As our elected representatives meet to consider the Estimates, it is again our hope that there will be serious reflection on the results of the various studies vis-à-vis the extent of our own contribution to assist in the mitigation of the effects of climate change. This is apart from our country being the first to issue carbon credits for its vast forest resources which, it must be noted, are a gift of nature. On the other hand, a significant portion of the Estimates is expected to be funded from revenues derived from the extraction of fossil fuels that is the main contributor of climate change.

As the Assembly meets this week to debate the Estimates, we again appeal to our Members of Parliament (MPs) to conduct themselves in a manner befitting the position they hold as the elected representatives of the citizens of this country. In the execution of their duties, MPs should be guided by the Code of Conduct contained in the Integrity Commission Act. While some degree of heckling and cross-talks are considered acceptable, the Speaker has the solemn duty to ensure that they do not degenerate into insults, personal vilification, and character assassinations. He must be even-handed on both sides of the House. The debate should be a healthy one, and each participant should be allowed to express his/her views without any form of interruption, subject to agreed time limits for each presenter. If there is merit in any arguments that may require an amendment to the Estimates, the national interest dictates that this be done. After all, this is the purpose of the budget debate. Parliamentarians must eschew taking positions based on narrow political interest and they should be allowed to take positions based on their conscience, after due reflection on the arguments presented.

In today’s article, we highlight the performance of the country’s economy in 2023 and its state of affairs at the end of the year, as contained in the Minister’s budget speech.

Real GDP growth

The total growth in the gross domestic product (GDP) for 2023 was projected 25.1 percent, while non-oil growth was expected to be 7.9 percent. The actual total growth was 33 percent, with non-oil growth accounting for 11.7 percent. This performance was primarily due to the expansion in the production of crude oil which also had a positive effect on the non-oil growth, including construction and services, mining, and quarrying.

Balance of Payments

The Balance of Payments is the net effect of trade in goods, services and capital between a country and the rest of the world. A positive balance means that the value of exports exceeds that of imports. It has the benefit of boosting production and hence employment. On the other hand, a negative balance indicates that the country is a net consumer rather than a net producer. If this negative balance persists, it has the effect of increased borrowings and hence the country’s indebtedness. It can also put pressure on the country’s exchange rate.

The Balance of Payments has two main components – the Current Account and the Capital Account. The Current Account essentially reflects transactions in goods and services for short-term consumption; while the Capital Account records transactions of a capital nature, or investments, which have long-term implications.

Guyana’s Current Account balance at the end of 2023 was US$1,980.9 million, compared with US$3,805.9 million at the end of 2022, a decrease of US$1,825.0 million. This decrease was due mainly an increase in import payments by 83.1 percent to an estimated US$6,636 million, including the arrival of the Prosperity FPSO which contributed approximately 26.6 percent to total import costs.

On the other hand, the Capital Account deficit was reduced from US$3,658.4 million at the end of 2022 to US$2,027.6 million, mainly due to enhanced net foreign direct investment with the arrival of the Prosperity FPSO. Taking the above into account, the overall Balance of Payments recorded a deficit of US$34.2, compared with a surplus of US$121.5 million at the end of 2022. The deficit was financed by a drawdown on the Bank of Guyana’s foreign reserves.

Inflation

The rate of inflation was 2.0 percent, compared with 7.2 percent recorded in 2022. According to the Minister, ‘[t]his largely reflects more moderate increases in the average prices of key commodities… Notably, food prices in the consumer basket increased by an estimated 3.8 percent at the end of 2023, substantially lower than the 14.1 percent increase at the end of 2022’. However, based on their experience, most Guyanese are likely to find it difficult to agree with this assessment of the inflation rate, considering the unprecedented rise in the cost of living since COVID-19 that continued during 2023.

Interest rate

As in the case of 2022, interest rates remained stable throughout 2023. For small savings, the rate remained unchanged at 0.81 percent, while the weighted average lending rate was 8.36 percent. The 91-day, 180-day and 364-day Treasury Bills attracted rates of 1.10 percent, 0.99 percent, and 0.99 percent, respectively.

Income

In 2023, there was a 6.5 percent increase in wages and salaries for public servants, while the Disciplined Services received an additional one-month tax-free bonus. The increase was announced close to Christmas retroactive to January 2022, a practice inherited in the pre-1992 era as an appeasement to government employees struggling to make ends meet. However, employees need immediate relief in the coming days and months to cope with the rising cost of living. Indeed, it is an established practice for wages and salaries increases to be granted at the beginning of the year. A recently released study by the Food and Agriculture Organisation indicates that 43 percent of Guyanese cannot afford a healthy diet, while five percent of the population is under-nourished. See https://www.fao.org/3/cc3859en/cc3859en.pdf.

That apart, we continue to ask: why is it that other categories of government employees are not in receipt of the additional benefit given to the Disciplined Services? If the Disciplined Services are deserving of such a benefit, there is a greater argument for such benefit to be extended to public servants, teachers, doctors, and nurses, among others. The Minister had considered that the previous Administration’s discontinuation of the practice of granting end-of-year bonuses to the Disciplined Services as “unconscionable”. But is it not true that the denial of this benefit to other categories of employees unconscionable and an act of discrimination?

Revenue and expenditure

A fiscal deficit of $167.031 billion was recorded in 2023, compared with $131.696 billion in 2022, an increase of $36.335 billion, or increase of 27.6 percent. This was due mainly to an increase in overall expenditure that outweighed the increase in revenue generated. Current revenue, excluding withdrawals from the Natural Resource Fund (NRF), was G$388.961 billion; while current expenditure amounted to $406.821 billion, giving an operating deficit of G$17.860 billion.

On the other hand, capital revenue, derived mainly the disbursements of external loans and grants to meet the cost of infrastructure development works, amounted to $63.704 billion.

However, capital expenditure was $421.819 billion which is over six times the capital revenue. As a result, a capital deficit of $421.819 billion was recorded. When account is taken of the NRF withdrawal totalling $204.944 billion, the overall fiscal deficit was $167.031 billion.

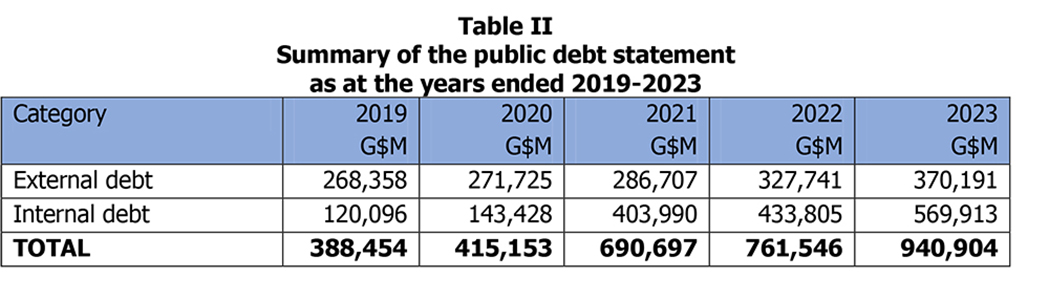

Table I provides a summary of the financial performance of central government activities over the five-year period 2019 to 2023 along with the Estimates for 2024.

The year 2023 represents the fourth consecutive year an operating deficit was recorded. On the other hand, capital expenditure rose by 636.6 percent over the amount expended in 2019.

In considering the above table, we must note that the withdrawals from the NRF in 2022 were treated as current revenue to be used to meet operating expenses. In our view, this treatment is inconsistent with Section 16(2) of the NRF Act which requires all withdrawals to be made for two purposes only, namely to finance: (i) national development priorities including any initiative aimed at realizing a green economy; and (ii) essential projects that are directly related to ameliorating the effects of a major national disaster. It is unclear what were the national development priorities were in 2022, while there has been no major disaster so far. The same treatment was reflected in relation to the reported of the performance of the economy in 2023 as well as in the proposed Estimates of Revenue and Expenditure for 2024. Section 16(2) does not anticipate that NRF withdrawals will be used to fund operational expenses. Rather, such withdrawals are to be used to carry out clearly identified developmental works which by their very nature should be reflected as capital expenditure.

In its 2022 Article IV Consultation Report, the IMF had advised that the overall fiscal deficit should not exceed the amount withdrawn from the NRF, which in effect means that there should be no deficit when the withdrawals from the Fund are taken into account. In its 2023 report, the IMF has made two key recommendations. The first is that given the sheer size of the expected oil transfers and fiscal spending, the policy priorities should be to avoid overheating and `Dutch disease.’ Additionally, there is need to closely monitor macroeconomic and financial indicators and further tighten monetary policy stance. Second, it is highly desirable for a comprehensive fiscal policy framework to be developed to guide spending decisions based on a medium-term fiscal framework (MTFF), along with further modernisation of the public financial management framework, including for public investment. The IMF noted that transitioning to a zero overall fiscal balance over the medium term will allow the government to meet its ambitious investment goals, while ensuring fiscal sustainability and intergenerational equity without creating macroeconomic imbalances.

It is indeed disappointing that the Estimates continue to be crafted without in isolation of any reference to any Medium-Term Budget Framework (MTBF) and MTFF. In other words, there are no strategic plans against which the Estimates can be anchored. In the private sector, it will be surprising if an organization prepares its annual budget without reference of a strategic framework.

Public debt

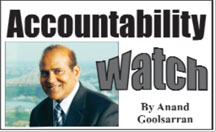

The total public debt, inclusive of publicly guaranteed debts, as at 31 December 2023 was US$4,508.8 million, compared with US$3,654.9 million at the end of 2022, an increase of US$853.9 million, or 23.4 percent. Table II provides a summary of the public debt in Guyana dollars at the end of the last five years.

According to the IMF, ‘[a] country’s public debt is considered sustainable if the government is able to meet all its current and future payment obligations without exceptional financial assistance or going into default’. An important tool used for this purpose is the debt-to-GDP ratio. At the end of 2023, Guyana’s debt-to-GDP ratio increased from 24.6 percent at the end of 2022 to 27 percent, despite the significant increase in the public debt. The main reason for this is that as production of crude oil increases, so is the GDP which is the denominator in the debt-to-GDP ratio.

According to the 2023 IMF Article IV Consultation Report, ‘Guyana’s debt-sustainability analysis (DSA) indicates that the risk of (overall and external) debt distress remains moderate, with debt dynamics improving significantly with incoming oil revenues’.

Gross international reserves

The gross international reserves at the Bank of Guyana stood at US$898.2 million, compared with US$ 939.2 million at the end of 2022. The reserves represented 1.1 months of import cover.