Dear Editor,

The Minister of Finance has kept his Budget Speech promise to come back to the National Assembly to a) raise the debt ceiling b) to revise upward the NRF withdrawal rule and c) saving an increasing share of the inflows into the Fund. Earlier yesterday, via the Fiscal Enactments (Amendment) Bill 2024 – a format which is typically utilised for amendments to tax legislation – the Minister delivered more than even his most optimistic supporter would have expected.

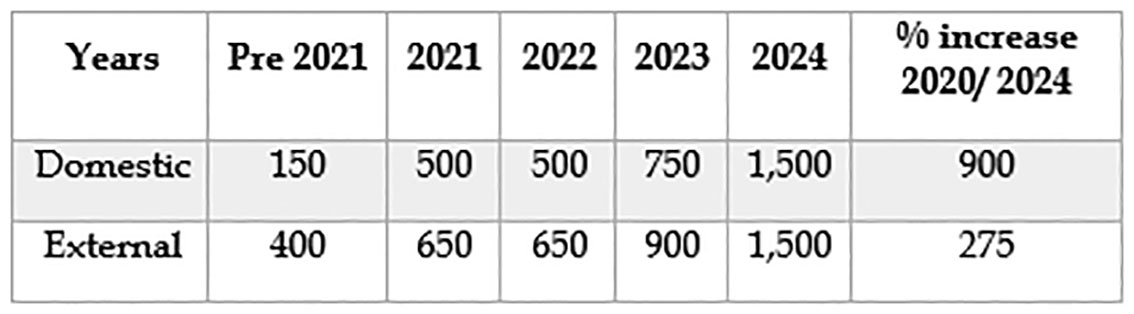

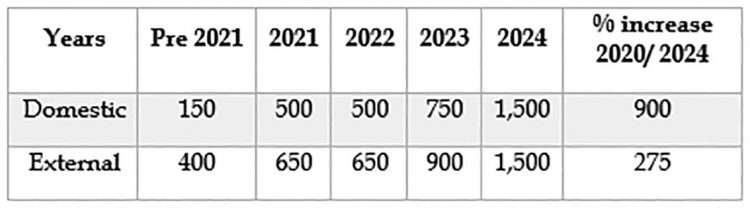

As the Table below shows, the Minister has increased the borrowing ceiling for Public (Domestic) Loans by 100% from G$750,000 Mn. to G$1,500,000 Mn. and the borrowing ceiling for External Loans by 66.7% from G$900,000 Mn. to G$1,500,000 Mn.

Debt Ceiling – Guyana Millions of Dollars

It means that since the PPP/C came to power in August 2020 they have increased the domestic debt ceiling by 900% and the external debt ceiling by 275%. By any measure, even for the fastest growing economy in the world, these are staggering increases, with obvious consequences. The domestic debt reported in the Budget Speech at December 2023 was $569,913 Mn. which means that he can borrow as much as $931,000 Mn. more on the domestic market. The 2024 Budget showed that the Government proposes to borrow in 2024 some $189,522 Mn. (net) from the domestic market and $206,394 Mn from external sources.

The Minister is giving himself a massive borrowing space both from local and external sources. It would be interesting to see how the private sector responds to this proposal which can crowd out local borrowings and possibly carry up the cost of capital.

The NRF

Contrary to the statement in the Budget Speech, the proposal by the Minister to increase the automatic withdrawals from the NRF will significantly reduce what is left for intergenerational savings and for expenditure stability in periods of downturn. To give one simple example, after US$2,000 Mn. of earnings from profit share and royalty, only US$50 million would be saved under the new arrangement, compared with US$750 million under the replaced formula. Let us take it further but expressed another way, savings of US$1,710 million would have been saved from earnings of US$3,000 Mn. under the existing system. Under the new proposal it would require earnings of US$6,000 Mn.!

The Minister has delivered on his promise to increase the borrowing ceilings and NRF withdrawals. Understandably, he has not been able to achieve the trick of withdrawing more and saving more at the same time.

Ram & McRae expressed concern in its Budget Focus that it is dangerous for any Government to treat the NRF like some ordinary piece of legislation. Sadly, that fear has been realised.

Yours faithfully,

Christopher Ram