As indicated thus far, in my long-running oil and gas series, within the short period of only three and a half years after its First Discovery in May 2015, Guyana’s First Oil began in December 2019. Following that happenstance, its operational crude oil prospects grew at a stellar rate. Indeed, by the following year, 2020, Guyana was being publicly branded by the extractivist / neo-extractivist school of political economy thought as, “the Americas newest and fastest emerging Petrostate” [see the earlier reference to Canterbury D and Clavijo W].

In real time the neo-liberal political economy school of thought was equally alert to the unfolding events in Guyana. However this school of thought labelled the happenstance as “Guyana’s exceptional oil opportunity”, as noted in the World Bank 2020 and IADB 2020 publications already reviewed.

Considered judgement

Throughout this oil and gas series thus far, and further having completed over the last three columns a review/evaluation of the outcome revealed in the introductory section, I can state with a high degree of conviction that outcome is the product of several complex considerations. With that in mind, it is also my considered assessment that the single most important factor in determining the outcome revealed in the above paragraph has been the resource price arrived at by the resource Owner [Government of Guyana, GoG] and the Contractor [investors] for permission to extract crude. Recall also I have all along urged readers to view this resource price paid by investors, [Contractor] for extraction of crude oil as the IADB proposes it should be seen, as the Average Effective Tax Rate, AETR on Guyana’s crude.

Given all the above, I bring to readers’ attention that, the GoG is proposing to offer new oil blocks by public auctions and that these arrangements are reportedly well advanced. The clear intention of the public auctions template is to put in place a best practice Production Sharing Agreement, PSA, to replace the Stabroek Block’s ruling PSA. I am sure the Authorities strongly anticipate an increase in the AETR or Guyana’s resource price now in operation by the GoG

It is for this reason that the title of today’s column refers to a likely post-public auctions circumstance, which drives Guyana onto a transition path that is no longer driven by today’s resource price; which as noted has led Guyana to years of unprecedented world class petroleum growth since First Oil in December 2019.

At this juncture it would be therefore useful for readers to take note of Guyana’s reported resource price or AETR and estimated resources, just prior to the proposed public auctions. The first topic is pursued in the rest of today’s column [resource price].

Taking stock

As events have unfolded, my first column this year, in this long running Sunday series [January 8, 2023], and for that matter the last in a 14-part sequence of columns devoted to, as I termed it then, was re-visiting Guyana Government’s Take ratio and estimates of the nation’s recoverable hydrocarbons. As stated then the columns had had three general aims. First, in light of spirited public exchanges on the topics, I sought to provide in a single source, all available published calculations of Guyana Government’s Take ratio. And in so doing, hopefully clarify a few key methodological issues.

Second, the column sought to provide the rationale informing my original estimate of Guyana’s recoverable resources. And thirdly, five years later, I updated that original `prediction. Further, in that column I referred to two related considerations; namely 1] the ruling and newly announced PSA template intended for auctions of additional oil blocks and 2] the secular trend in the global energy mix and the opportunity window for Guyana’s hydrocarbons.

I mention all this but readers should note that it is my purpose here simply to use the material for taking stock of Guyana’s resource price prior to the public auctions and not to re-litigate the wider issues, which that column addressed

Government Take

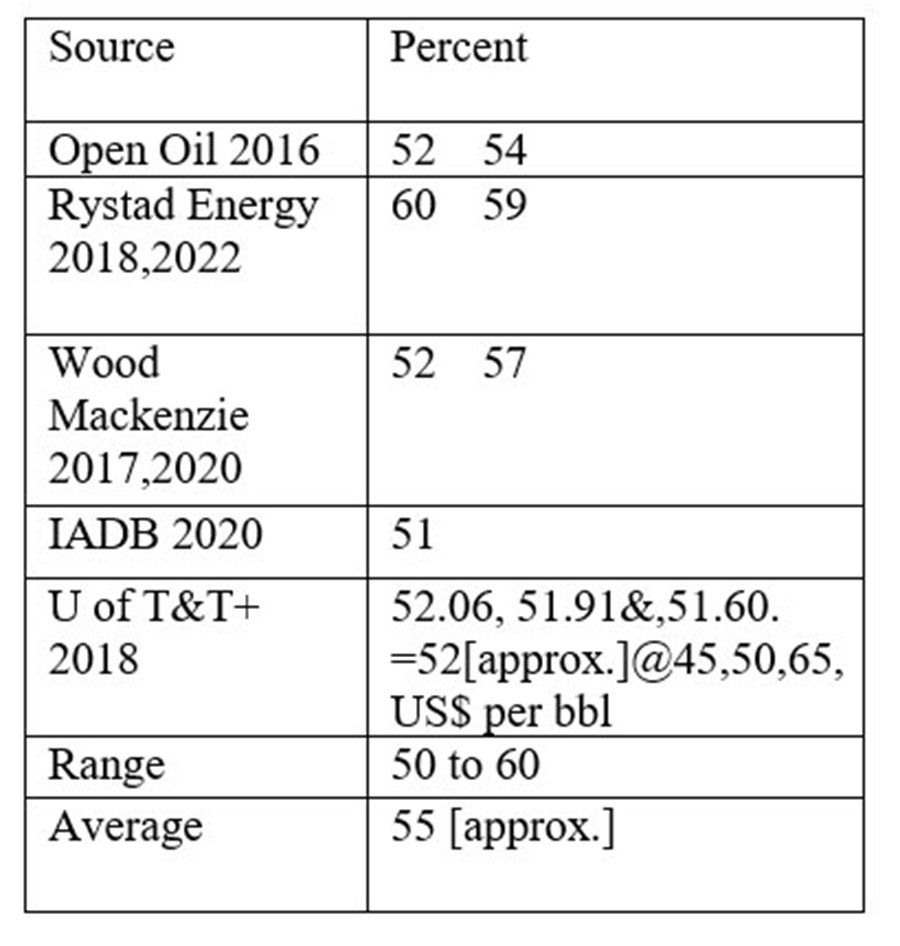

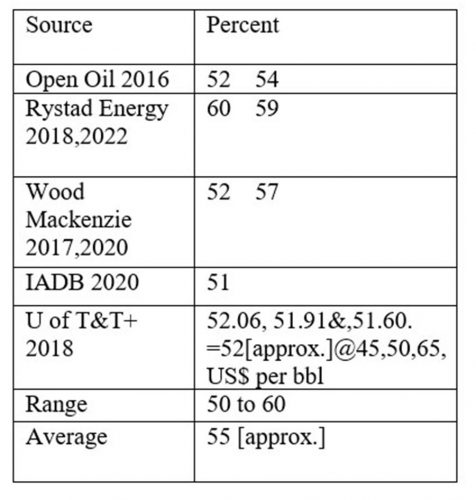

Schedule 1 below summarizes the sources and results of the publicly available projections of Guyana Government Take ratios, which I had reported on in that column. For the record I had identified five sources and ten separate estimations. These Take ratios range from 50 to 60 percent, and average 55 percent after rounding

Schedule 1: Summary of Guyana Government Take ratios

A few observations related to the sources of these estimates are warranted. First, for purposes of stocktaking, I re-affirm that, in no capacity, formal or informal, have I ever been privy to any official estimate or measurement of Guyana’s expected net cash flow share, calculated by either of the Parties to the current Stabroek Block PSA. That is, the Contractor or Government of Guyana, GoG.

Second, I have however, seen the supporting calculations released by Open Oil, Inter-American Development Bank, and the University of Trinidad and Tobago. These three are non-profit based organizations and access is easy. Details for the two commercial firms [Rystad Energy and Wood MacKenzie] are available for a fee, which I cannot afford. And, third the related ratios cluster within a fairly narrow range.

Conclusion

Next week I take stock of the other component, which is the current pre-public auctions estimate of recoverable resources.