefore, the profit shares of $4,000,000 each to EEPGL and Guyana are more attractive than the previous profit level. Consequently, including CAPEX in expenses in the income and expense statement is a ploy to hide the real profit from Guyana and for EEPGL to go smiling to the bank.

Editor, when I reflect on what JB has presented in the closing lines of his letter, ‘… all things equal’, I can only think of the current one-sided PSA: Please Step Aside, Guyana, for your crumbs, if at all, are coming much later, if you are lucky.

Sincerely,

Dr. C. Kenrick Hunte

Professor and Former Ambassador