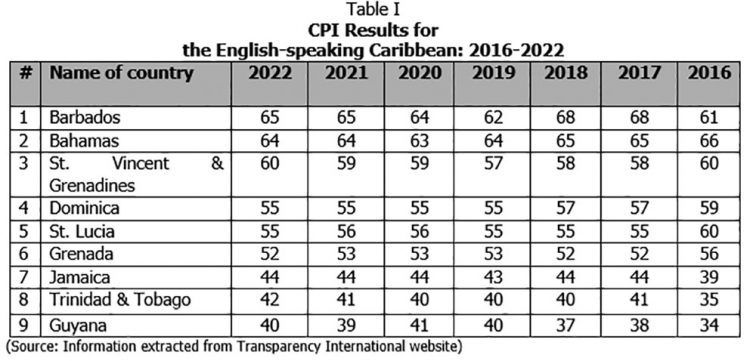

Tomorrow, Transparency International will be releasing its 2023 Corruption Perceptions Index (CPI) based on surveys carried out in 180 countries. It will be of interest to learn how Guyana has been assessed and ranked from among these countries. In 2022, Guyana scored 40 out of 100, a one percentage point increase from 2021. Table I shows the CPI scores for the English-speaking Caribbean over the 7-year period from 2016 to 2022.

As can be noted, except for 2020, Guyana occupied the bottom place in these years, a position it held since 2005 when Guyana was first assessed. In 2012, Guyana’s CPI score was 28 out of 100. Eight years later, it moved to 41. This 13-point increase occurred mainly during the period 2016-2020 when its score increased from 29 to 41. The largest increase was in 2016 when Guyana scored a five-point increase, moving from 29 to 34. This enhanced performance was mainly due to several anti-corruption initiatives undertaken, including:

Holding of local government elections in 2016 and 2018 after a hiatus of 22 years.

Amendments of the Anti-Money Laundering and the Countering of Financing of Terrorism Act 2009 in compliance with the requirements of the Financial Action Task Force.

Conduct of numerous forensic audits of State institutions and the involvement of the Special Organised Crime Unit (SOCU) in instituting charges against those who have been fingered in the abuse and misuse of State resources.

Establishment of the now disbanded State Assets Recovery Agency in keeping with a key provision of the United Nations Convention Against Corruption relating to freezing, seizure and confiscation of property.

Activation of the Public Procurement Commission for the first time in more than 15 years since the constitutional amendment in 2001, to provide for such a body to monitor and oversee Guyana’s procurement processes.

Activation of the Bid Protest Committee to investigate complaints from aggrieved suppliers and contractors in relation to the award of public contracts.

Re-activation of the Integrity Commission after more than a decade of dormancy through the appointment of new members and the revision of the Code of Conduct contained in the Integrity Commission Act.

Establishment of Guyana’s Extractive Industries Transparency Initiative.

Tabling of draft legislation for the establishment of the Petroleum Commission.

Enactment of the now repealed Natural Resource Act 2019.

Enactment of whistleblower protection legislation; and

Amendment of the Fiscal Management and Accountability Act to provide for the financial independence of constitutional agencies.

We had stated on several occasions that Guyana has the potential to build on this improved performance if it could intensity its efforts to improve its governance, including transparency and accountability, and ensure appropriate disciplinary actions are taken against those found guilty of undermining such efforts. The area of most concern relates to the award of contracts for the procurement of goods/services and works, and the effective monitoring of contract execution to ensure good value for money is achieved.

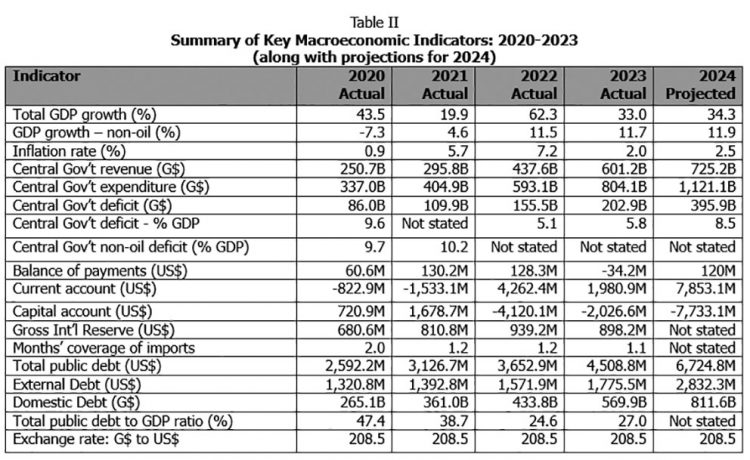

In last Monday’s article, we discussed the performance of the economy in 2023, as outlined by the Minister of Finance in his budget speech two Mondays ago introducing the Estimates of Revenue and Expenditure for the fiscal year 2024. At Table II, we provide a summary of the macroeconomic indicators over the last four years, along with projections for 2024.

In today’s article, we continue our discussion of the 2024 Estimates of Revenue and Expenditure by looking at the budget measures.

Budget measures

The following are the key budget measures as outlined in the Minister’s budget speech:

Containing cost of fuel: Zero percent excise tax on petroleum products introduced in March 2022 will continue to be maintained.

Reduction in freight charges: In August 2021, freight charges were adjusted to the pre-pandemic levels for the purposes of computing import taxes and to combat the increase in shipping costs that was passed on to consumers by importers. Initially implemented for a six-month period and subsequently further extended to December 31, 2023, the reduction in freight charges will continue for another 12-month period.

Expansion of part-time job programme: Introduced in 2022, the part-time job programme involves one person per household earning $40,000 by working 10 days per month in public offices in close proximity to where they live. In 2023, over 15,000 persons were employed through the programme in all the Regions, except Region No. 8. The programme will continue to be expanded in 2024.

Other cost of living measures: A total of $7 billion is allocated for measures relating to containing the impact of price increases. These include support in drainage and irrigation as well as distribution of fertilizers to farmers.

Support for small business: In relation to the cost of financing for small and medium enterprises to assist them to develop and grow, the Government will partner with the commercial banks to lower the interest rates on loans up to $5 million.

Removal of Duty and VAT on sports equipment and technology: The Government had previously removed VAT on data for residential and individual use, along with the applicable taxes on cell phones. To further promote access to sports and technology, VAT and Duty on sports equipment and essential cell phone accessories will be removed.

Increase in Old Age Pension: With effect January 2024, old age pension will be increased from $33,000 to $36,000 per month.

Increase in public assistance: With effect from January 2024, public assistance will be increased from $16,000 monthly to $19,000.

Supporting eye care for school children and pensioners: The Government will provide $3,000 per person towards the cost of an eye test as well as $15,000 towards the cost of the spectacles.

Support for cervical cancer testing: To encourage testing for cervical cancer, Government will provide $8,000 for women between the ages of 21 to 65.

Removal of Duty and VAT on firefighting equipment: VAT and Duty on fire extinguishers and smoke alarms will be removed.

Increase in minimum pension for NIS beneficiaries: The minimum pension payable to NIS beneficiaries will be increased from $35,000 monthly to $43,075. Also included in the budget measures are: (i) increase in survivors’ benefit from $17,500 monthly to $21,537; (ii) increase in invalidity pension from $35,000 monthly to $43,045; and (iii) a one-off grant to eligible persons with NIS contributions ranging from 700 to 749 as full and final settlement.

Increase in Because We Care Grant: The grant will be increased from $35,000 to $40,000 to assist parents of school children.

Support to University of Guyana graduates: The first phase of eliminating outstanding loans to the University of Guyana will commence for graduates who can demonstrate proof of being employed or self-employed in Guyana after their graduation for a minimum period to be specified.

Reducing the cost of life and medical insurance: The deductible ceiling for income tax purposes for insurance premiums will be increased from $30,000 to $50,000 monthly or 10 percent of income, whichever is lower.

Increase in income tax threshold: The income tax threshold will be increased from $85,000 monthly to $100,000.

Several commentators have expressed their views on the above measures. For our part, we believe that in relation to old age pension and public assistance, more relief should have been granted. We make the same comment as regards the 6.5 percent increase in the salaries of public servants. These increases are not enough to cope with the rising cost of living.

As regards the part-time job programme, amounts totalling $7.2 billion would have been expended in 2023. It is, however, unclear what mechanisms are in place to determine the nature of the work to be performed where the part-time workers are employed as well as its effective monitoring to ensure that value for money is achieved. Perhaps this is an area for the Auditor General to conduct a performance audit. The Because We Care Grant should also be the subject of a special audit by the Auditor General to ensure transparency and proper accountability.

Size of the budget

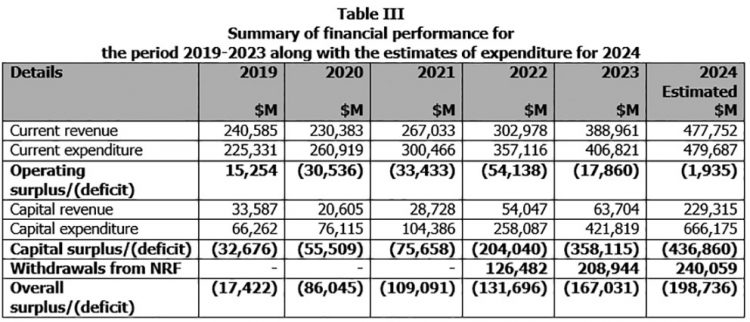

The size of the proposed budget for 2024 is $1.146 trillion, compared with $828.640 billion actual expenditure incurred in 2023, a 38.3 percent increase, or 46.6 increase compared with the 2023 Estimates. It is worth repeating the table we compiled last week showing the financial performance of central government activities over the five-year period 2019 to 2023 along with the Estimates for 2024.

As can be noted, capital expenditure in 2024 will be approximately ten times that of 2019. The fiscal deficit will also increase more than eleven-fold. These deficits are being financed by the incurrence of overdraft on Consolidated Fund held at the Bank of Guyana. As at 31 December 2020, the Fund was overdrawn by $163.340 billion. In 2021, the overdraft was liquidated through the issue of debentures. However, at the end of 2022, the Consolidated Fund once again went into overdraft amounting to $90.695 billion.

Considering the recorded fiscal deficit of $167.031 billion in 2023 as well as the estimated deficit for 2024, the overdraft on the Consolidated Fund at the end of 2024 is estimated at $456.562 billion! Will we be seeing another round of liquidation of overdraft through the issue of debentures, thereby significantly increasing the public debt?

As indicated in last week’s article, the public debt has more than doubled over the last five years, due to an almost five-fold increase in the internal debt. At the end of 2023, the debt-to-GDP ratio increased from 24.6 percent at the end of 2022 to 27 percent, despite the significant increase in the public debt. The main reason for this is that as production of crude oil increases, so is the GDP which is the denominator in the debt-to-GDP ratio. It is somewhat of a distortion in that 87.5 percent of crude oil production does not belong to Guyana. In the circumstances, a more realistic measure of debt to GDP ratio is the use of the non-oil GDP, adjusted to take into account Guyana’s share of profit oil.