Dear Editor,

Oil spills are the release of crude oil (or refined petroleum products) from wells, rigs, offshore platforms and tankers. Oil spills are disasters that can have severe social, economic and environmental impacts for both short-term and long-term prospects. These oil spills are most common in marine environments but can also occur on land. As such, they can have disastrous consequences for local ecosystems and can be expensive due to the loss of oil and the costs associated in the clean-up exercises.

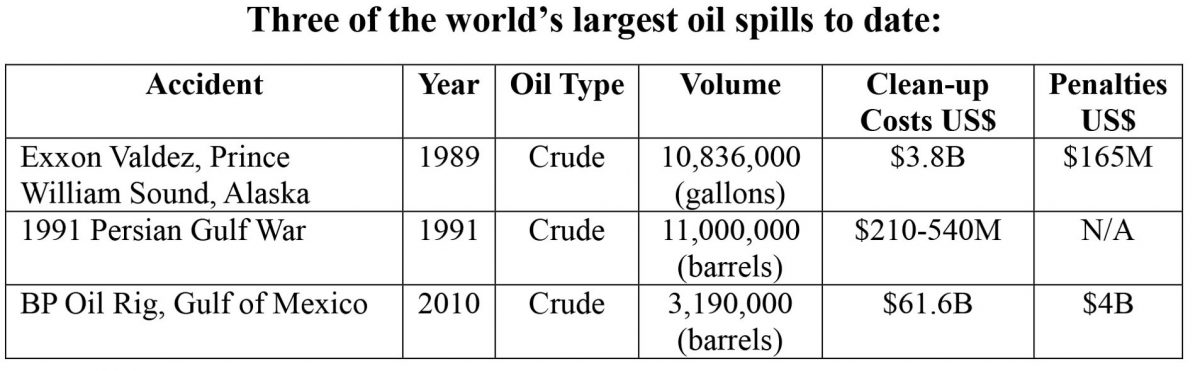

The actual spill costs in a particular incident are completely dependent on the actual circumstances of the spill. By and large, these costs; even on a per unit basis are influenced by a variety of interrelated factors, such as geographical location (proximity to the shoreline & sensitive resources), political regime, oil type, amount spilled, and the technologies employed in the clean-up exercises. The actual costs incurred can only be examined and determined in the aftermath of the oil spill once the predictable and the unpredictable circumstances play themselves out as per case.

In Guyana’s context as an oil production country, it would only be fair and realistic for an enterprise involved in drilling to purchase adequate mandatory liability insurance (in amounts more than US$10 to $20 billion, notwithstanding that the insurance industry may not be able to supply this much coverage and given the intensity of monitoring activities) for any oil spill as a going-concern in the oil & gas industry.

Sincerely,

Paul Ramrattan, CBMBA, MCBI, ICEA (Grad, Acct.)