Introduction

Today I will deliberately use the Chinese aphorism that “a picture is worth a thousand words” with great effect. So, with two pictures, we start with two thousand words which takes me over my word limit. Some weeks ago, the Government announced that two historic cricket grounds and green spaces in Georgetown are being handed over to its Middle Eastern friends from Qatar and their exclusive clientele for the paltry sum of $2 Bn, or less than US$10 Mn! Forget for a moment that the President and Vice President seem incapable of distinguishing between the State and the Government, or that selling in the absence of a robust valuation was their alleged ground for wanting to jail former Finance Minister Winston Jordan.

As dessert, VP Jagdeo, who is no stranger to tax holidays, indicated that the Qataris will have a 10-year tax holiday! We recall that about fifteen years ago, Jagdeo publicly insulted the late Yesu Persaud for being ignorant of the tax laws when the icon asked for equality and equity of tax concessions. Yet, any ignorance was on the part of Mr. Jagdeo who had extended concessions to his friend Dr. Bobby Ramroop, which the law did not allow. Mr Jagdeo showed no embarrassment or contrition over his error but rushed to change the law to accommodate Dr. Ramroop.

The wealthy poor

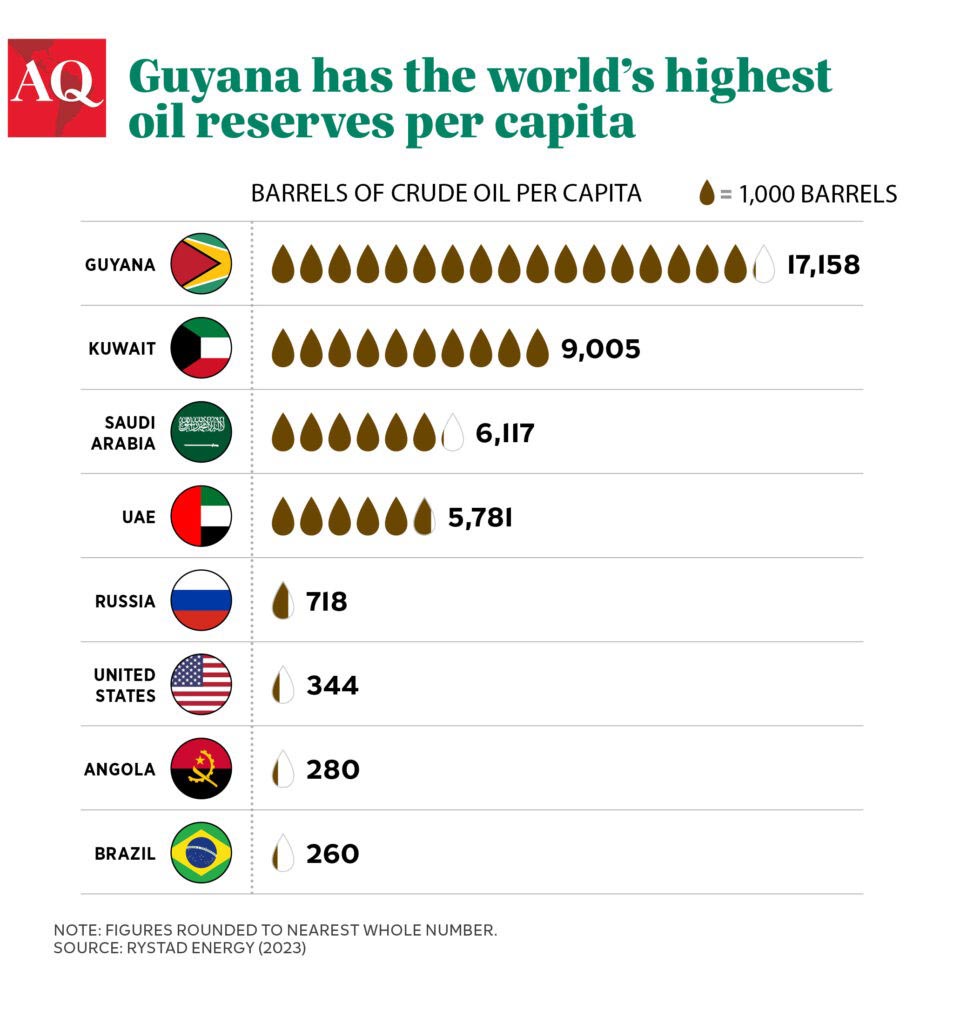

Let us look at the two charts. The first is by energy consultants Rystad Energy (which is duly acknowledged) showing that Guyana now has the highest per capita petroleum of any country in the world. And by far. Even if we estimate the population to be 800,000, it means that each Guyanese has a claim to 16,250 barrels of oil, the value of which at roughly US$80 per barrel, means that every man, woman and child is worth about US#1.3 Mn! For the moment, let us forget that Exxon and the Government are concealing several additional billions of barrels from Guyanese. Of course, these are gross values from which expenses have to be deducted, as they are for every other country on the chart. By any measure, however, that is a lot of money.

Sadly, these numbers seem to mean nothing to this Administration or to suggest to them that there ought to be a better revenue sharing between Guyana and the oil companies. Nor does It stir them that Guyanese are still queuing for freeness, teachers have to strike for better pay, and the working struggle to make ends meet even as the oil companies take a disproportionate share of the patrimony of the people and their officials live a life that would make the British Raj envious.

Tax to GDP ratio

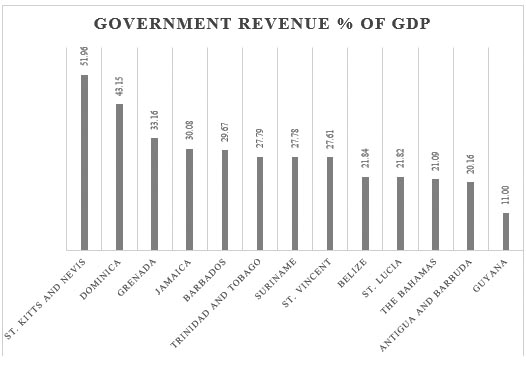

Now for the second graph. It shows the tax collected by the central Government relative to the gross domestic product of the country. By this measure, Guyana has the lowest tax to GDP ratio across the entire Commonwealth Caribbean countries. It further tells us is that Guyana collects even less tax as a proportion of GDP than the near-tax free countries of the Caribbean. Guyana’s ratio is about a quarter of Dominica’s, a third of Grenada’s, and about half of Antigua and Barbuda’s, its nearest comparator.

It is difficult to accept that Guyana’s economic managers can believe that oil revenues displace the need for taxation and that we can go handing out tax concessions to any friend or flatterer. That is the President’s chosen role in the economy. He gave away huge tax concessions to the CPL cricket extravaganza – outside of the law – and continues to do so whenever he brings regional artistes to entertain the masses.

But the VP will not be outshone. He has taken it upon himself not only to give away state land without any consideration of its implications for the national interest but also tax holidays to persons who have neither applied for nor are entitled to them. The Income Tax (In Aid of Industry) Act is clear – it must be for “new economic activity of a developmental and risk-bearing nature”. It seems that neither the Vice-President nor the President has any respect for the laws or resources of the country, or the intelligence of its people.

Guyana recently entered into a Double Taxation Treaty with the United Arab Emirates that is all one-sided. That has not even made the news. But now, completely outside of a treaty, the Qataris enjoy exceptionally cheap land, irreplaceable resources, no taxes and the red carpet. This cannot be rational, responsible or reasonable. It is more like recklessness and drunkenness with power. Or is it the resource curse?

Source: International Monetary Fund Website. All percentages are stated for 2022 except for Guyana which is stated for 2023.