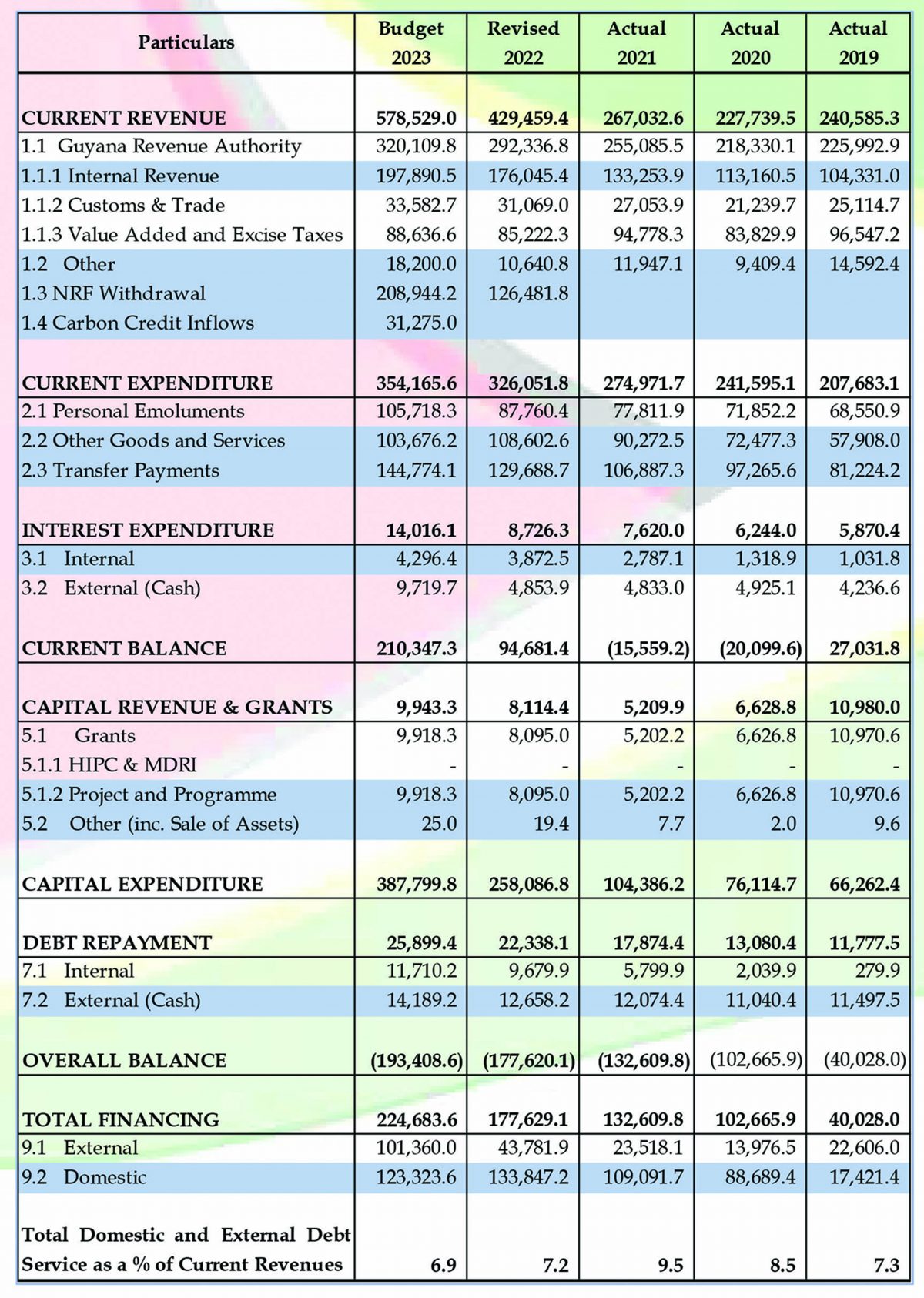

● Real GDP is projected to grow by 25.1%, with the non-oil economy projected to grow by 7.7%.

● Inflation is projected at 3.8%.

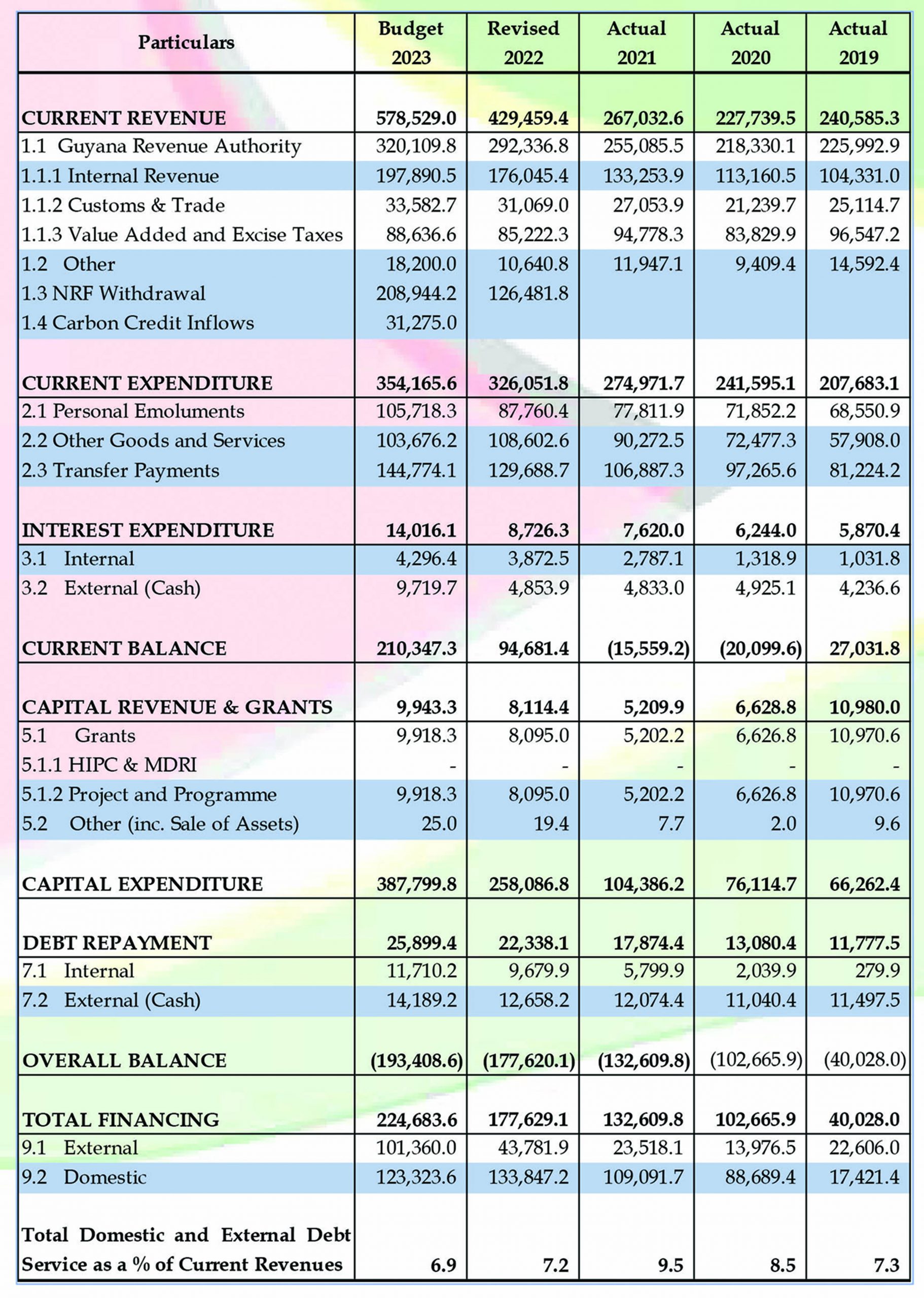

● Current revenue of $578.5 billion, an increase of 34.7%. Current expenditure of $354.2 billion, and interest of $14.0 billion, representing increases of 8.6 % and 61% respectively over 2022.

● Capital expenditure of $387.8 billion, an increase of 50% over 2022.

● Overall fiscal deficit of $193.4 billion, an increase of 9%.

● Balance of Payment is expected to register a surplus of US$ 150 million, compared with US$128.3 million.

● Merchandise exports of US$12,977.8 million, an increase of US$1,573.5 million or 12.1 % while imports are expected to move from a deficit of US$3,623.6 million to a deficit of US$5,536.4 million, an increase of US$1,912.8 million or 34.5%.

Table showing Real GDP growth and Inflation Rate

Source: Annual Budget Speeches (2011 – 2022)

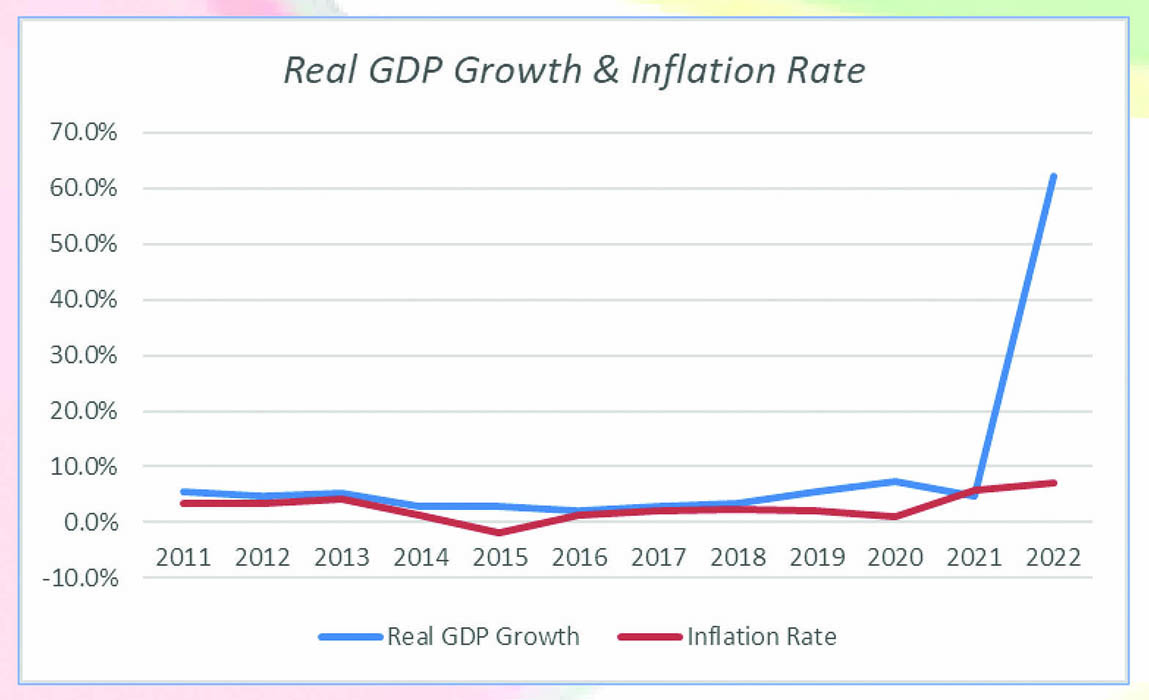

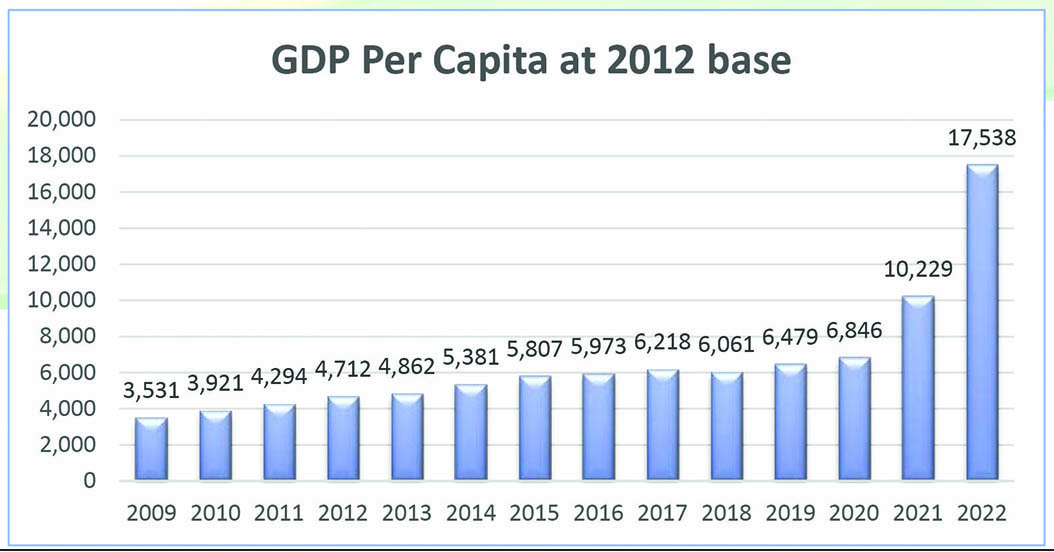

Per Capita Gross Domestic Product (GDP)

On this traditional measure of GDP, Guyana ranks above China, Brazil, Suriname, and many more in the world league of nations. Yet, we rely on China to support or finance our development goals.

Table showing GDP Per Capita at 2012 Base

Ram & McRae Comments:

It is doubtful that the average Guyanese can identify herself with these astounding per capita numbers. Numbers and ranking have consequences, including the rate of interest at which the country can access borrowings.

Financial Performance

Current Revenue for 2022 amounted to $429,459.4 million, made up of tax revenues, NRF withdrawals and GRIF inflows. While the shortfall in overall revenue was negligible – by $2,554.2 million, or 0.6% – this is a net change which masks some significant over- and under-collections.

Of the revenue, $292,336.8 million derived from corporate and personal income tax and value added tax an increase of $37,251.3 million or 14.6% over 2021. Specifically, Corporation Tax collected was $104,580 million, an increase of $28,683 million or 27. 0% over 2021 while the self-employed businesses contributed $4,022 million, a decrease over the preceding year. Personal Income Tax collections in 2022 amounted to $54,881 million, an increase of $11,974 Mn or 27.9%.

Excise tax and taxes from international trade transactions, including import and export duties and travel taxes, amounted to $58,666 million, some $13,346 million less than collections in 2021. Of this latter sum, Excise tax collections fell by $18,127 Million, but there were increases in excise tax on domestic supplies ($119 million), duties on imports ($3,388 million), duties on export ($55 million) and travel taxes ($1,219 million).

The total withdrawn from the Natural Resources Fund increased from G$126,481 million to $208,944 million, an increase of $82,463 million or 65%.

On the expenditure side, Personal Emoluments amounted to $87,760 million, an increase of $9,948 million, or 12.8%. Other Goods and Services amounted to $108,602 million, an increase of $18,330 million over 2021, and Transfer Payments amounted to $129,688 million, an increase of $22,801 million or 21.3%.

In total, these amount to $326,051.8 million, which was $51,080.1 million, or 18.6% over actual 2021.

Interest expenditure for 2022 was $8,726.3 billion, an increase of $1,106.3 billion, or 14.5%, expended for the preceding year.

The current account balance in 2022 is reported a positive balance of $94,681.4 billion, compared with a negative balance of $15,559.2 billion in 2021.

Ram & McRae comments

The major cause of the fall in Excise Tax was the removal of the tax in previous from 50% down to zero currently. Citizens using public transport might wonder who benefitted from this reduction.

While companies and employed persons – including high earning expatriates in the petroleum sector – have paid significantly more in taxes, the self-employed are the only category of taxpayers whose condition does not appear to have benefitted from all this growth.

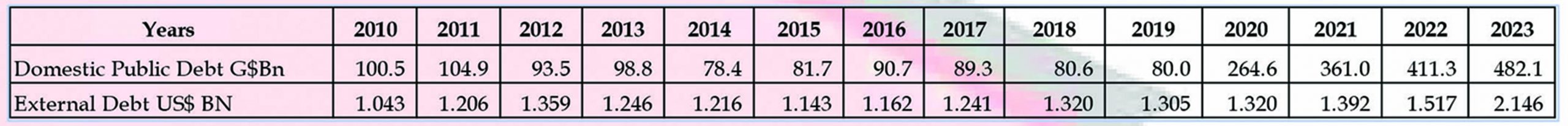

Domestic Debt

Domestic debt amounted to US$2,080.6 million at end-2022, up from US$1,731.5 million at end-2021. This increase is attributed to Government’s issuance of new fiscal treasury bills.

Source: Annual Budget Speeches Appendix VI 2023

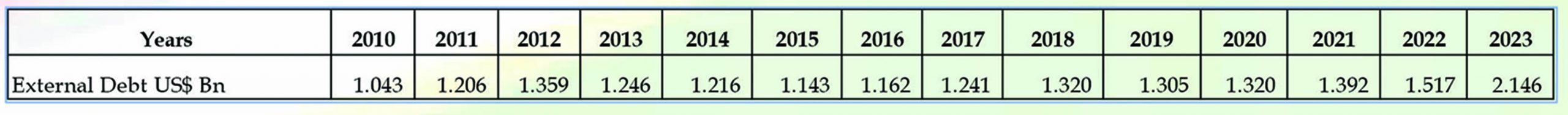

External Debt

At the end of 2022, Guyana’s external debt totalled US$1,571.9 million, representing a 12.9 percent increase compared to end-2021, mainly because of positive net flows from both bilateral and multilateral creditors. The table below shows that over the period 2010 – 2023 (projected), the stock of external public debt will have grown from US$1,043 million to US$2,146 million, or 105.8%.

This Speech reported that external debt service payment in 2022 increased by US$85.2 million or 5.5%

Source: Appendix to Budget Speech 2023 (Appendix VI)

Ram & McRae Comments:

● Unlike the prior year, the Speech did not offer the reasons for

increase in both domestic and external debt.

● The Minister attributed the decline in the debt ratio to “judicious contracting of development financing”. The improvement is also due to the substantial increase in GDP, which is the denominator in calculating the debt to GDP ratio.

● One of the experiences in oil producing countries is the contracting of debts in good years servicing of which poses challenges in bad years.

Financial Operations of Central Government

(Accounting Classification)