No contract or other arrangement providing for the payment of public moneys with respect to any programme for which there is an appropriation or an item included in the annual budget proposal then before the National Assembly to which that payment is to be charged, shall be entered into unless there is a sufficient unencumbered balance available in the appropriation or the proposed budget item, as the case may be, to make that payment.

Section 16 specifically prohibits the incurrence of expenditure without an appropriation, except as provided for under Article 217 of the Constitution. A review of the Estimates of Revenue and Expenditures for the fiscal year 2023 indicates that there is no funding for the production of electronic ID cards. The Attorney General appeared to have acknowledged this when he stated that he believes that when the issue of funding comes before the Assembly, the matter will be ventilated there.

We had reiterated our call for the suspension of the contract, or preferably its recission, until such time that wide public consultations are held to discuss, among others, issues of personal privacy; the apparent overlapping of responsibilities among State agencies; which agency has the legal authority for issuing such cards; and the status of the existing national ID cards as well as passports. After the views of citizens are taken into account, the proposal should be reformulated, tabled in the Assembly and referred to a Special Select Committee for detailed consideration.

In response, the Attorney General has deemed as ‘uninformed’ and ‘premature’, calls for the cancellation of the contract which he felt can attract litigation. He insisted that there was no breach of the Procurement Act which provides for sole source procurement in certain circumstances, one of which relates to national security. The Attorney General also stated that there was no infringement of the FMA Act, without addressing our concern that there has been a breach of sections 16 and 30(1) of the Act. Instead, he referred to compliance with 18013-5 of the ISO Standard and acceptance by the International Civil Aviation Organisation for international travel, which is irrelevant to the issue on hand.

If cancellation of the contract is likely to result in litigation, so be it, as the greater good will be served. Besides, those responsible for initiating and signing the contract should be held personally liable, as provided for under Section 49(1) of the Act:

If a loss of public moneys should occur and, at the time of that loss, a Minister or official has caused or contributed to that loss through misconduct or through deliberate or serious disregard of reasonable standards of care, that Minister or official shall be personally liable to the Government for the amount of the loss.

Additionally, by Section 85, an official who knowingly permits any other person to contravene any provision of this Act, is guilty of an indictable offence and liable on conviction to a fine of two million dollars and to imprisonment for three years.

Last week, we referred to the views of three leading world economists who considered the Gross Domestic Product (GDP) a poor way of measuring the health of economies and how it fails as a measure of well-being. They identified five main areas, the most important of which relates to a situation where the GDP does not adjust for the distribution of goods. The economists gave the example of two economies: one where one has a ruler who gets 90 per cent of what is produced, with everyone else – barely – subsists on what is left over; and the other where the distribution of the GDP is considerably more equitable. In both cases, GDP per capita will be the same. The Guyana situation is not dissimilar if one were to substitute “one has a ruler who gets 90 percent“ with “ExxonMobil’s subsidiaries which gets 87.5 percent”.

According to the World Bank’s latest assessment to be found at https://www.worldbank.org/en/news/factsheet/2020/09/02/the-world-bank-in-guyana:

Poverty in Guyana, measured using the upper-middle income poverty line (US$5.50 per day in 2011 PPP) has dropped from close to 61 percent in 2006 to around 48 percent in 2019, but was still among the highest in the Latin America and Caribbean (LAC) region.

Poverty rates are highest in the sparsely populated interior or hinterland, where communities have limited access to economic opportunities, healthcare and public services. The country experiences high emigration and brain drain, with 39% of all Guyanese citizens currently residing abroad and roughly half of all Guyanese with a tertiary education having emigrated to the United States.

And in his Stabroek News column titled “GDP’s faulty measurement of the good life” appearing in December 2017, Ian McDonald referred to the work undertaken to develop a Canadian Index of Wellbeing (CIW). The CIW describes wellbeing as:

The presence of the highest possible quality of life in its full breadth of expression, focused on but not necessarily exclusive to: good living standards, robust health, a sustainable environment, vital communities, an educated populace, balanced time use, high levels of democratic participation, and access to and participation in leisure and culture.

CIW is a composite index involving an assessment of the above areas of activity. It acts as a companion measure of societal progress to the GDP that is based solely upon economic productivity. Further details can be obtained at https://uwaterloo.ca/canadian-index-wellbeing/what-we-do/domains-and-indicator.

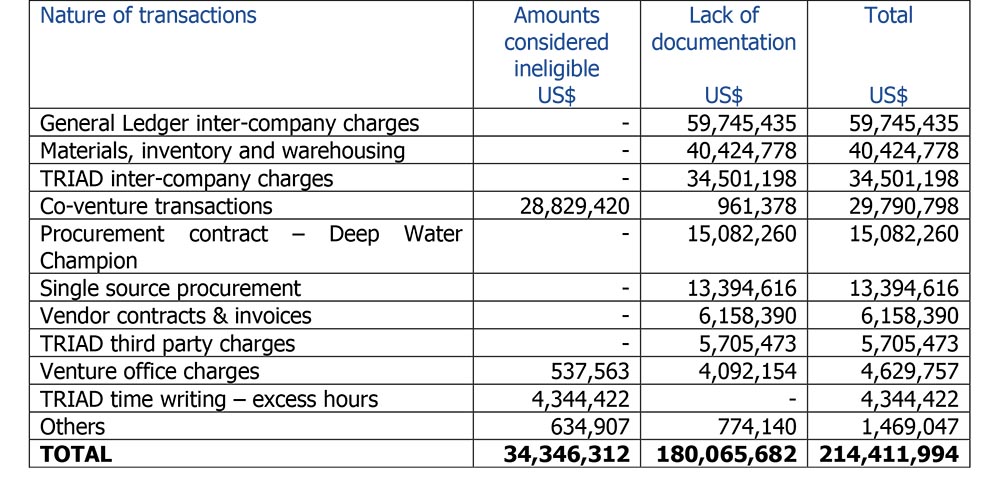

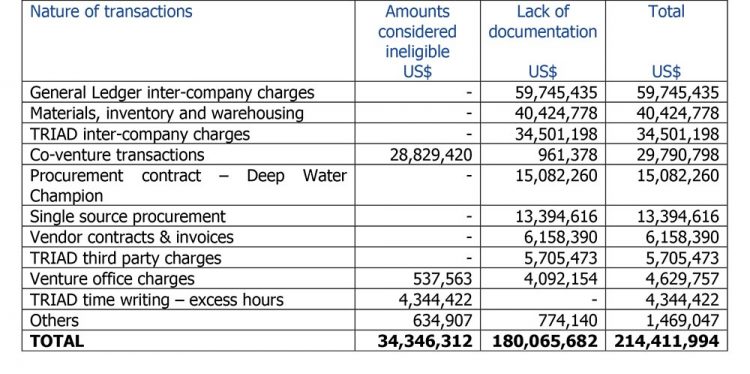

In last week’s article, we began a discussion of the results of the audit of pre-contract costs totalling US$1.678 billion incurred by Exxon during the period 1999 to 2017. The contract for undertaking the audit was awarded to the UK firm IHS Markit in September 2019 with the objective of identifying expenses that the auditors consider to have been added in error, do not relate to petroleum operations, or for which there is insufficient evidence and transparency to determine the validity of the expenses. According to the 2016 Petroleum Sharing Agreement (PSA), these costs are to be considered recoverable costs for the purpose of computing profit oil to be shared equally between Exxon and the Government. It follows that any overstatement of expenditure will result in a corresponding reduction in Guyana’s share of profit oil.

The auditors’ main finding is that the Government has reasonable grounds for disputing US$214.4 million due to either ineligibility of expenditure in the context of the PSA, or lack of adequate supporting documentation. If these charges are removed from the cost recovery statement, Guyana’s share of profit oil will increase by US$107.2 million. This is a minimum position since the auditors were unable to quantify certain transactions for which they have serious reservations about their completeness, accuracy and validity as recoverable costs. For example, supporting documents for expenditure incurred during the period 1999 to 2004 were not available as they were purged in accordance with Exxon’s internal policies. It will be recalled that some US$460 million was being claimed as pre-contract costs during the period 1999 to 2015.

In today’s article, we provide further analysis of the report.

Summary of disputed recoverable costs

Table I provides a summary of pre-contract costs that the auditors consider either ineligible to be treated as recoverable costs, or lack adequate supporting documentation:

Table I

Summary of recoverable costs

considered ineligible & lack of supporting documentation

General Ledger inter-company charges

A total of US$78.4 million was recorded in the main accounting record, the General Ledger, for which the auditors believe relate to inter-company charges that had not been reviewed as part of the TRIAD review or the contracts review. (Exxon’s TRIAD system is used to capture expenses incurred by Affiliated Companies.) However, the General Ledger records were also not always clear, with information missing on many entries, and the supporting documentation provided lacked details of what the charges relate to or why they apply to the Stabroek Block. Following the review of all available information, the auditors concluded that there is insufficient evidence to support US$59.6 million as recoverable costs.

Materials, inventory and warehousing

The total recorded expenditure on well materials was US$143.3 million. However, the auditors were unable to verify the return to shore base of unused materials issued to the operations. Additionally, approximately US$40.4 million in materials lacked specific vendor details to enable them to be traced to the related purchase contracts. Further, the Government was not invited to witness the materials count during the audit period, as required by the PSA. Moreover, an adjustment of US$349,098 was made as inventory adjustments but there were no supporting documents to substantiate this adjustment to the General Ledger.

TRIAD inter-company charges

Total expenditure recorded in the TRIAD system amounted to US$391 million. However, around 11.4 percent of this expenditure lacked sufficient clarity to allow for the tracing of the transactions. These consist of time writing – US$4,450,745; inter-company – US$34,501,198; third party charges – US$5,705,788; and other expenses – US$62,912.

Co-venture transactions

Of the amount of US$31.43 million representing co-venture costs, EEPGL was only able provide contracts and invoices for US$2.6 million to demonstrate that these expenses were related to Stabroek Petroleum Operations. An additional US$28.83 million was incurred prior to the co-venturers being signatories to the PSA. There was also no documentary evidence to justify a further US$0.95 million of costs. The auditors concluded that US$29.79 million should be removed from the cost recovery statement.

Procurement contract – Deep Water Champion

According to the auditors, Deep Water Champion drillship, which was on long term hire to ExxonMobil and for drilling the Liza-1 well, was one of the highest ever recorded daily rates for an offshore rig. Additionally, an amount of US$500,000 was recorded as seismic-related costs but there was no evidence of seismic activities being carried our during the period under review.

Vendor contract & invoices

Payments to vendors for the period under review amounted to US$953 million. However, 25 percent, or US$240 million, of the contracts awarded were based on single source procurement; while 11 percent, or US$99.5 million, were partial single source contracts. EEPGL did not demonstrate the competitiveness of the rates for contracts valued at US$28,476,876. The auditors have also recommended the removal of an additional US$6.2 million from the cost recovery statement.

Venture office charges

The auditors have noted deficiencies in reporting of expenditure relating to Venture Office & Payroll charges and have identified amounts totalling $4,555,002 as not having adequate transparency and justification.

Auditors’ recommendations

Work programme & budget: The current work programme and budget format is insufficient in that, while it meets the minimum requirement set out in the PSA, it does not meet ‘the spirit of the PSA’.

The auditors have included a suggested format in the report. Additionally, the current process of multiple rate adjustments throughout the year and some employees charging what might be considered excessive hours each month, do not meet expected practice. Accordingly, the auditors have recommended that a set of manhour rates charged for affiliates should be agreed and fixed for the year and there should be a cap on the manhours that can be charged.

In relation to the submission of the cost recovery statement at the end of each year, EEPGL should provide a comparison against each of the budget items to justify changes and overruns experienced during the year. This should include a summary of the jobs performed by affiliates, along with summaries of employees’ charge to each job and progress made.

Insurance: It is a requirement of the PSA that appropriate insurance coverage is maintained. However, there was no evidence that Hess and CNOOC complied with this requirement.

Evidence of insurance coverage along with copies of insurance certificates should be provided at the beginning of each year.

– To be continued