Two remarkable reports on Guyana were separately published by two leading international organizations towards the end of the first year of Guyana’s First Oil. These were the Inter-American Development Bank, IADB’s, Traversing a Slippery Slope: Guyana’s Oil Opportunity, Infrastructure and Energy Sector, Technical Note, IADB TN 1994, August 2020; and the World Bank Group, A Pivotal Moment for Guyana: Realizing the Opportunities, Systematic Country Diagnostic, SCD, November 2020.

Written for general audiences these do not appear to be widely read within Guyana, judging from the “noise and nonsense” circulating in locally based exchanges. I have referenced, cited and otherwise treated with the IADB Report on many occasions to date. Today I use information in the World Bank study to frame my presentation on Guyana’s poverty status and my rationale for juxtaposing this to the country’s expected windfall revenues/earnings.

World Bank Group, SCD

What is a SCD? The Report puts it simply as “ a comprehensive overview of key macroeconomic, fiscal and sectoral challenges as the country begins its historic transformation into an oil producer” A SCD is data intensive but unfortunately, as the Report further notes income poverty analysis is a serious challenge in Guyana due to infrequent data collections. While selected prices, commodity production, services delivery, and selected transactions data like money supply, deposit rates and trade data are regularly available on a more or less real time basis over the years.

It is only the United Nations System of National Accounts data, which are produced on a regular annual and sub-annual basis. The situation has remained so serious that the SCD was forced to improvise a solution to the Guyana data gap which is reported on in the next section.

Improvising a measure

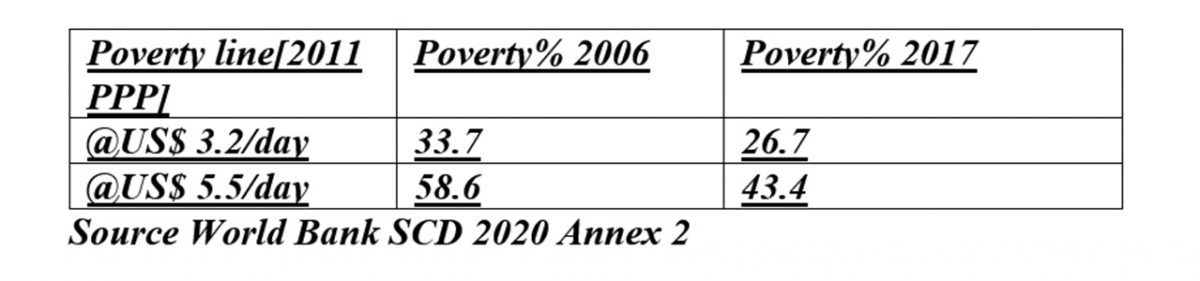

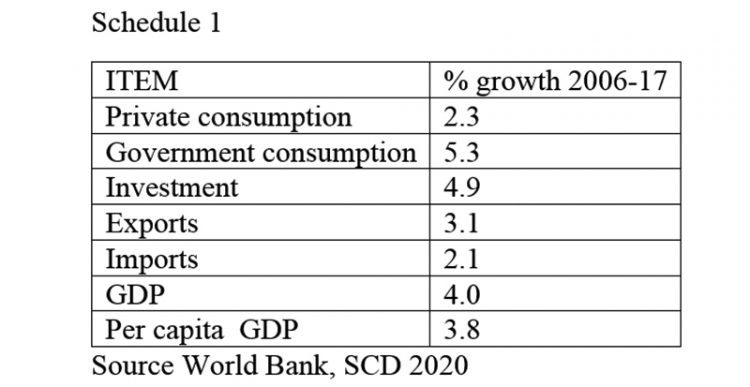

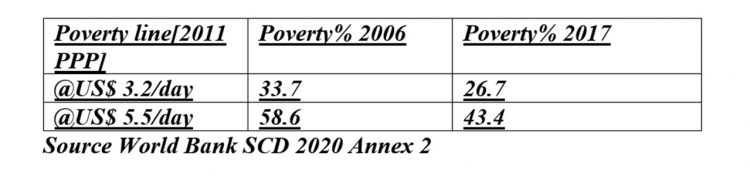

Because national structured surveys take place roughly once a decade the SCD was forced to improvise and use the Household Budget Survey, HHBS, of 2006, and the Labor Survey of 2017, to generate an estimate of income poverty performance in Guyana over the 2006 – 2017 pre-Covid 19 pandemic period. I summarize the results of this effort in Schedules 1 and 2 below. Schedule 1 provides the macroeconomic performance outcomes. And, Schedule 2 shows the income poverty outcomes.

The macroeconomic performance calculated at 2010 prices [see Annex 1 Guyana’s Development Patterns 2006 to 2017] reveal strong 4 percent annual real GDP growth, led by the mining sector. A strong hint of Dutch Disease is reported along with low labour absorption and high capital intensity of the sector as causal factors driving its limited potential for positive poverty reduction impacts.

With high migration rates, per capita GDP has grown at an impressive 3.8 percent per annum over the period. Government consumption has grown at more than twice the rate of private consumption! The investment rate was high – 4.9 percent per annum; while exports grew faster [3.1 percent] than imports [2.1 percent]

It is not the purpose of this column to analyze the macroeconomic sector performance beyond this illustration see Schedule 1 below.

The income poverty data [see Annex 2, Income Poverty Methodology, Guyana 2006 HHBS and LFS 2017] reveals a decline in the high poverty levels in 2006. These levels are based on a US$3.2 and US$5.5 per day poverty line respectively. The measures are based on 2011 purchasing power prices, PPP, and resulted in 33.7 percent and 58.6 percent. The declines resulted in lower rates of 26.7 percent and 43.4 percent respectively for the two separate poverty lines Schedule 2 reveals these results.

World Bank Factsheet

I wrap up this column with four brief references to a 2022 World Bank factsheet;

1] Guyana is one of the poorest countries in South America, with 43.4% of the population living on less than US$5.50 per person a day in 2011 Purchasing Power Parity (PPP).

2] The country has one of the highest emigration rates in the world – roughly half of nationals with tertiary education leave Guyana and more than 39% of its citizens reside abroad– making it among the largest recipients of remittances relative to GDP in Latin American and the Caribbean.

3] Recent rises in active cases of COVID-19 and deaths are cause for concern. Economically, Guyana is facing many challenges from the closure of borders and drops in commodity prices during the pandemic.

4] Guyana became one of the top 20 largest oil and gas reserve holders in the world following a series of substantial discoveries offshore starting in 2015. To manage the expected resource windfall, Guyana needs to improve the quality and capacity of public and private institutions; make revenue collection and management more efficient and transparent; and adopt sound macroeconomic and fiscal management policies.

Conclusion

As we shall note in some detail later, despite its title the World Bank’s Report is not solely focused on diagnosis, to the exclusion of prescription. This is hinted at in para 4 above. I shall therefore return to this analysis after rounding out the discussion on poverty as a central policy-driven feature of Guyana’s political economy. I continue from here next week.