Today’s column considers issues related to the breakeven price for Guyana‘s fledgling hydrocarbons sector. It covers both the business commercial breakeven price and its fiscal counterpart. These matters are addressed consecutively in what follows.

Break-even Price

Economists define the break-even price for any business, as that price where the total cost of operating the business is just equal to the total revenue obtained by that business from its sales. The cost referenced here is the opportunity or economic cost. Rational investors expect a return on their investment based on the risk-adjusted next best return they could obtain. Economists term this return normal profit. While the break-even price is applied regularly in business and economic analyses, economists however, emphasize that the break-even price is not a standard generic price; indeed it varies widely across different types of businesses!

Unsurprisingly, the break-even price of crude oil has developed as a measure, which is specific to the crude oil industry. Given this feature, one can safely assert that Guyana’s petroleum environment already displays certain unique features, even though the country is still at its infant stage! Take two examples:

1) Guyana is certain to be a price-taker and not a price maker in global crude oil markets. Why is this the case? Bluntly put, even the world’s largest producers, (operating as a cartel through OPEC), do not have sufficient market power to “fix prices”, or indeed determine “broad price ranges” for crude oil.

2) Non-OPEC players with considerable global geo-strategic clout also do not have sufficient global market power to determine price.

Importance

Knowledge of the break-even price is, however, useful to Guyana’s oil and gas producers (exporters) for several policy reasons. These include: 1) the need to fix a benchmark for rating Guyana’s competitiveness in the sector; 2) to guide Guyana’s market share strategy; 3) to determine the most efficient expansion path for Guyana’s petroleum production; 4) to have an effective gauge of Guyana’s productivity; 5) to rate Guyana’s cost competitiveness and efficiency; and, finally, 6) to support Guyana’s market and pricing policies.

It can be inferred from this perspective that the gap between the break-even price established for Guyana’s crude oil exports and the prevailing market price would indicate the margin of safety, as it is termed, which exists for Guyana’s petroleum operations. In practice, the wider this gap is, the greater is the margin of safety.

Since as indicated above, the break-even price is, uniquely, the price at which the total cost of operating any business is just equal to the total revenue obtained from the sales of that business’ output and, further, this cost refers to opportunity or economic cost, then based on this, the determination of the break-even price is a strategic operational necessity for Guyana’s crude oil exporters, as is indeed the break-even price for all businesses. In other words, it is absolutely essential for efficient decision-making in Guyana’s emerging oil and gas industry.

Comparative Break-even Prices

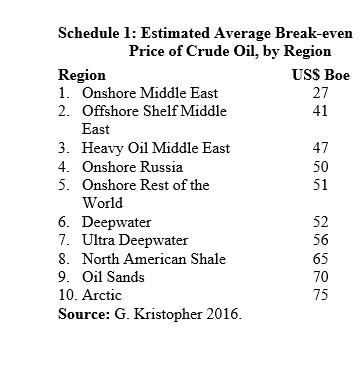

The break-even price for crude oil varies across various regions. Schedule 1 reveals the extent of this variation in 2016. As can be seen the range for these data is great. Thus, the highest break-even price estimate (Arctic Region @ US$75 per boe) is 2.8 times more than the lowest break-even price estimate (Middle East Onshore @ US$27 per boe)! Further, the mean break-even price is high, US$53.

Fiscal Break-even Price

At this point I shift focus to what the economic literature terms the fiscal break-even price for crude oil exports. In its simplest essence, this fiscal break-even price reflects the perspective of governments as the legal owners of a country’s petroleum resources that are being exploited by them and International Oil Companies (IOCs). This perspective holds, regardless of whether Guyana’s oil and gas resources are being developed as it is now, by consortia of external business, or through a specially created government-owned National Oil Corporation (NOC).

The introduction of the word fiscal as a descriptor of the break-even price converts the concept into a social or national price. It is no longer a price determined in the market place for private businesses. From such a perspective it becomes a normative price. In other words it reflects what governments think it ought to be.

Economists define Guyana’s fiscal break-even price as the minimum price for a barrel of crude oil equivalent (boe), that the Government of Guyana (GoG) requires in order to obtain revenues from selling its crude, which it deems sufficient to meet its spending requirements in full. The requirements will be based on the several policies, plans, programnes and projects that the GoG intends to implement during a given budget period while maintaining a balanced budget. This is clearly a normative price, because, as described here, it is based on the price government believes it ought to receive, rather than a price which is determined objectively (by demand and supply) in the market place.

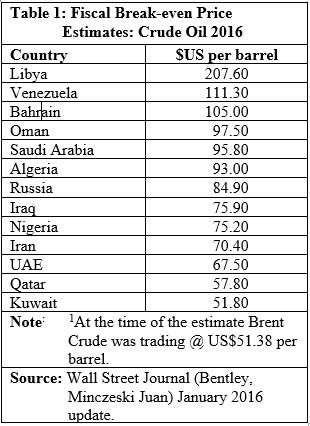

Table 1 reproduces previous estimates of fiscal break-even prices for a sample of thirteen countries from among the top 20 crude oil exporters. The Table’s data reveal wide variation in these break-even prices, with prices ranging from US$51.80 per barrel for Kuwait to as much as US$207.60 for Libya. It is to be observed though that all the listed fiscal break-even prices had exceeded the Brent crude oil price at that point in time.

Conclusion

This discussion continues next week.