Introduction

While the fiscal rules of Guyana’s PSA indicate the sources of its oil revenues yield, the finds/discoveries indicate the quantity, quality and trend in petroleum reserves accumulation and its reporting. Taken together these two allow us to estimate the likely Daily Rate of Production, DROP. Since starting this Sunday column series on oil and gas in Guyana, I have observed repeatedly that I am consciously adopting a conservative stance in regard to the Guyana Government Take ratio, but remain “strongly bullish” in assessing Guyana’s petroleum reserves potential. Upfront therefore, in this re-visit of the topic I start by reasserting as a baseline that my original estimate of Guyana’s long-term crude oil reserves in its reservoirs is about 13-15 billion barrels of oil equivalent, boe.

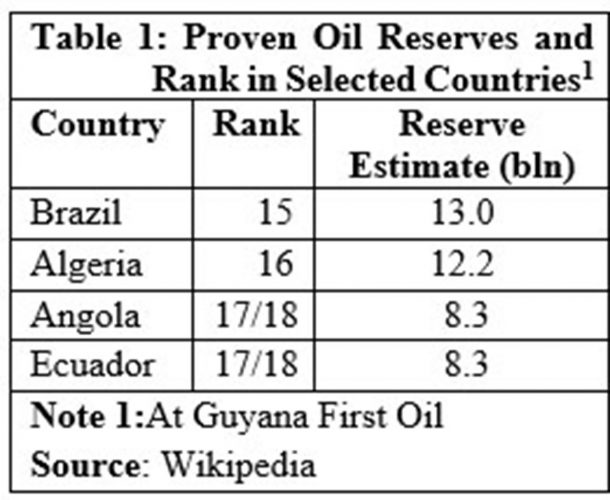

How massive this original prediction is can be readily gleaned from the global ranking of countries with proven oil reserves. Wikipedia indicates that at Guyana’s First Oil, Brazil was then ranked 15 globally, with a holding of 13.0 billion barrels of oil reserves. Algeria was ranked 16, with a holding of 12.2 billion barrels. And, Angola and Ecuador, were ranked 17/18, as each had exactly 8.3 billion barrels of oil equivalent. These data are repeated in Table 1 below.

In this column I provide my justification for the original estimate of Guyana’s long-term potential being as high as 13 to 15 billion boe. However, before turning to this task I draw attention to two pertinent observations. One is the present level of petroleum reserves estimates, which is offered by the two main Contractors’ that are scheduled to begin production in the short-term (1-3 years). The other is Exxon and partners, whose reported estimate in various press releases and media statements is for an amount of 11+ billion boe.

Eco Atlantic indicates approximately 3 billion boe. Exxon’s estimate is derived from a steady stream of announcements on their “Finds” and scheduled dates for production. Eco Atlantic’s is derived from company announcements, reflecting both internal company estimation and those provided through a Competent Persons Report, CPR, which was commissioned from Gustavason and Associates, Canada. l.

Justification

In what follows I shall repeat the rationale for my original estimation. As originally indicated the rationale is grounded on four principal lines of argument. First, I had based this estimation on an appreciation of Guyana’s petroleum geology as captured in the geological principle of the “Atlantic mirror image”. Second, I depended on authoritative estimates, of Guyana’s potentially “recoverable resources” provided by the United States’ Geological Assessments, during the 2000s. Third, I rely on a battery of comments and features on Guyana’s petroleum potential, which are sourced from energy researchers and analysts. These similarly demonstrate a “bullish” outlook as mine. Fourth, I argue that Guyana’s creaming curve to date confirms the rationale.

Justification 1: Petroleum Geology

First, a bit of background would be useful. So far Guyana’s recent petroleum discoveries are located in the Stabroek Block; one of three major blocks that ExxonMobil has contracted for with the Government of Guyana (GoG). The other two are the Kaieteur and Canje Blocks. The Stabroek Block is an area of 6.6 million acres or 26,800 square kilometers offshore the Guyana Coastline. This is where the leading oil and gas exploration is presently taking place, under a PSA between the GoG and ExxonMobil and partners.

ExxonMobil’s first discovery was announced in May 2015. This followed the successful drilling of the Liza-1 well. The well was drilled to 17,825 feet in 5,719 feet of water, and is located 120 miles off the Guyana Coast. It encountered 295 feet of oil-bearing sandstone reservoirs. The initial estimation is for 700 million barrels of commercially recoverable oil. Subsequent to this, other wells were successful and these were later announced by ExxonMobil.

The basic background is that geoscientists have posited that this occurrence is the outcome of the earlier drifting apart of what was originally, a unified super-continent, combining both South America and Africa. This took place over geological time, millions of years ago. The geologic principle is that, the Guianas Equatorial Margin, encompasses both offshore and onshore portions of Guyana, Suriname, French Guiana, as well as limited portions of Venezuela and Brazil. The petroleum geology of the Guianas area closely resembles that of West Africa. Indeed, the Guianas Equatorial Margin includes two sedimentary basins, namely, the Guyana-Suriname Basin and the Foz do Amazonas Basin.

In my earlier columns on this topic, I had cited Justin Stolte, who noted in his paper “Testing the Atlantic Mirror Theory” that geologists view “the petroleum system of the Guianas Basin as a mirror image – labelled the ‘Atlantic Mirror’ theory – of the petroleum system present in West Africa.” As I had observed in those earlier columns, he goes further to suggest that “the similarities of such basins” are responsible for the rush by multiple companies exploring for gas and oil offshore and onshore Guyana! Indeed, during the late 2000s and 2010s, several companies had engaged in systematic petroleum explorations, including: Repsol, Century Guyana Ltd, CGX Energy, Anadarko, RATIO Oil, Eco Atlantic, Tullow, NABI Oil and ExxonMobil.

It is also reported that the Guianas Equatorial Margin, embraces two sedimentary basins (known collectively as the “Guianas Basins”). These are separated by the Demerara Plateau, which is a structurally high, thick succession of Jurassic and Lower Cretaceous carbonate-rich sediments.

Conclusion

The above yields the thesis that, the petroleum system of the Guianas Basin is a mirror-image – labeled the “Atlantic Mirror” theory – of the petroleum system present in West Africa, where several large petroleum accumulations have been discovered in recent years, including, the Jubilee discovery offshore Ghana.