Introduction

This week’s column wraps up my consideration of the US Energy Information Administration, EIA’s, International Energy Outlook 2019 with projections to 2050. I have offered this Report as one of three publications that have made all the difference in shaping my long-term understanding of the on-going global energy dynamic. Above all, this particular report has provided me with guidance on what I have labelled elsewhere as a “foundational consideration; that is, predicting the status of petroleum liquids and natural gas as sources of global primary energy consumption over the long-term (secular)”

There are several long-term/secular studies on this topic. These include studies conducted by global energy organizations, energy firms, academic institutions, national governments, as well as individual analysts. My choice indicated here is not intended to convey a rejection of any similar projection

Results

Expressed in British thermal units, Btu, the Report projects global consumption of energy at 911 quadrillion. Of this global total, 287 quadrillion Btu are projected to come from the Organization for Economic Cooperation and Development, OECD, countries and 624 quadrillion from non-OECD countries. Three further observations immediately arise. First, this 2050 outcome is 50% above the consumption level in 2018. Second, the expected rate of growth in consumption for the OECD countries is projected at 1.5% and for the non-OECD 3.8%. Third, the projections arrived at in the model for the performance of the USA is consistent with that obtained in the EIA’s annual 2019 country performance for the USA.

Long-term Energy Mix

As noted above, there are several studies offering long-term projections of the global energy mix, ranging from those provided by individual academic researchers, private energy and energy-related businesses, energy consultancy and business intelligence firms, to national and international institutionally-sponsored sources like the EIA, and the International Energy Agency, IEA. For the purposes of this column, I have chosen to rely on the EIA Reference Case projection cited in the EIA’s International Energy Outlook, 2019. This Report models the Reference Case to estimate the world’s energy situation in 2050.

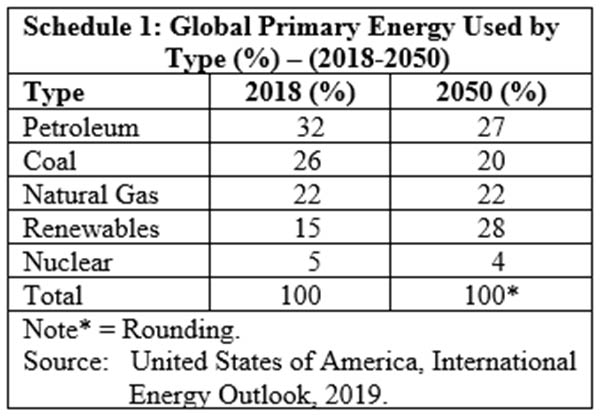

The modelling centers on the five standard modes of categorizing primary energy supply. These are currently in descending order of importance: petroleum 32 percent, coal 26 percent, natural gas 22 percent, renewables 15 percent, and nuclear 5 percent. Changes have been drastic and by 2050 their projected respective global shares are: renewables 28%, petroleum 27%, natural gas 22%, coal 20% and nuclear 4%.

Over this long period of three decades plus, the most striking occurrences exhibited in the projections are: 1) petroleum liquids has lost the pre-eminence it held in 2018 (32%); and in fact has declined as a share of total global primary energy demand; 2) the share of renewables rises from 15% to 28%; 3) the share of natural gas has remained constant over the period, at 22%; 4) coal’s share has fallen the most, a whopping decline from 26% to 20%; and, finally, 5) the share of nuclear power has declined from 5% to 4%, while remaining through this long period a marginal source of primary energy supply.

In summary, therefore, the fastest growing energy source projected by EIA over the period 2018 -50 is renewables, which is projected to grow at 3% per annum. Natural gas is projected to grow by 1.1% and liquid petroleum by 0.8% per annum over the period. These data are summarized in Schedule 1.

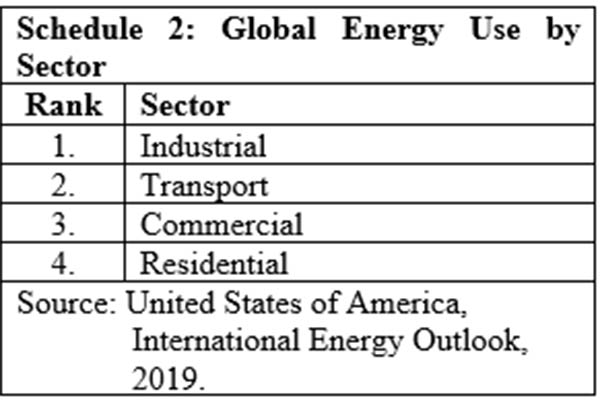

The EIA model identifies the leading primary energy consuming sectors globally as industrial, transportation, commercial, and residential. In this classification, industrial includes manufacturing, refining, mining, construction, and agriculture. This sector grows by 30% and accounts for more than half of projected energy use in 2050. Schedule 2 summarizes these data.

Schedule 2: Global Energy Use by Sector

To remind readers, the EIA has classified the world economy into two broad groupings; namely, the 38-member OECD, and the others, that is, non-OECD. The latter grouping is further sub-divided into six geographical areas: Asia, Middle East, Africa, Americas, Europe and Eurasia.

Looking into the secular future, I believe that an inflection point for global crude oil production is likely to be reached on/or before 2050. This is captured at the point when liquid petroleum loses its pre-eminence as a primary energy supplier. An important caveat, however, must be introduced. Despite liquid petroleum’s reduced share by 2050, between now and then, global demand for this item is indeed projected to increase by a whopping 30%! This means that today, the existential threat to Guyana’s infant oil and gas sector still remains a secular prospect. This is a key outcome for my appraisal of the probable impact of the 2020 general crisis on that sector.

Conclusion

It cannot be over-stressed how great are the uncertainties and risks embedded in results flowing from model-based societal projections more than three decades into the future. The known and unknown unknowns are huge and made worse in a sector where volatility and variations are so intrinsic.

Next week, I turn to consider Terry Etam’s book. This I have listed to come next in my discussion of the three most influential publications shaping my long-term perspective on Guyana’s emergent oil and gas sector.