Introduction

Today’s column continues my evaluation of the “likely impacts of the 2020 global general crisis on Guyana’s infant oil and natural gas sector.” More specifically, the column focuses on responding to the query that captioned last week’s column: “Does Guyana’s World Class Potential Trump the Baptism of Fire and Brimstone which its infant oil and gas sector is presently facing?” This query is analytically an important sub-text for my broader evaluation of the “likely impacts” referred to above.

Readers would recall that I have been postulating that the metaphor “a baptism of fire and brimstone” accurately reflects the major challenges which Guyana’s six-month old production of crude oil presently faces. Chief among these are: 1) strong global imbalances in world crude oil, as well as broader energy markets; 2) the Covid-19 pandemic-led decline in global demand for crude oil; 3) the consequential effects of all these on crude oil prices, Guyana’s export income, and Government of Guyana (GoG) revenue; 4) the Covid-19 impacts on oil workers availability, as well as work arrangements on offshore platforms; and 5) reported start-up performance difficulties, which have led to the flaring of natural gas and production cut-back, due to technical breakdowns.

On Method

For purposes of my evaluation, the key concern over method boils down to determining answers to two questions. First, are the effects of the “baptism of fire and brimstone” decisive enough to deflect significantly either the direction or pace of Guyana’s commercial development of its petroleum resource potential over the projected commercial life of that potential? And, secondly, given any deflection in pace and/or direction of development, what will be the total value of the negative impacts, when compared to the projected benefits from Guyana’s expanding resource potential, over the lifecycles of all future projects utilising its recoverable petroleum resources.

Massive Potential

Last week I reminded readers that as far back as 2016, I had advanced the view that Guyana possesses “world class potential petroleum resources”. The estimate given back then was 13 to 15 billion barrels of oil equivalent (BoE) and 23 to 43 billion cubic feet of natural gas and natural gas liquids. At that time Guyana’s reported resource finds were 600 million, or 0.6 billion BoE. The current resource estimate of ExxonMobil, the lead operator, and its partners is 8.8 billion+ BoE. Last week I indicated to readers that recently several analysts, specialists and energy-intelligence businesses are now expressing views on Guyana’s petroleum resource potential well in excess of Exxon’s estimate of 750,000 BoE per day by 2025. This is projected to be produced from five offshore Floating Platforms for Storage and Off-loading (FPSO).

I cited two examples of this work last week, and offered to add further evidence of such stepped-up projections in today’s column. I do this in the next Section.

Other Projections

Further to last week citations, I cite four additional examples in this Section.

First, the Bank of America Merrill Lynch has recently forecasted (2019) that ExxonMobil’s stock would surge, by nearly 50 percent as “production is ramped-up by its oil recovery pursuits in Guyana.” Second, earlier this year, S&P Global predicted “many more discoveries and further increases to the 8 billion BoE figure.” Third, Credit Suisse has projected (2020) that as many as 25 additional exploration projects are yet-to-be tested (YTBT) in the Stabroek Block, “leaving room for further resource upside to the more than 8 billion BoE.” Finally, Wood Mackenzie (2020) has projected: “Guyana’s output will surpass 1.1 million BoE per day by 2028, making it the 11th nation in oil’s history to reach the 1 million barrels per day milestone.”

World Class Petroleum Finds

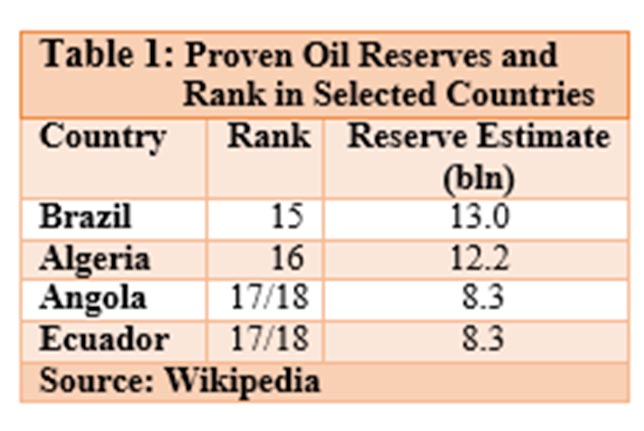

My assessment of Guyana’s petroleum reserves potential still stands at 13 to 15 billion BoE and 23-43 billion cubic feet of natural gas and natural gas liquids. I admit this is a high prediction. To compare, Wikipedia’s ranking of countries with proven oil reserves, lists Brazil 15th (with a holding of 13.0 billion BoE); Algeria is 16th, (12.2 billion boe); and Angola and Ecuador 17th and 18th (with 8.3 billion BoE) (Table 1).

My estimate is supported by two lines of argument. Firstly, an appreciation of Guyana’s petroleum geological principle of the “Atlantic mirror image”. Secondly, estimates provided by the United States’ Geological Services (USGS).

Atlantic Mirror Image Theory

Geoscientists have posited that the Guyana discoveries reflect the earlier drifting apart of what was originally a unified super-continent, combining South America and Africa. The separation took place over geological time; resulting in the Guianas Equatorial Margin (encompassing offshore and onshore portions of Guyana, Suriname, French Guiana, as well as limited portions of Venezuela and Brazil). The petroleum geology of the Guianas area closely resembles that of West Africa. It includes two sedimentary basins, namely, the Guyana-Suriname Basin and the Foz do Amazonas Basin. It is further reported that the Guianas Equatorial Margin/Guianas Basin is separated by the Demerara Plateau, which is a structurally high, thick succession of Jurassic and Lower Cretaceous carbonate-rich sediments.

This circumstance yields the thesis that the petroleum system of the Guianas Basin is a “mirror-image” of West Africa’s petroleum system, where several large hydrocarbon accumulations have been found recently, including, the famed Jubilee discovery offshore Ghana.

Conclusion

Next week I shall detail the second rationale in support of my assessment of 13 to 15 billion barrels of crude oil and 23 to 43 billion cubic feet of natural gas and natural gas liquids as evidence of Guyana’s “massive world class petroleum resource potential”, as I continue my evaluation of the likely impacts of the 2020 general crisis on its infant oil and gas sector.

Arising from that evaluation, I will advance the following thesis: if Guyana’s recoverable resources turn out to be anywhere close to my predictions, then the long run benefits to Guyana would far outdistance the significant losses that will be occasioned by the 2020 general crisis. The losses however, remain.